Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 26 June 2023 03:19 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

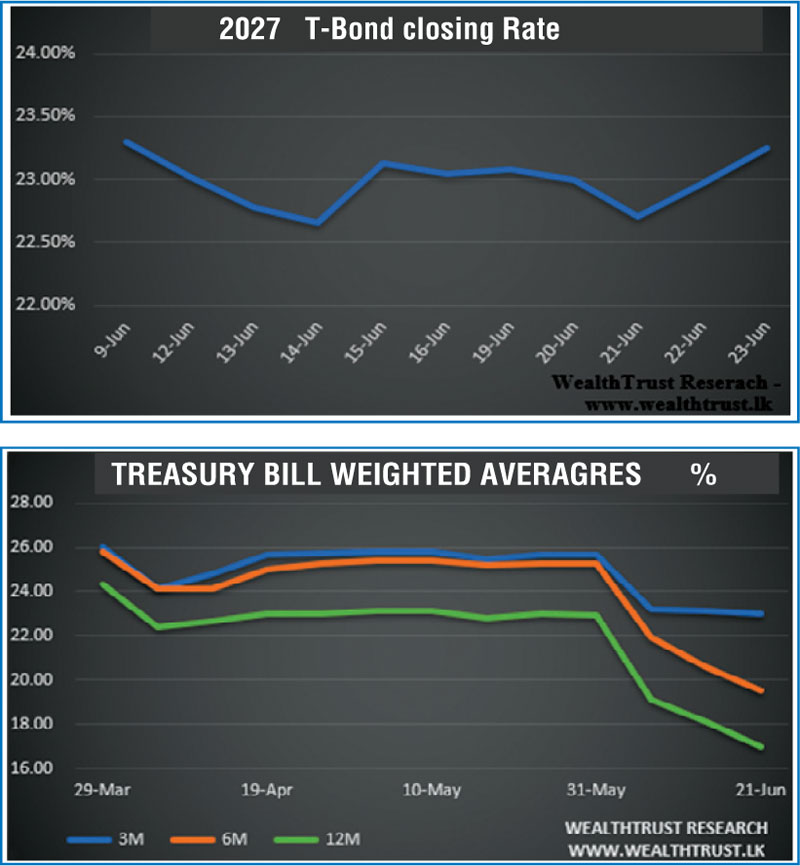

The secondary bond market ending 23 June, witnessed a week of volatility, as yields decreased during the first half of the week on the back of expectations of the outcome at the weekly Treasury bill auction and thereafter increased towards the latter part of the week, backed by fresh selling interest due to uncertainties on the Domestic Debt Optimisation (DDO) front.

The secondary bond market ending 23 June, witnessed a week of volatility, as yields decreased during the first half of the week on the back of expectations of the outcome at the weekly Treasury bill auction and thereafter increased towards the latter part of the week, backed by fresh selling interest due to uncertainties on the Domestic Debt Optimisation (DDO) front.

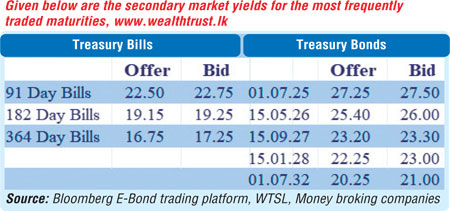

Yields of the 01.07.25, 15.05.26, two 2027’s (i.e., 01.05.27 and 15.09.27) and 15.01.28 maturities were seen decreasing to weekly lows of 26.47%, 24.75%, 22.82%, 22.75% and 22.00% respectively during the early party of the week.

However, subsequent to the weekly Treasury bill auction, where the weighted average yields of the 182-day and 364-day bills crashed further by 112 and 109 basis points respectively to 19.49% and 16.99%, selling interest returned to the market driving yields up once again. The said maturities were seen hitting weekly highs of 27.25%, 25.50%, 23.25%, 23.40% and 22.50% respectively, reflecting an upward shift of the yield curve.

Meanwhile, the National Consumer Price Index – NCPI (Base;2021=100) or National inflation for the month of May came in at 22.1% on its point to point as against 33.6% recorded in April.

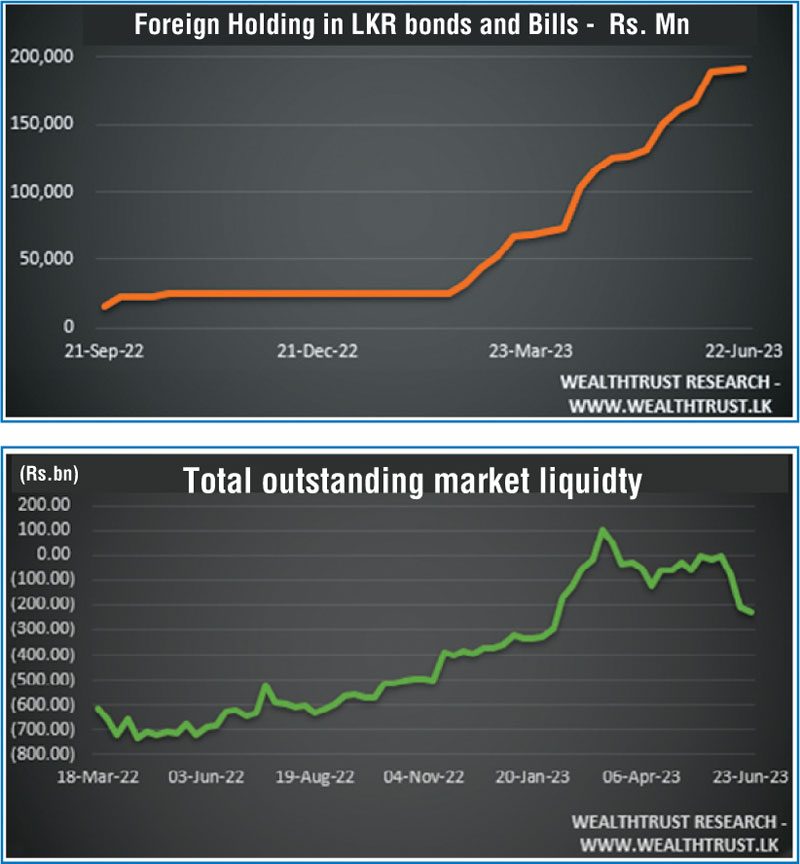

In the meantime, the foreign holding in Government Securities recorded an inflow to the tune of Rs. 1.34 billion for the week ending 22 June.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 27.02 billion.

In money markets, the total outstanding liquidity deficit increased further to Rs. 230.02 billion by the end of the week against its previous week’s deficit of Rs. 212.12 billion while the Central Bank of Sri Lanka’s (CBSL) holding of Government Securities decreased to Rs. 2,456.34 billion against its previous week’s of Rs. 2,476.79 billion. The Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to 30-day Reverse repo auctions at weighted average yields ranging from 13.46% to 17.00%.

In the forex market, the USD/LKR rate on spot contracts was seen closing the week at Rs. 307.00/309.00 against its previous week’s of Rs. 304.00/306.00 subsequent to trading within the range of Rs. 305.00 to Rs. 310.00. The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 52.54 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)