Sunday Apr 20, 2025

Sunday Apr 20, 2025

Wednesday, 26 March 2025 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary bond market yesterday saw yields increase further on the back of profit taking pressure following the recent bull run and ahead of the 2nd Monetary Policy Review for the year 2025 due today. However, renewed buying interest was seen kicking in at the elevated levels which curtailed any further upwards movement. Activity and transaction volumes were witnessed at high levels during the early part of the day but subsequently moderated to a virtual standstill as market participants adopted a wait-and-see approach ahead of the MPA.

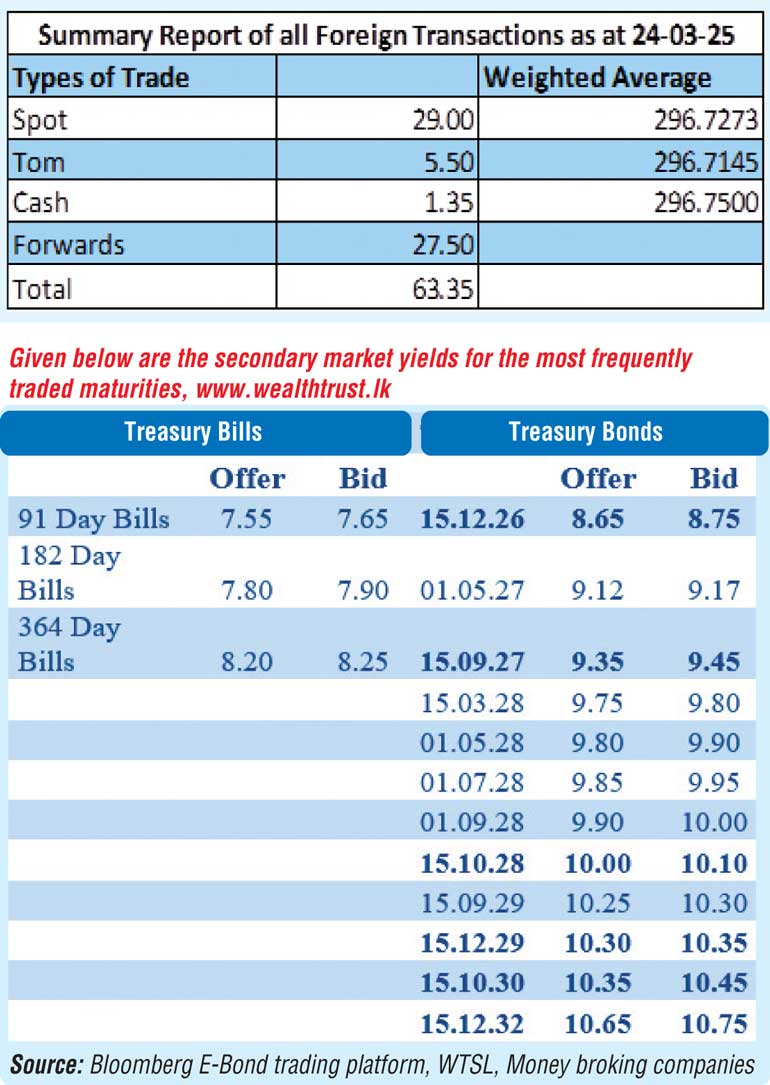

Accordingly, the yield on the 15.09.27 maturity increased from 9.30% to 9.40%. The 15.03.28 maturity was seen trading up the range of 9.73%-9.80%. The 15.10.28 maturity traded up from an intraday low of 9.95 to a high of 10.05%. The 15.09.29 and 15.12.29 maturities also traded up from intraday lows to highs of 10.15%-10.35% and 10.20%-10.35% respectively. The 15.10.30 maturity traded up from 10.38%-10.40% and the 15.12.32 from 10.70%-10.75%.

Recap: At the inaugural Monetary Policy Announcement for 2025, the Central Bank of Sri Lanka (CBSL) decided to hold all key rates unchanged. In particular, the monetary policy rate, the Overnight Policy Rate (OPR) was maintained at the current level of 8.00 per cent. In addition, the Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR), which are linked to OPR with pre-determined margins of ± 50 basis points, remain unchanged at 7.50% and 8.50% respectively. The cumulative reduction in interest rates since monetary easing began in June 2023 on the Standing Facility Rates stand at 800 bps. The statutory reserve rate also remained at 2.00%.

The total secondary market Treasury bond/bill transacted volume for 24 March was Rs. 16.68 billion.

In the money market, the net liquidity surplus stood at Rs. 169.66 billion yesterday. Rs. 1.58 billion was withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 8.50%, while an amount of Rs. 171.24 billion was deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 7.50%.

The weighted average rates on call money and repo were registered at 7.95% and 7.98% respectively.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating slightly to

Rs. 296.55/296.65 as against Rs. 296.75/296.85 the previous day.

The total USD/LKR traded volume for 24 March was

$ 63.35 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.