Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 5 July 2021 02:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

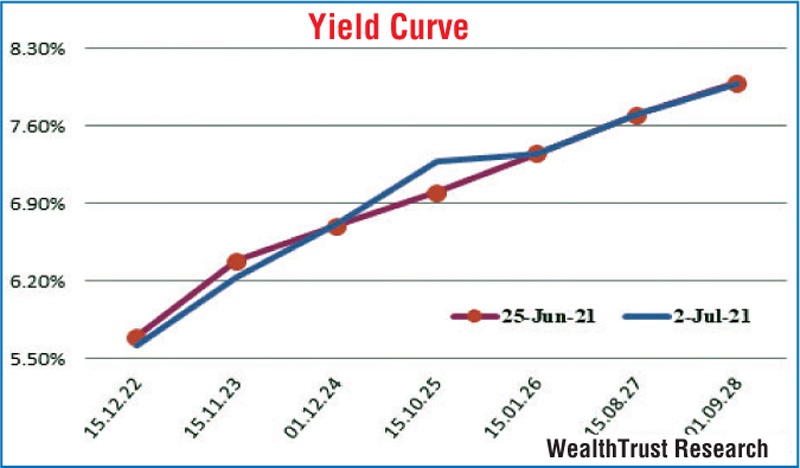

The secondary bond market witnessed an unusual development during the week ending 2 July, as the short end of the yield curve comprising of maturities up to the four-year duration of 2025 was seen steepening due to buying interest on 2022 and 2023 durations while selling interest and auction cut off on 2024 and 2025 durations saw its yields increase.

The secondary bond market witnessed an unusual development during the week ending 2 July, as the short end of the yield curve comprising of maturities up to the four-year duration of 2025 was seen steepening due to buying interest on 2022 and 2023 durations while selling interest and auction cut off on 2024 and 2025 durations saw its yields increase.

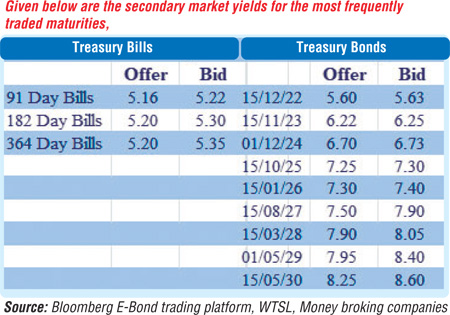

Trading activity centred on the liquid maturities of 2022’s (i.e. 01.10.22 and 15.12.22) and 2023’s (i.e. 15.03.23, 15.05.23, 15.07.23, 01.09.23 & 15.11.23) as its yields were seen decreasing during the week to weekly lows of 5.55%, 5.61%, 5.90%, 5.95%, 6.03%, 6.11% and 6.24% respectively.

Selling interest on the 2024 maturity saw its yield increase to a weekly high of 6.78% from a low of 6.72% while the cut off level of 7.31% at the primary auction on the 15.10.25 maturity saw it change hands at levels of 7.27% to 7.31% in the secondary market during the week.

The primary auctions conducted during week reflected mix outcomes as the total accepted volume at the weekly Treasury bills auction increased to a five-week high of 80.80% of its total offered amount. Nevertheless, the second phase of the 15.10.2025 maturity at the Treasury bond auction was opened at its weighted average rate due to its offered amount of Rs. 27.5 billion not been fully subscribed at its 1st Phase of the auction.

This was the first instance the second phase of an auctioned maturity was opened while it was not fully subscribed, following two rounds or four maturities of full subscription during the month of June.

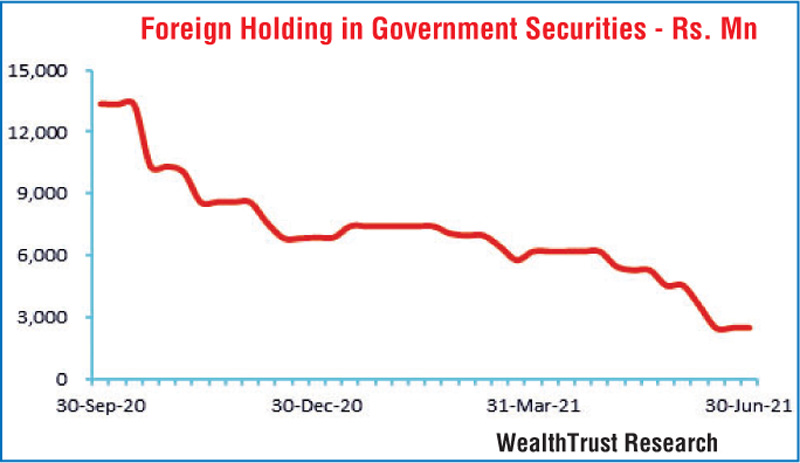

The foreign holding in rupee bonds remained steady at Rs. 2.49 billion for the week ending 30 June while inflation or the Colombo Consumer Price Index (CCPI) for the month of June increased further to 5.2% on its point to point against its previous months 4.5%.

The daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 9.50 billion.

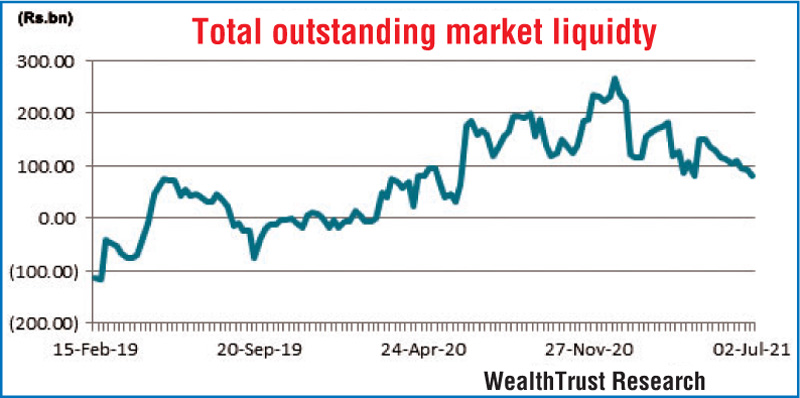

In money markets, the total outstanding liquidity surplus decreased further to Rs. 82.20 billion against its previous weeks Rs. 91.62 billion while CBSL’s holding of Government securities increased marginally to Rs. 921.85 billion against its previous weeks of Rs. 919.22 billion.

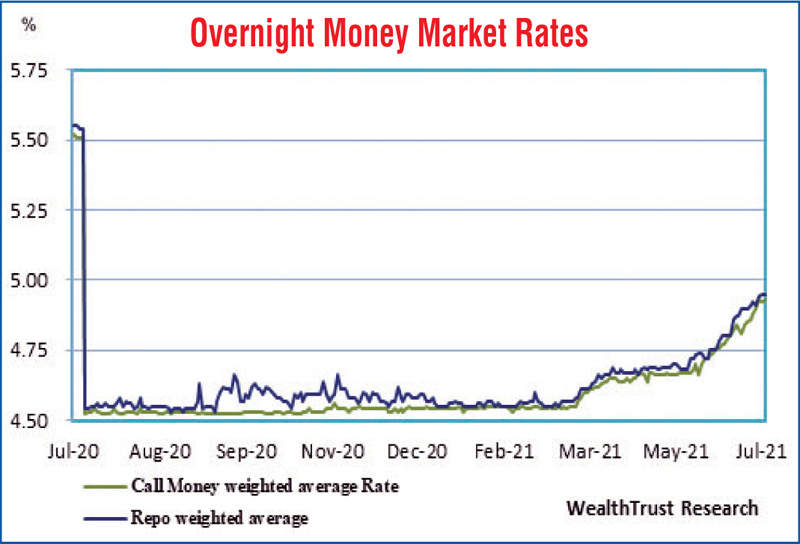

Furthermore, the overnight net surplus liquidity continued to fluctuate during the week as its was seen hitting over a 14-month low of Rs. 73.26 billion subsequent to it recording a one month high of Rs. 116.01 billion. The weighted average rates on overnight call money and repo increased further to average 4.91% and 4.93% respectively for the week.

USD/LKR

The Forex market continued to remain inactive during the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 68.11 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)