Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Wednesday, 13 January 2021 00:00 - - {{hitsCtrl.values.hits}}

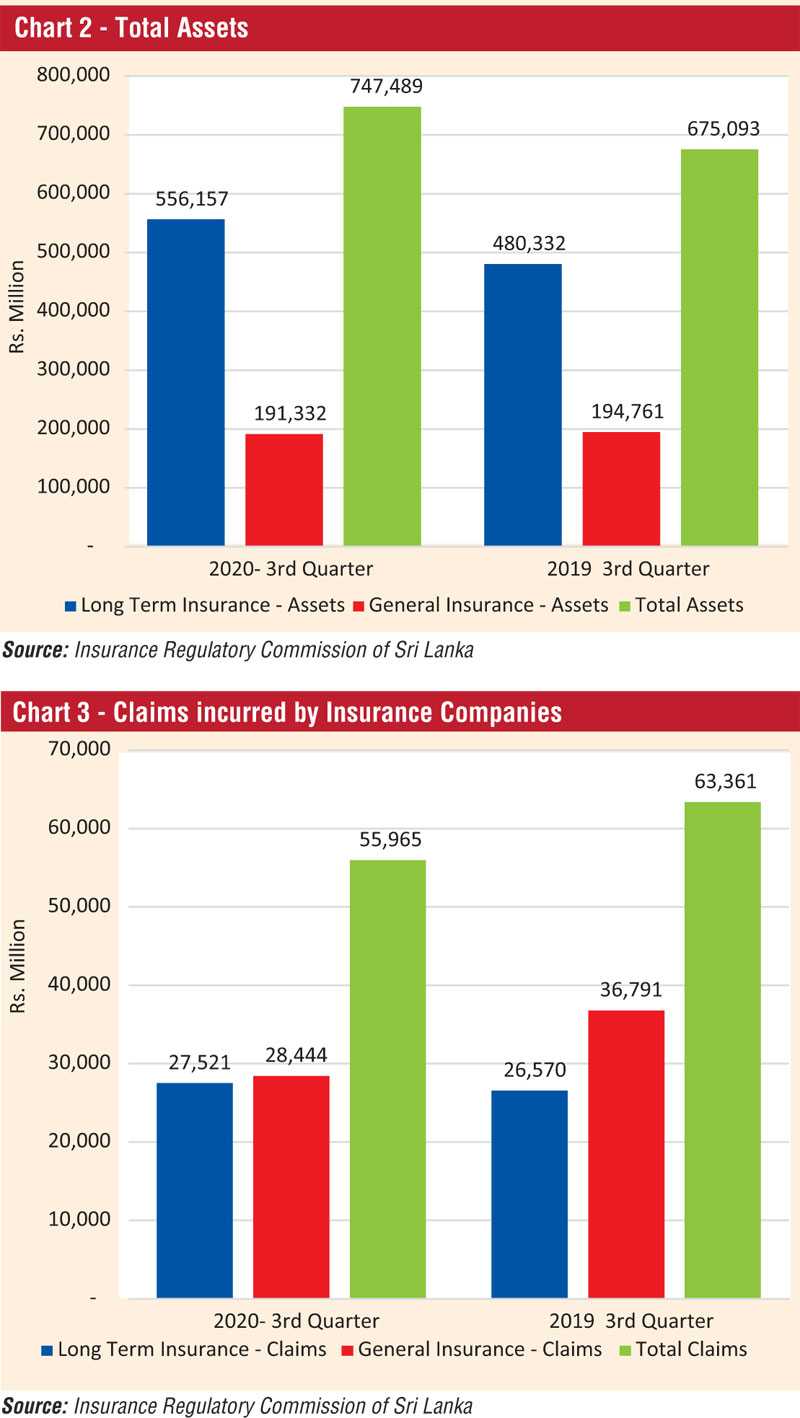

The insurance industry had achieve a growth of 3.7% in terms of overall Gross Written Premium (GWP), during the third quarter of 2020, recording an increase of Rs. 5.23 billion from a year earlier whilst profits have improved.

According to review of the quarter by Insurance Regulatory Commission of Sri Lanka (IRCSL), the GWP for Long-Term Insurance and General Insurance Businesses for the period ending 30 September 2020 was Rs. 145,391 million (Q3 2019: Rs.140,160)

The GWP of Long -Term Insurance Business amounted to Rs. 72,297 million (Q3 2019: Rs. 63,913 million) recording a growth of 13.12%. The GWP of General Insurance Business amounted to Rs. 73,094 million (Q3 2019: Rs. 76,247 million) recording a decline in growth of 4.14%.

As at 30 September 2020, 27 insurers were registered with the IRCSL. Two of them were composite companies transacting both Long Term Insurance and General Insurance business, whilst 13 of them engaged in Long-Term Insurance Business and 12 companies engaged only in General Insurance Business.

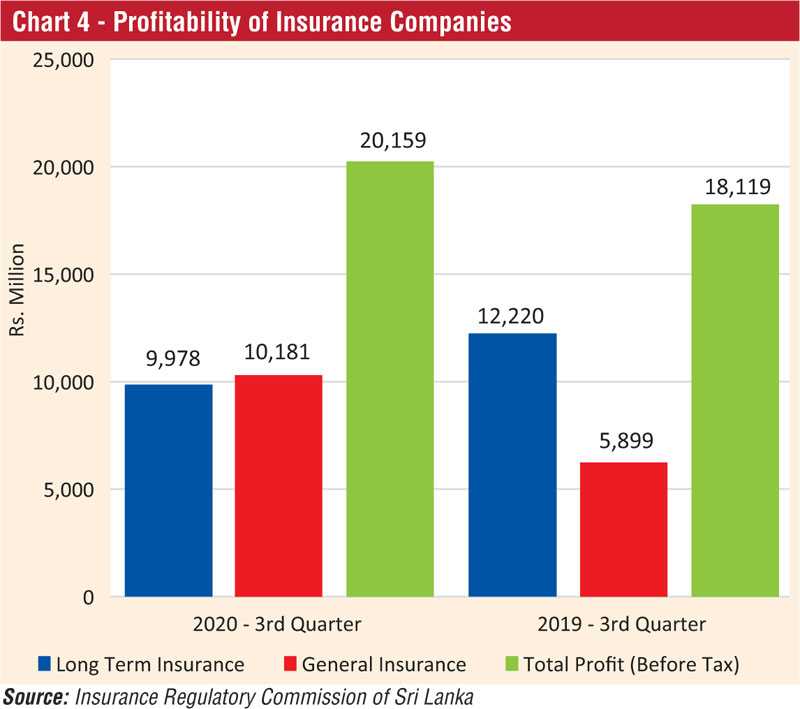

Total assets

The value of total assets of insurance companies has increased to Rs. 747,489 million as at 30 September 2020, when compared to Rs. 675,093 million recorded as at end of 30 September 2019 reflecting a growth of 10.72%.

The assets of Long-Term Insurance Business amounted to Rs. 556,157 million (Q3 2019: Rs. 480,332 million) indicating a growth rate of 15.79%. The assets of General Insurance Business amounted to Rs. 191,332 million (Q3 2019: Rs. 194,761 million) depicting a decline growth rate of 1.76% at the end of the third quarter 2020.

Investment in Government Securities

At the end of the third quarter 2020, investment in Government Debt Securities amounted to Rs. 224,173 million representing 45.6% (Q3 2019; Rs. 205,202 million; 48%) of the total investments of Long-Term Insurance Business, while such investments of the total investment of General Insurance Business amounted to Rs. 44,264 million representing 35.9% (Q3 2019: Rs. 43,207 million; 36.5%).

Accordingly, the total investment of both Long-Term Insurance Business and General Insurance Business in Government Debt Securities amounted to Rs. 268,437 million (Q3, 2019: Rs. 248,409 million). Thus, the investment in Government Debt Securities of Long-Term Insurance Business and General Insurance Business has increased by 9.25% and 2.45% respectively.

Claims incurred by Insurance Companies

The claims incurred by insurance companies during the third quarter of 2020 in both Long-Term Insurance Business and General Insurance Business was Rs. 55,965 million (Q3 2019: Rs. 63,361 million) showing a decrease in total claims amount by 11.67% year-on-year.

The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 27,521 million (Q3 2019: Rs. 26,570 million). The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 28,444 million (Q3 2019: Rs. 36,791 million).

Hence, during the third quarter of 2020, there has been an increase in Long Term Insurance claims by 3.58% and a decrease in General Insurance Businesses claims by 22.69% when compared to the same period in 2019. The claims incurred in Long Term Insurance as a percentage of GWP of Long-Term Business is 38% (2019; 42%) whereas the claims incurred in General Insurance as a percentage of GWP of General Insurance Business is 39% (2019; 48%).

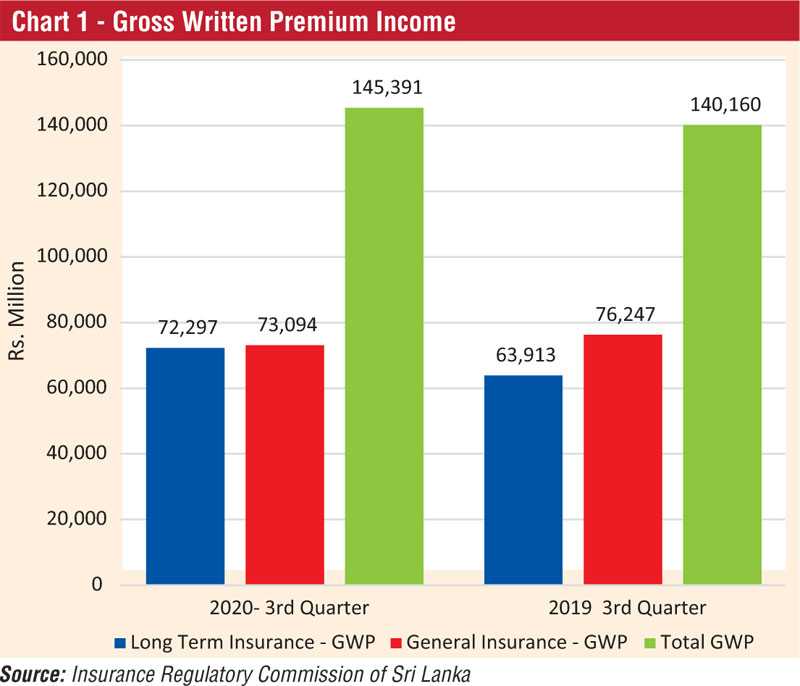

Profit (Before Tax) of Insurance Companies

The profit (before tax) of insurance companies as at end of the third quarter 2020 in both Long-Term Insurance Business and General Insurance Business amounted to Rs. 20,159 million (Q3 2019: Rs. 18,119 million) showing an increase in total profit amount by 11.26%.

The profit (before tax) of Long-Term Insurance Business amounted to Rs. 9,978 million (Q3 2019: Rs. 12,220 million) while the profit (before tax) of General Insurance Business amounted to Rs. 10,181 million (Q3 2019: Rs. 5,899 million). Thus, profit (before tax) of Long-Term Insurance Business has decreased by 18.34% and General Insurance Business has increased by 72.59%.

The above analysis (2020) does not include information in respect of NITF and Cooperative Insurance Ltd.

For Claims of Insurance Companies for Life category, only gross benefits and claims paid and claims ceded to reinsurers were considered.