Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 7 April 2022 00:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

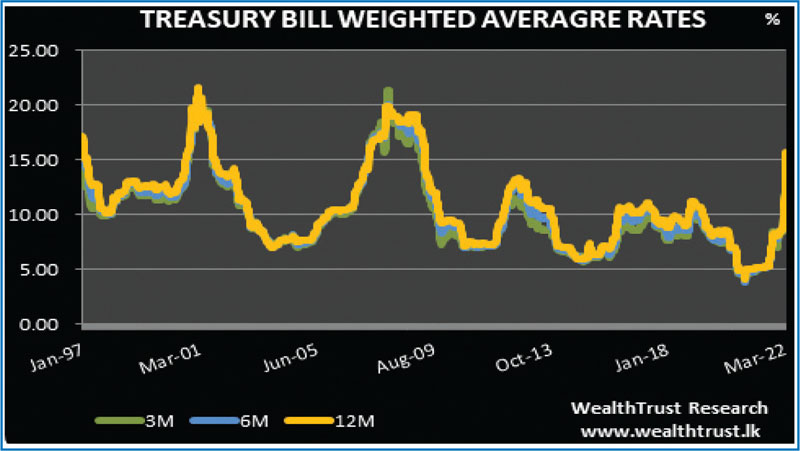

The weekly weighted averages were seen catapulting for a sixth consecutive week across all three maturities at its auctions held yesterday.

The weekly weighted averages were seen catapulting for a sixth consecutive week across all three maturities at its auctions held yesterday.

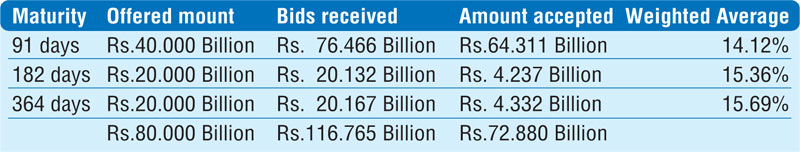

The week on week increase on the 182 day and 364 day bills was the highest witnessed in over 25 years, recording 311 basis points (3.11%) and 341 basis points (3.41%) respectively to hurl above 15.00% and register weighted averages of 15.36% and 15.69% respectively.

The 91 day bill recorded an increase of 120 basis points (1.20%), registering a weighted average of 14.12%.

A total amount of Rs.72.88 billion was successfully taken up against a total offered amount of Rs. 80 billion while the bids to offer ratio decreased to 1.46:1.

Meanwhile, the secondary bond market remained at a standstill yesterday while in secondary bills, May 2022 maturities changed hands at levels of 11.75% to 12.25%, pre-auction. The latest 91 day bill traded at levels of 14.50% to 14.75% following the auction.

In money markets, the net liquidity deficit stood at Rs. 586.05 billion yesterday as an amount of Rs. 120.51 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 6.50% against an amount of Rs. 706.56 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 7.50%. The weighted average rates on overnight Call money and REPO stood at 7.49% and 7.50% respectively.

Forex Market

In the Forex market, a trade on the USD/LKR spot contracts was seen at levels of Rs. 312.00 yesterday while the overall market remained inactive.

The total USD/LKR traded volume for 05 April was $ 14.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)