Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 6 November 2020 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The sluggish sentiment in the secondary bond market continued yesterday as well, due to most market participants’ persistence in staying on the sidelines.

The sluggish sentiment in the secondary bond market continued yesterday as well, due to most market participants’ persistence in staying on the sidelines.

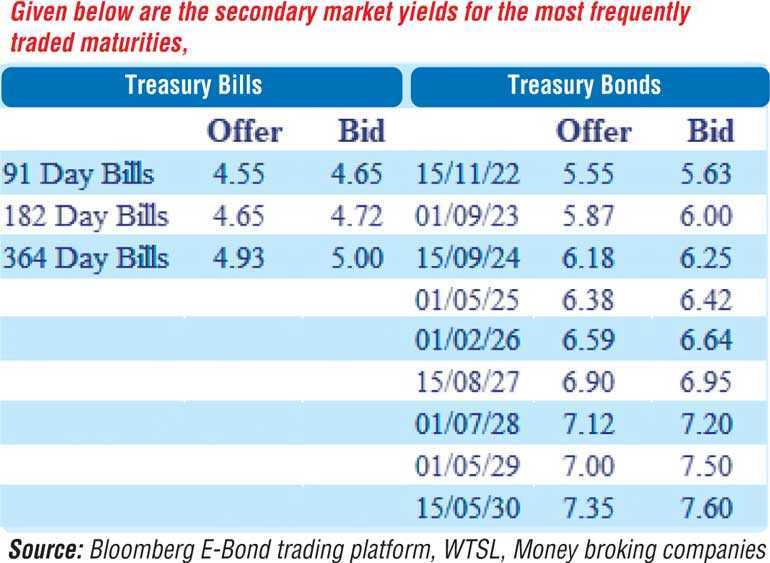

Limited trades were witnessed on the maturities of 2022s (i.e. 15.03.22 and 15.12.22) and 15.10.27 at levels of 5.40%, 5.64% and 6.97% to 6.99% respectively. In secondary bills, January, February, March and September 2021 maturities were seen changing hands at levels of 4.60%, 4.61%, 4.62% and 4.82% respectively.

The total secondary market Treasury bond/bill transacted volumes for 4 November was Rs.13.42 billion.

In the money market, overnight surplus liquidity was seen increasing further to record Rs.152.59 billion yesterday. The weighted average rates on overnight call money and repo remained steady at 4.53% and 4.59% respectively.

Rupee loses marginally

The USD/LKR rate on spot contracts was seen depreciating marginally yesterday to close the day at Rs. 184.45/55 against its previous day’s close of Rs. 184.35/45, subsequent to changing hands at level of Rs. 184.45 to 184.48.

The total USD/LKR traded volume for 4 November was $ 72.17 million.