Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 25 November 2020 00:00 - - {{hitsCtrl.values.hits}}

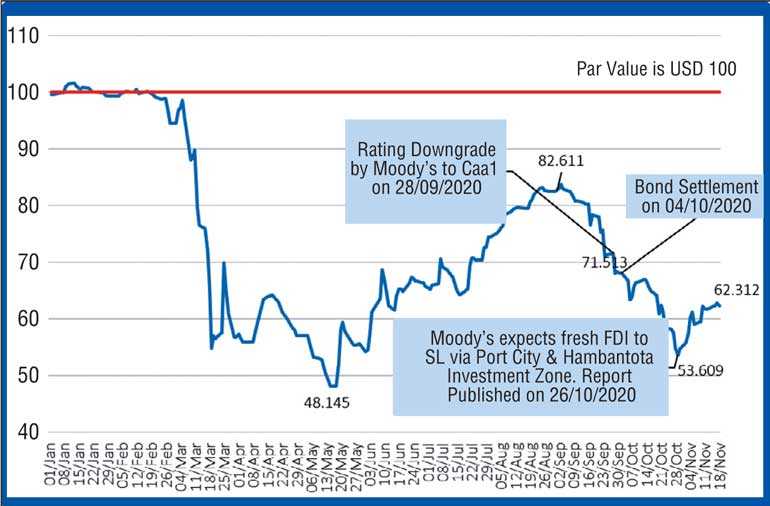

2030 SLISB price movement during 2020 (from 1 January to 18 November) – Source: www.bondevalue.com

|

| CAM Chairman Malaka Bandara

|

|

| CAM Director Dinesh Ambani

|

New Ceylon Asset Management (CAM) Chairman Malaka Bandara highlighted “this is a rare opportunity to invest in Sri Lanka sovereign bonds at discounted prices” after a Moody’s rating report overreaction to downgrade Sri Lanka to Caa1 in September (Source: Moody’s Investor Service, 28

September).

However, Moody’s recent report, was positive on Sri Lanka, highlighting strong FDIs expected during 2021. Thereafter, Sri Lanka International Sovereign Bond (SLISB) prices bounced back with strong buying from foreign investors. Analysts expect the SLISB prices to maintain positive momentum with improving economic fundamentals of Sri Lanka.

The Ceylon Dollar Bond Fund (CDBF) managed by CAM is exclusively invested in Sri Lanka Government Guaranteed Dollar Sovereign bonds and is open to local individual investors who hold a Personal Foreign Currency Account (PFCA), corporate investors with a Business Foreign Currency Account (BFCA) and Foreign Investors. Investors can exit at any time without penalties, and repatriate dollars to the originating bank account. CDBF offers true diversification for a minimum investment of $ 1,000 while an individual SLISB purchase has a minimum trade size of $ 200,000.

Dinesh Ambani, the new Director to join the Board of Directors of CAM, expects new Foreign Direct Investments to Dinesh Ambani following the 2021 Budget announcement this month, while expecting a positive country rating outlook. He emphasised that “local dollar investors should exploit the opportunity available through the Ceylon Dollar Bond Fund”.

Sri Lanka International Sovereign Bonds (SLISBs) underwent a turbulent October after Sri Lanka was downgraded from B to Caa1 (Stable Outlook) by Moody’s on 28 September. As a result, SLISB prices failed to gain despite the $ 1 billion Sovereign Bond settlement on 4 October demonstrating Sri Lanka’s creditworthiness.

Moody’s on 26 October published a favourable report on Foreign Direct Investments into Sri Lanka in 2021. The rating agency attributes the development of economic/investment zones by the ports and state-of-the-art development projects in Port City as the main factors for improved FDIs, including a BOI approved $ 24 billion oil refinery investment over five years. Given the geographic location of the island and intra-island connectivity with development in infrastructure, global names are expected to invest in manufacturing facilities in Hambantota Free Trade Zone (FTZ).

The 2030 SLISB with a par value of $ 100, traded at $ 71.5 on 28 September levels before the rating downgrade by Moody’s but plunged to $ 53.6 on 29 October 2020 after the downgrade. However, the bond prices recovered to $ 62.31 on 18 November levels following the recent publication by Moody’s on Sri Lanka’s FDI.

The Ceylon Dollar Bond Fund (CDBF), the only dollar denominated Sovereign Bond Fund in Sri Lanka, is managed by Ceylon Asset Management Co Ltd., an associate company of Sri Lanka Insurance Corporation. CDBF offers a unique opportunity to invest in dollar SLISBs that are traded globally. The fund is licensed by the Securities and Exchange Commission of Sri Lanka and Deutsche Bank AG acts as the Trustee and Custodian of the fund.

The CDBF reported a performance of 10.33% in USD during 2019. However, the fund performance as at 18 November is -31.09% (YTD), due to several challenges including the unprecedented pandemic shock and country rating downgrade of Sri Lanka from B to Caa1.

The CDBF is now trading at a unit buying price of $ 0.7360 as at 18 November 2020 in comparison to the YTD highest unit buying price of $ 1.0922 reached on 12 February (Source: Ceylon Asset Management). Accordingly, investors are able to take advantage of the discounted SLISB prices via CDBF with improving economic fundamentals of Sri Lanka. The fund size stands at $ 21.84 m as at 18 November, offering a current weighted average Yield-to-Maturity (YTM) of 17.25% in dollar terms as at 18 November.

Past performance is not an indicator of future performance. Yield to Maturity (YTM) is variable and subject to market change, investors are advised to read and understand the contents of the explanatory memorandum on www.ceylonam.com.