Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 24 March 2022 02:26 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

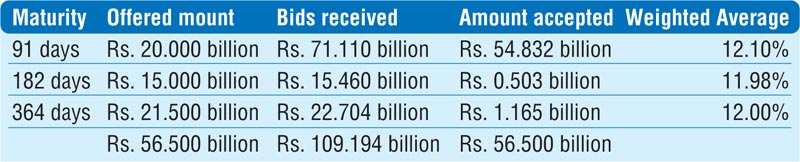

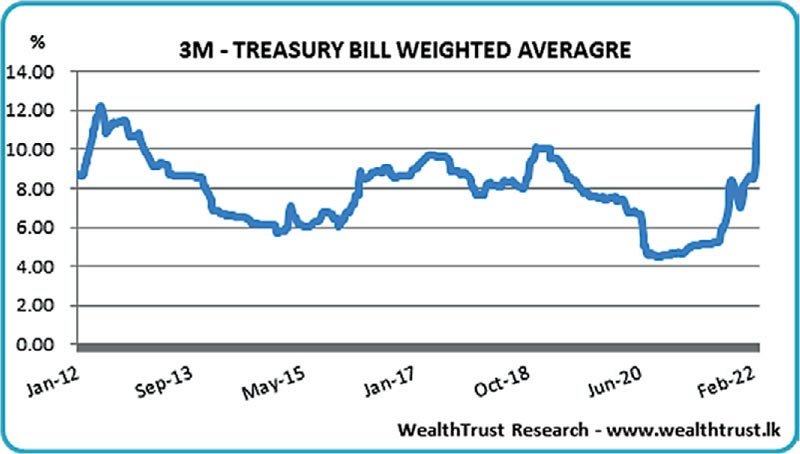

The steep increases in the weekly Treasury bill weighted averages were seen continuing for a fourth consecutive week at its weekly auction held yesterday with the market favourite 91 day bill crossing the 12.00% psychological level for the first time since May 2012 to record 12.10%.

The steep increases in the weekly Treasury bill weighted averages were seen continuing for a fourth consecutive week at its weekly auction held yesterday with the market favourite 91 day bill crossing the 12.00% psychological level for the first time since May 2012 to record 12.10%.

The 182 day bill recorded the sharpest increase of 93 basis points to 11.98% closely followed by the 364 day by 85 basis points to 12.00%. The 91 day bill continued to dominate the auction as it represented 97.05% of the total accepted amount.

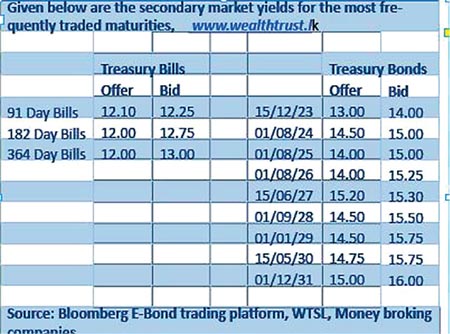

Meanwhile, activity in the secondary bond market reduced once again yesterday, with limited trades witnessed only on the 15.06.27 maturity at levels of 15.25% against its previous day’s closing levels of 14.90/25. In the secondary bill market, 6 May maturity changed hands at levels of 10.00% to 10.25% respectively, pre-auction.

The total secondary market Treasury bond/bill transacted volume for 22 March was Rs. 2.94 billion.

In money markets, the net liquidity deficit stood at Rs. 585.95 billion yesterday as an amount of Rs. 109.76 billion was deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 6.50% against an amount of Rs. 695.71 billion withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 7.50%. The weighted average rates on overnight Call money and REPO stood at 7.50% each.

Forex market

In the forex market, the overall activity remained moderate yesterday while spot contracts closed the day at Rs. 290.00/300.20 as against its previous day’s closing of Rs. 275.00/300.00.

The total USD/LKR traded volume for 22 March was $ 34.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)