Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 21 October 2024 00:34 - - {{hitsCtrl.values.hits}}

The International Chamber of Commerce’s Committee for Research, Knowledge Mobilisation, and Taxation (ICC-RKMT), in collaboration with the Inland Revenue Department (IRD) and panelists from EY, KPMG, and RTA Sri Lanka, hosted a highly impactful webinar on advanced income tax (AIT) and withholding tax (WHT).

Moderated by Dr. Nadee Dissanayake, the event drew a large audience and revealed significant knowledge gaps and challenges in practical application.

This article highlights key findings, recommendations for policymakers, and proposals for future webinars based on participant feedback.

The webinar revealed key insights, with participants highlighting difficulties in navigating the complexities of AIT and WHT frameworks. There was a clear demand for more accessible guidance and practical, hands-on sessions to bridge the gap between theory and real-world application. The discussion also uncovered significant knowledge gaps, particularly in WHT laws, underscoring the need for targeted educational resources to help professionals tackle these complex regulations effectively.

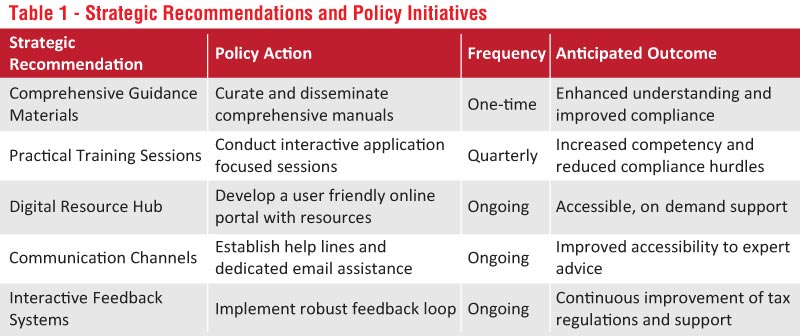

In response to the challenges articulated during the webinar, several key recommendations and policy initiatives have been proposed, aiming to streamline tax compliance, improve knowledge, and encourage deeper engagement within the tax community. The following Table 1 encapsulates these recommendations and the envisioned outcomes of their implementation.

The webinar effectively spotlighted the complexities of AIT and WHT, with participants expressing a strong demand for further support and hands-on training.

The implementation of the proposed strategic actions, coupled with the curation of targeted future webinars, promises to significantly strengthen taxpayer education and adherence to compliance . The high level of engagement during the session emphasizes the importance of these initiatives and highlights the ongoing need for sustained efforts to support and educate both tax professionals and individuals.