Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 5 January 2024 00:02 - - {{hitsCtrl.values.hits}}

Insurance has long been recognised as a crucial factor in supporting economic development and safeguarding the livelihoods and assets of individuals, businesses, low-income families, and micro, small and medium enterprises (MSMEs).

In Sri Lanka, there are 28 insurance companies and 78 insurance brokering companies. However, insurance penetration is still 1.1%. The insurance industry has faced its unique set of challenges, often struggling to thrive. These challenges are deeply rooted in cultural and attitudinal barriers, as well as a lack of public trust in the industry. The situation has been further compounded by the impact of the COVID-19 pandemic and other economic hardships.

To address these issues and enhance public trust in insurance, the Insurance Regulatory Commission of Sri Lanka (IRCSL), has embarked on a comprehensive study conducted by the Department of Demography at the University of Colombo (UOC). The study aims to investigate public perceptions of insurance, the level of confidence in both life and general insurance, and the challenges and attributes influencing this confidence. The primary goal was to identify the factors affecting public trust and formulate strategies for increasing insurance penetration in the country.

The quantitative study was adopted through survey design of a nationally representative sample to collect the public perception of the confidence towards insurance in Sri Lanka across the nine provinces of the country with a robust coverage of urban, rural and estate localities in the country. The survey was conducted using face-to-face questionnaire administration by a well-trained team of data collectors under the supervision of panel of supervisors comprising Prof. K.A.P. Siddhisena and Prof. Manori Weeratunga of UOC.

Key Findings

The study findings portrait a national representation picture of the public confidence level towards insurance, and it is at average level at the overall country level.

Confidence Level

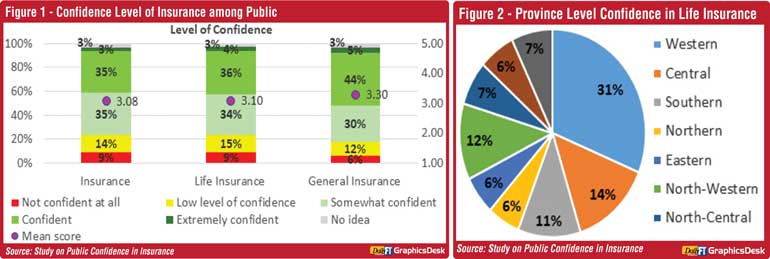

The findings reveal that confidence in Insurance among the public of Sri Lanka is close to average (mean score of 3.08 on a five-point Likert scale). The same for life insurance is not significantly different, and it is at 3.10 mean. Nevertheless, confidence in general insurance is slightly higher (3.30) (Figure 1). When considering the top two boxes (Extremely confident + confident) percentage, 38% is confident on insurance, 39% is confident on life insurance and 49% is confident on general insurance which is mainly on motor insurance.

As revealed from the estimation of composite index in Sri Lanka, the average insurance confidence index is 50.2 out of 100. The survey revealed that there is no significant difference in confidence towards insurance among the different profiled segments in the country. It is interesting to note that district level representation of the confident segment of people towards insurance indicates the highest level in Colombo and Gampaha districts, while Kurunegala, Kandy, and Galle show a moderate level of confidence (Figure 2).

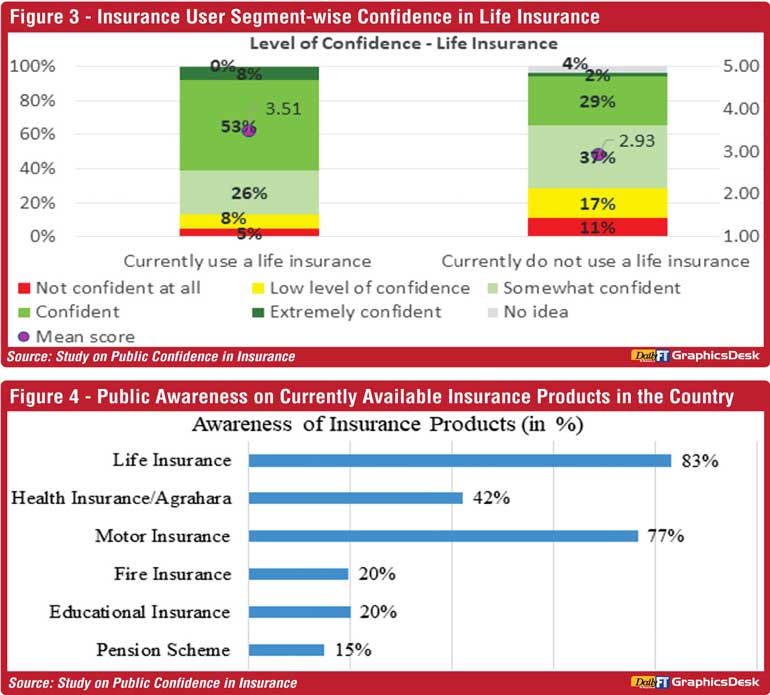

The study reveals a significant difference in confidence levels towards life insurance between current users and non-users. Those with life insurance products exhibit significantly higher confidence, while 28% of non-users express extremely low or no confidence (Figure 3).

Awareness

Intuitive awareness of life insurance is 83%, and a significant percentage of people are aware of life insurance products. Awareness of motor insurance is at 77%. However, only 42% were able to recall health insurance. Except for a small percentage difference, awareness levels of fire, educational and pension insurance products in the country are mostly similar across demographic groups (Figure 4).

The findings of this study provide valuable insights into the insurance industry in Sri Lanka and offer a roadmap for improving public confidence and increasing insurance penetration. The UOC presented the survey findings and recommendation to CEOs of insurance companies. The IRCSL intends to implement the survey recommendations to enhance the insurance landscape in the country.