Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 1 July 2021 00:00 - - {{hitsCtrl.values.hits}}

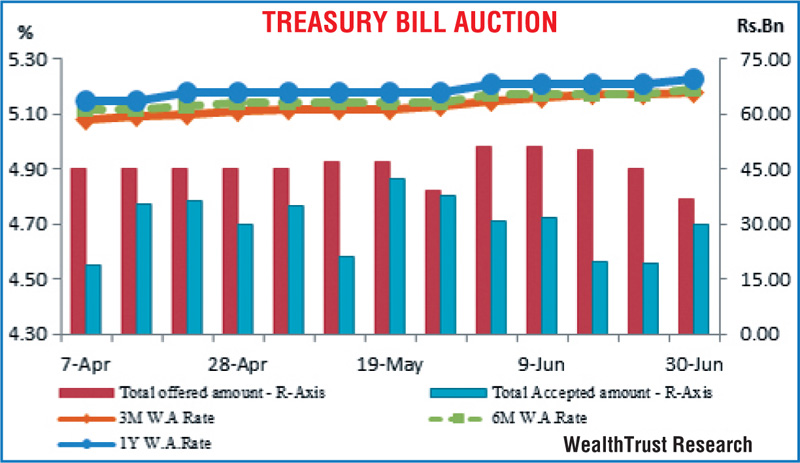

The total accepted amount at yesterday’s Treasury bill auction was seen increasing to a five-week high of 80.80% of its total offered amount while its bids to offer ratio increased to a five-week high of 1.66:1 as well. A total amount of Rs. 29.9 billion was accepted against its total offered amount of Rs. 37.0 billion.

The total accepted amount at yesterday’s Treasury bill auction was seen increasing to a five-week high of 80.80% of its total offered amount while its bids to offer ratio increased to a five-week high of 1.66:1 as well. A total amount of Rs. 29.9 billion was accepted against its total offered amount of Rs. 37.0 billion.

The weighted average yields increased across the board with the 182 day and 364-day maturities recording an increase of 2 basis points each to 5.19% and 5.23% respectively followed by the 91-day maturity by 01 basis point to 5.18%. The 91-day bill dominated the auction as it represented 89.06% of the total accepted amount.

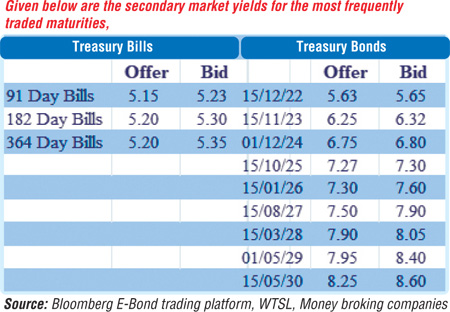

Meanwhile, activity in the secondary bond market remained moderated yesterday as most market participants continued to be on the side lines. In limited trades, the yield on the 15.12.22 maturity dipped to a low of 5.65% against its previous day’s closing level of 5.67/70 on renewed buying interest while the maturity of 15.10.25 changed hands at a level of 7.30%.

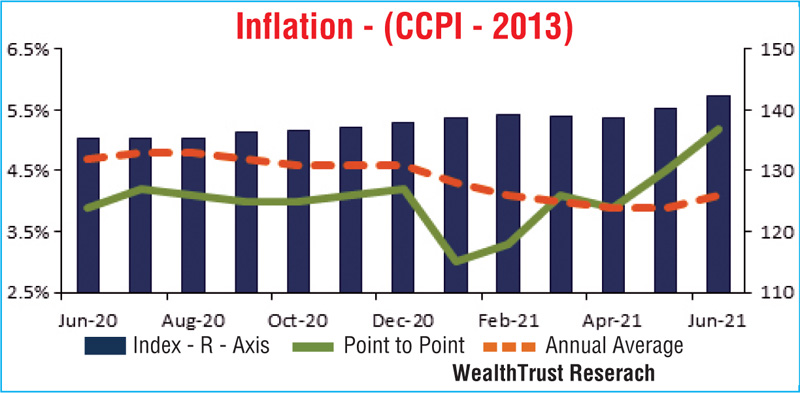

Moreover, the Colombo Consumer Price Index (CCPI) saw its point to point inflation for the month of June 2021 increase further to register 5.2% against 4.5% recorded in May while its annual average increased to 4.1% from 3.9%.

The total secondary market Treasury bond/bill transacted volume for 29 June was Rs. 6.90 billion.

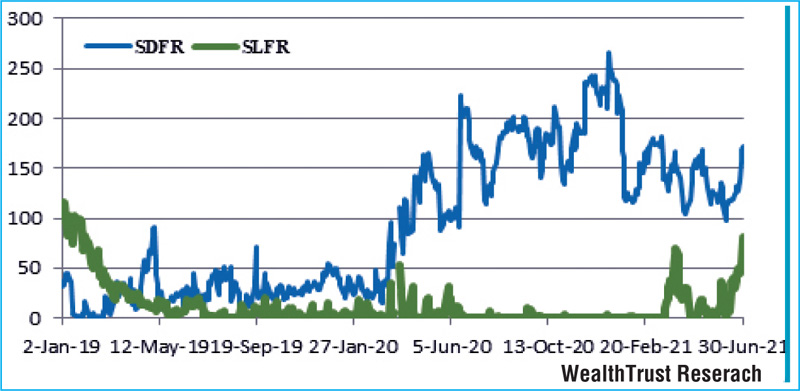

In money markets, the weighted average rates on overnight call money and repo increased marginally to 4.93% and 4.94% respectively as the overnight net liquidity surplus decreased once again to Rs. 91.25 billion yesterday.

An amount of Rs. 172.54 was deposited at Central Banks SDFR (Standard Deposit facility Rate) of 4.50% against a two-year and five-month high amount of Rs. 81.30 billion been withdrawn from Central Banks SLFR (Standard Lending facility Rate) of 5.50%. The CBSL’s holding of Gov. Securities remained steady at Rs. 919.24 billion.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 29 June was $ 74.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)