Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 19 August 2021 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

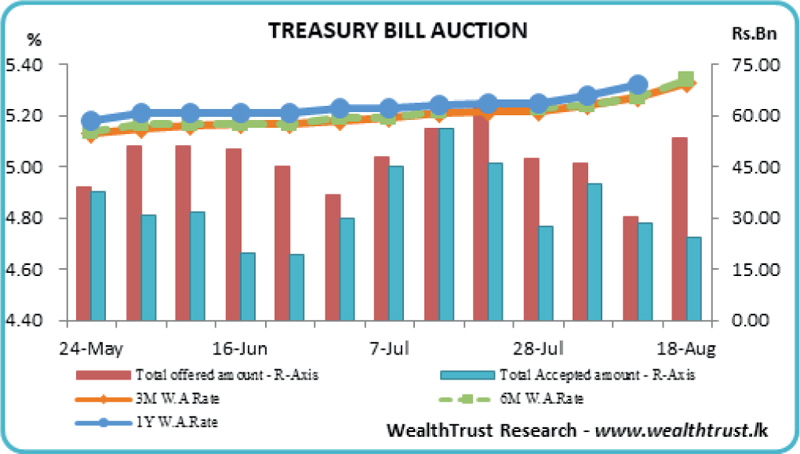

The demand for Treasury bills at the weekly auction decreased yesterday, as only 45.16% of its total amount was accepted in comparison to its previous week’s 93.17%. The weighted average rates on the 91-day and 182-day maturities were recorded at 5.33% and 5.34% respectively, reflecting increases of six and seven basis points. All bids received on the 364-day bill were rejected while the bids-to-offer ratio stood at 1.25:1.

The demand for Treasury bills at the weekly auction decreased yesterday, as only 45.16% of its total amount was accepted in comparison to its previous week’s 93.17%. The weighted average rates on the 91-day and 182-day maturities were recorded at 5.33% and 5.34% respectively, reflecting increases of six and seven basis points. All bids received on the 364-day bill were rejected while the bids-to-offer ratio stood at 1.25:1.

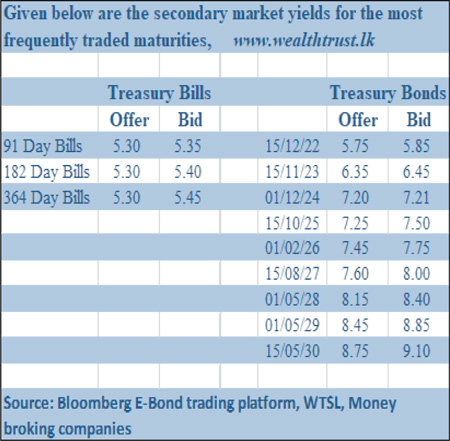

The secondary bond market was at a standstill yesterday, with most market participants opting to be on the side-lines ahead of the sixth monitory policy announcement for the year 2021 due today at 7:30 a.m. The monetary board of the Central Bank of Sri Lanka, at its last announcement made on 8 July 2021 kept its policy rates of Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) steady at 4.50% and 5.50% respectively for an eight consecutive announcement. Limited trades were witnessed on the 2026 maturities (i.e. 15.01.26 and 01.02.26) at levels of 7.45% to 7.50%.

The total secondary market Treasury bond/bill transacted volume for 17 August was Rs. 0.90 billion.

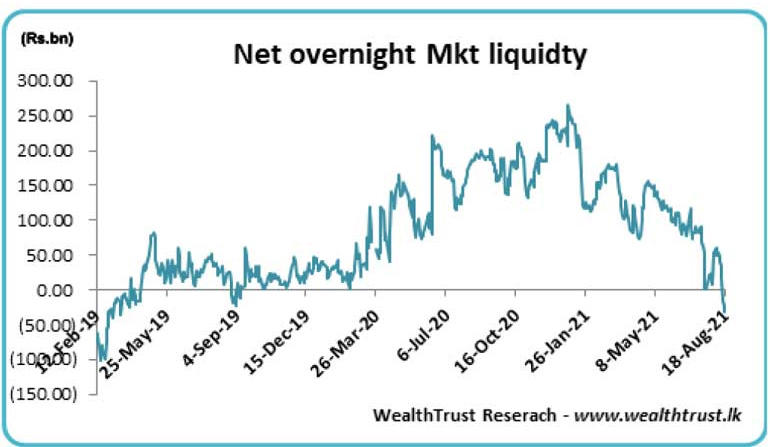

In money markets, the net liquidity shortage increased further to Rs. 32.37 billion yesterday with an amount of Rs. 113.88 billion been withdrawn from Central Banks SLFR of 5.50% against an amount of Rs. 81.51 billion deposited at Central Banks SDFR of 4.50%. The weighted average rates on call money and repo stood at 5.09%.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 17 August was $ 40.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)