Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 26 August 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

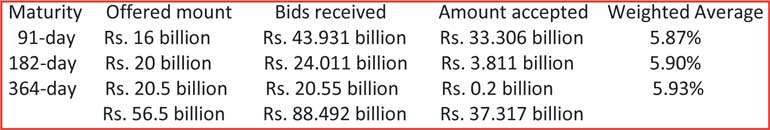

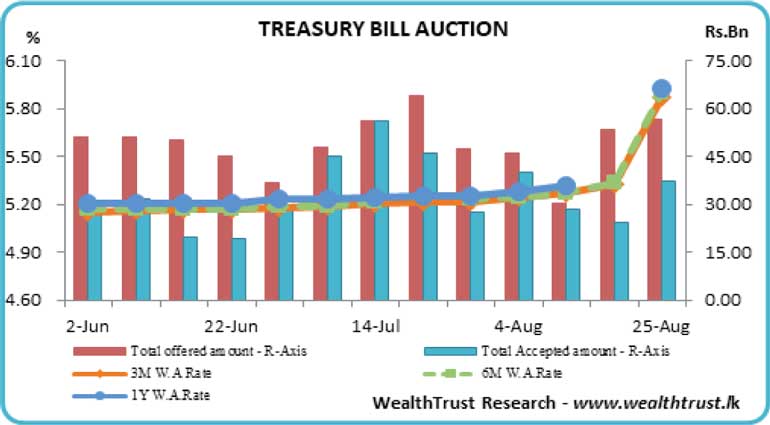

The weekly Treasury bill auction conducted yesterday saw its total accepted volume increase to 66.05% of its total offered amount against the previous week’s 45.16%, as the bid to offer ratio increased to 1.56:1. The weighted average yields increased across the board following the policy rate increases, with the 364-day maturity recording an increase of 61 basis points to 5.93% followed by the 91-day and 182-day maturities by 54 and 56 basis points respectively to 5.87% and 5.90%. Given below are the details of the auction.

The weekly Treasury bill auction conducted yesterday saw its total accepted volume increase to 66.05% of its total offered amount against the previous week’s 45.16%, as the bid to offer ratio increased to 1.56:1. The weighted average yields increased across the board following the policy rate increases, with the 364-day maturity recording an increase of 61 basis points to 5.93% followed by the 91-day and 182-day maturities by 54 and 56 basis points respectively to 5.87% and 5.90%. Given below are the details of the auction.

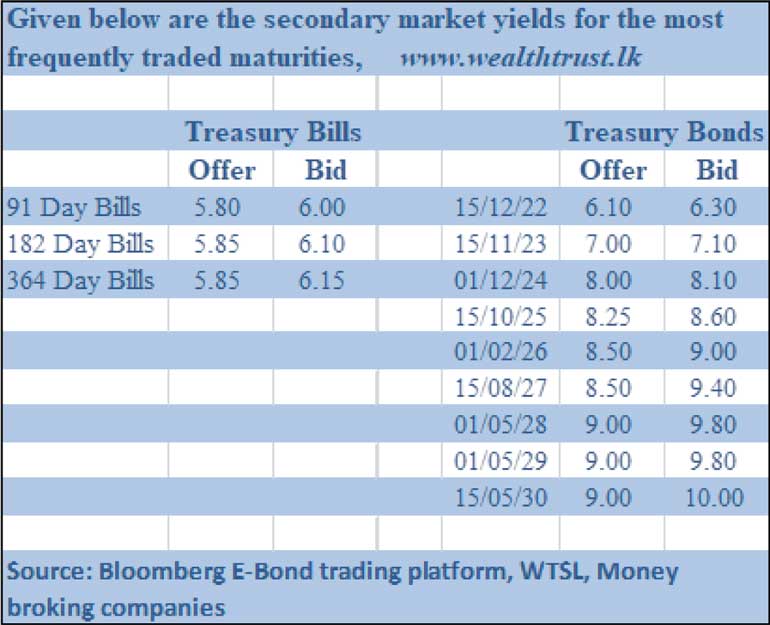

The activity in the secondary bond market moderated yesterday with limited trades seen on the 2024 maturities (i.e. 15.09.24 and 01.12.24) at 8.05% each.

The total secondary market Treasury bond/bill transacted volume for 24 August was Rs. 4.02 billion.

In money markets, the weighted average rates on overnight call money and repo stood at 5.76% and 5.74% respectively, as the overnight net liquidity surplus in the system increased to Rs. 12.12 billion yesterday. Furthermore, the Domestic Operations Department (DOD) of the Central Bank of Sri Lanka commenced conducting repo auctions from the 24 August in order to drain out excess liquidity from the system. It drained an amount of Rs. 6.95 billion on an overnight basis yesterday for the first time since 19 March 2020, at a weighted average of 5.71%.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 24 August was $ 6 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)