Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 11 July 2024 01:43 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

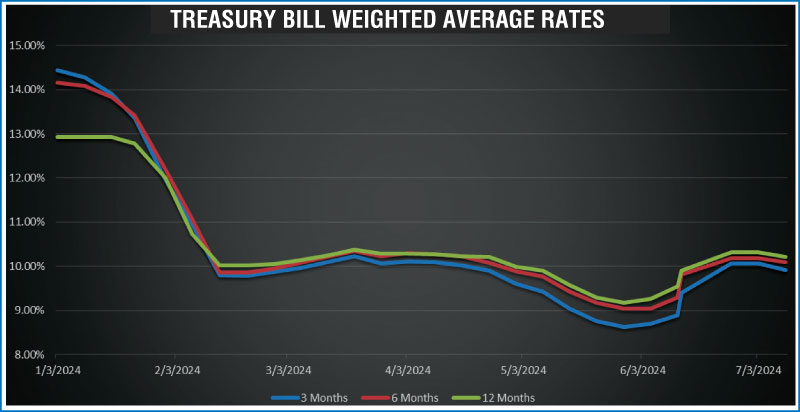

The Treasury bill weighted average rates were seen decreasing across board for the first time in six weeks at its auctions held yesterday while the auction was fully subscribed as well. Robust demand was observed, as total bids received exceeded the offered amount by 2.86 times. This marked a reversal of the recent upward trend, which had seen rates increase in four out of the last five weeks. Last week’s auction saw rates hold steady and significant buying interest was observed in the secondary market in the run-up to this auction. The decline in rates from their recently elevated levels was broadly in line with market expectations.

The Treasury bill weighted average rates were seen decreasing across board for the first time in six weeks at its auctions held yesterday while the auction was fully subscribed as well. Robust demand was observed, as total bids received exceeded the offered amount by 2.86 times. This marked a reversal of the recent upward trend, which had seen rates increase in four out of the last five weeks. Last week’s auction saw rates hold steady and significant buying interest was observed in the secondary market in the run-up to this auction. The decline in rates from their recently elevated levels was broadly in line with market expectations.

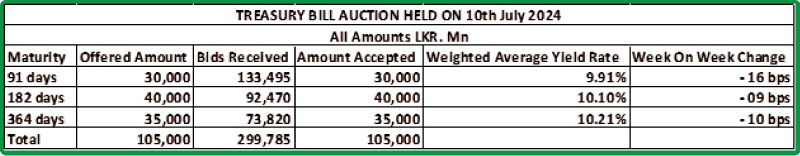

The weighted average yield on the 91-day maturity decreased by 16 basis points, registering at 9.91%. The 182-day maturity yield was down by 9 basis points, standing at 10.10%. Meanwhile, the 364-day maturity yield reduced by 10 basis points to record at 10.21%.

The 2nd phase of subscription, across all three maturities will be opened until 4:00 pm on the day before the settlement date (i.e., 11.07.2024) at the respective weighted averages determined at the 1st phase of the auction. Given below are the details of the auction;

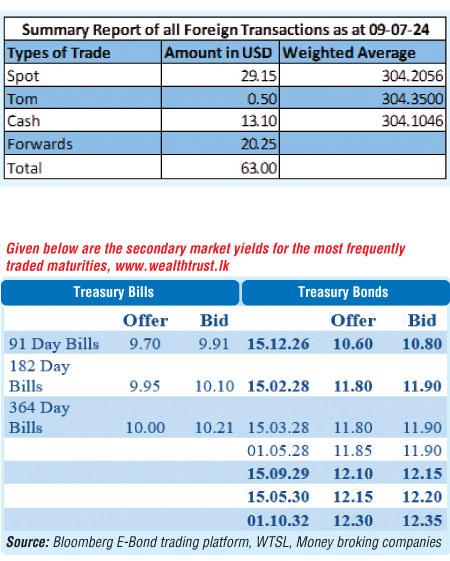

The secondary bond market yesterday displayed mixed signals, with trades limited to selected maturities. The 2028 tenors witnessed significant buying interest. Specifically, the yield on the 15.02.28 maturity declined from an intraday high of 11.85% to a low of 11.80% on the back of considerable volumes transacted. Similarly, the 01.05.28 maturity also saw yields decline from a high of 11.90% to a low of 11.85%. However, conversely the 15.09.29 maturity experienced yields increasing from a low of 12.10% to a high of 12.15% also on the back of substantial volumes.

The Treasury Bond auctions due to be held today will offer a total of R.s 138.00 b. This will comprise of Rs. 58.00 billion from a bond due on 15 December 2027 bearing a coupon of 11.25% and Rs. 80.00 billion from a bond due on 01 December 2031 bearing a coupon of 12.00%.

For context, at the last Treasury bond auction conducted on 27/06/24, the entire offered amount of Rs. 75.00 billion was fully subscribed. The 15.02.28 maturity, was issued at a weighted average yield of 11.90% and the 01.06.33 maturity was issued at a weighted average of 12.41%, both above the prevailing pre-auction rates on similar maturities.

The total secondary market Treasury bond/bill transacted volume for 09 July was Rs. 3.97 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.75% and 9.05% respectively while the net liquidity was a surplus Rs. 110.55 billion yesterday. An amount of Rs. 126.05 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%, while an amount of Rs. 5.49 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50%.

Further, the DOD (Domestic Operations Department) of Central Bank conducted an overnight reverse repo auction amounting to Rs. 10.00 billion at the weighted average rate of 8.65%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day up further at Rs. 303.63/303.72, against its previous day’s closing level of Rs. 303.90/304.05.

The total USD/LKR traded volume for 09 July was $ 63.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)