Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 30 October 2024 00:18 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

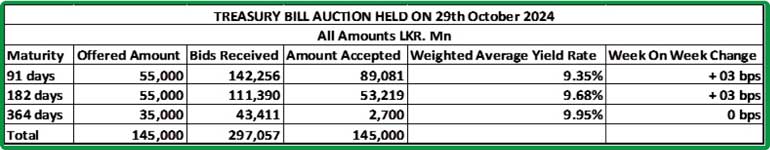

At the weekly Treasury bill auction conducted yesterday, weighted average rates were seen increasing very marginally on the shorter tenors, the first instance in 6 weeks. Last week, rates remained unchanged, after 4 weeks of steady declines, prior to that. Accordingly, the weighted average rate on the 91-day tenor increased by 03 basis points to 9.35%, while the 182-day tenor also rose by 03 basis points to 9.68%. However, the weighted average rate on the 364-day tenor remained unchanged at 9.95%. Total bids received exceeded the offered amount by 2.05 times, and the entire Rs 145.00 billion on offer was successfully raised at its 1st phase.

The 2nd phase of subscription for the auction will be opened for the 182-day and 364-day tenors at the weighted average rates until close of business of the day prior to settlement (i.e., 4.00 p.m. on 30.10.2024). Given below are the details of the auction;

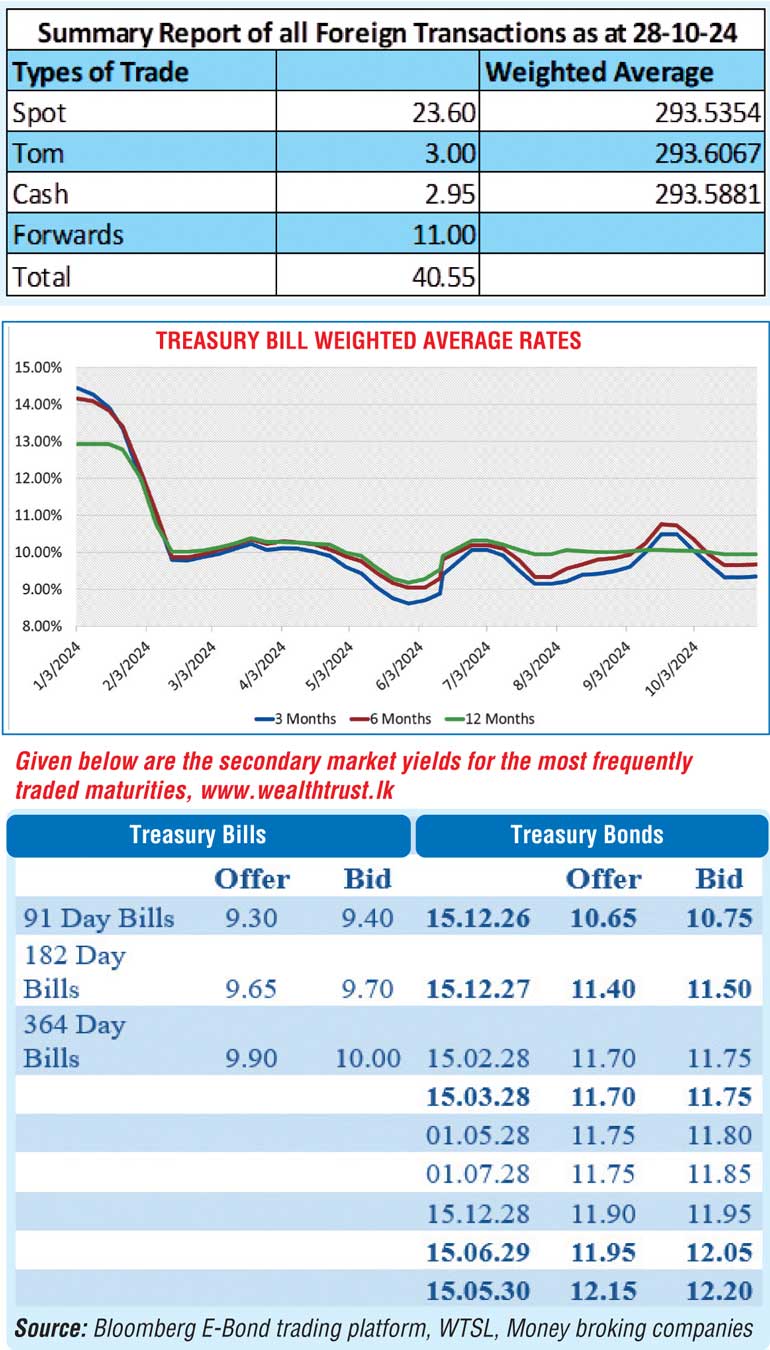

Meanwhile, secondary market activity in bonds was subdued and transaction volumes were relatively thin, as market participants were seen taking a step back.

Accordingly, limited trades were observed on selected maturities. The 2026 tenors (i.e. 15.05.26, 01.06.26, 01.08.26 and 15.12.26) changed hand within the range of 10.50%-10.65%. The 15.01.27 maturity was seen changing hands at the elevated level of 10.75%-10.80%. The 01.07.28 traded at the rate of 11.80%. The yield on the 15.12.28 moved up the range of 11.95%-11.97%. The yield on the 15.09.29 held steady to trade at 12.00%. Additionally, the medium tenor 15.05.30 maturity changed hands at the rate of 12.20%.

The total secondary market Treasury bond/bill transacted volume for 28 October was Rs. 15.88 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.55% and 8.72% respectively.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight and 7-day reverse repo auction for

Rs. 14.47 billion and Rs. 60.00 billion at the weighted average rates of 8.40% and 8.63% respectively.

The net liquidity surplus stood at

Rs. 126.85 billion yesterday. No funds were withdrawn from the Central Banks SLFR (Standing Lending Facility Rate) of 9.25% as against an amount of Rs. 201.32 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.25%.

Forex market

In the Forex market, the USD/LKR rate on spot contracts closed the day depreciating marginally to

Rs. 293.70/293.75 against its previous day’s closing level of Rs. 293.60/293.70.

The total USD/LKR traded volume for 28 October was $ 40.55 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money

broking companies)