Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 22 May 2024 00:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

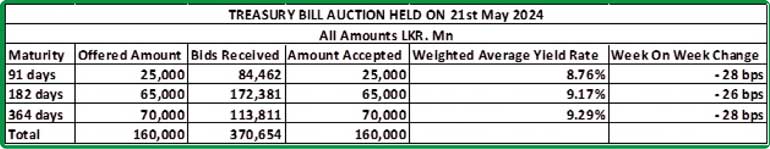

At the weekly Treasury bill auction conducted yesterday, the weighted average yields declined across all three maturities for a seventh consecutive week, reaching its lowest levels in over two years.

At the weekly Treasury bill auction conducted yesterday, the weighted average yields declined across all three maturities for a seventh consecutive week, reaching its lowest levels in over two years.

This week’s decline was also notably steep, with the 91-day maturity falling by 28 basis points to 8.76%, the 182-day maturity by 26 basis points to 9.17% and the 364-day maturity by 28 basis points to 9.29%. The yield on the 91-day tenor was seen dropping below 9.00% for the first time since February 2022. As a result, the yields on all three tenors were seen dropping below the monetary policy Standing Lending Facility rate of 9.50%. The auction went fully subscribed with the entire offered amount of Rs. 160.00 billion accepted at the 1st phase. The total bids received exceeded the offered amount by 2.32 times.

The 2nd phase of subscription, across all three maturities will be opened until 4 p.m. on the day before the settlement date (i.e., 22.05.2024) at the respective weighted averages determined at the 1st phase of the auction. The given chart displays details of the auction.

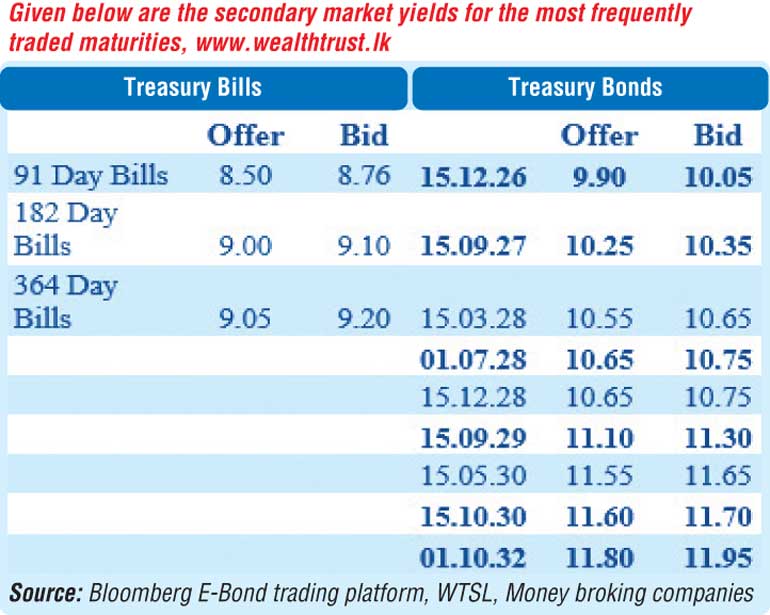

Meanwhile the secondary bond market saw an increase in activity in the run up to and post announcement of the auction results, as compared to the previous day. Trading as usual continued to be centred on the short to medium end of the yield curve with a specific emphasis on 2025-2032 tenors.

The yield on the liquid 15.12.26 maturity declined to an intraday low of 10.05% from an intraday high of 10.10%, with a sizeable volume collected at the low. While the 15.05.26 and 01.08.26 maturities both traded at 10.00. This momentum was also witnessed on the popular 2028 durations, such as the 15.03.28, 01.07.28 and 15.12.28 which hit intraday lows of 10.60%, 10.72 and 10.70% respectively as against highs of 10.65% and 10.75% each respectively. While the medium tenor 2030 (i.e. 15.05.30 and 15.10.30) and 01.10.32 maturities were seen trading within the ranges of 11.60% to 11.65% and 11.85% to 11.90% respectively.

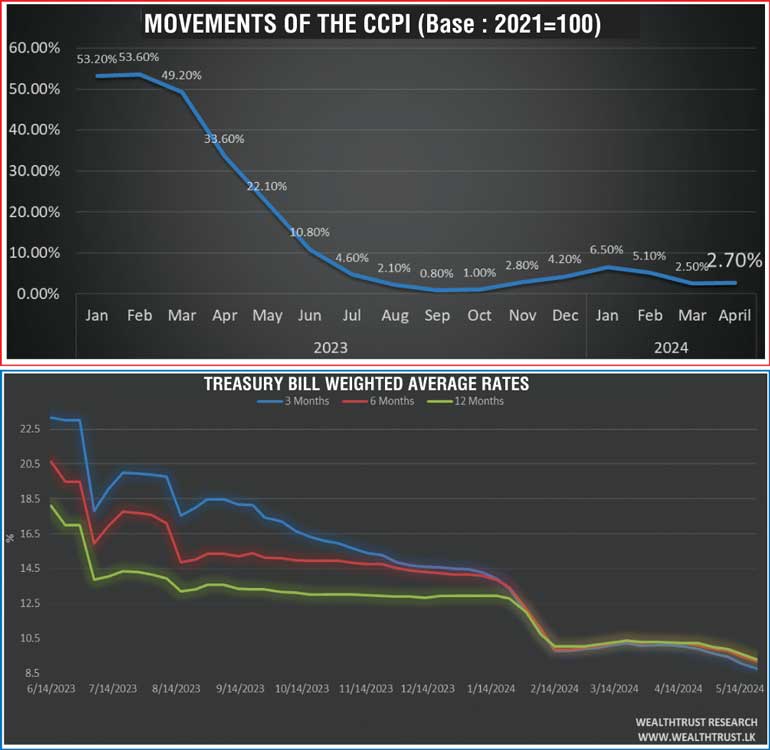

On the inflation front, the National Consumer Price Index – NCPI (Base: 2021=100) or National inflation for the month of April 2024 was recorded at 2.70% on its point to point as against 2.50% recorded in March 2024. While annual average inflation was recorded at 5.20%.

The total secondary market Treasury bond/bill transacted volume for 20 May was Rs. 10.87 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.65% and 8.68% respectively while the net liquidity was a surplus Rs. 145.88 billion yesterday. An amount of Rs. 0.70 billion was withdrawn from Central Bank’s SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 146.58 billion deposited at Central Bank’s SDFR (Standard Deposit Facility Rate) of 8.50%.

Forex market

Forex market

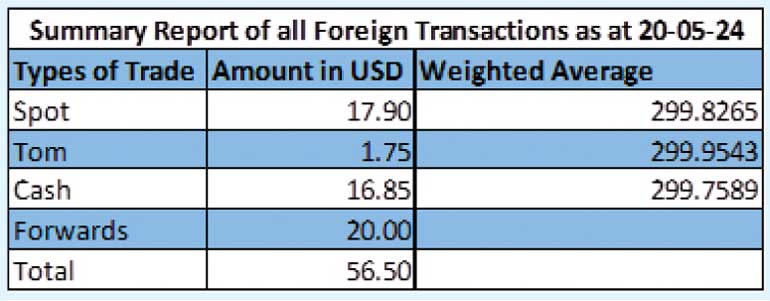

In the forex market, the USD/LKR rate on spot contracts closed the day, broadly steady, at Rs. 299.80/299.95, against its previous day’s closing level of Rs. 299.60/299.75.

The total USD/LKR traded volume for 20 May was $ 56.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)