Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 15 July 2024 01:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

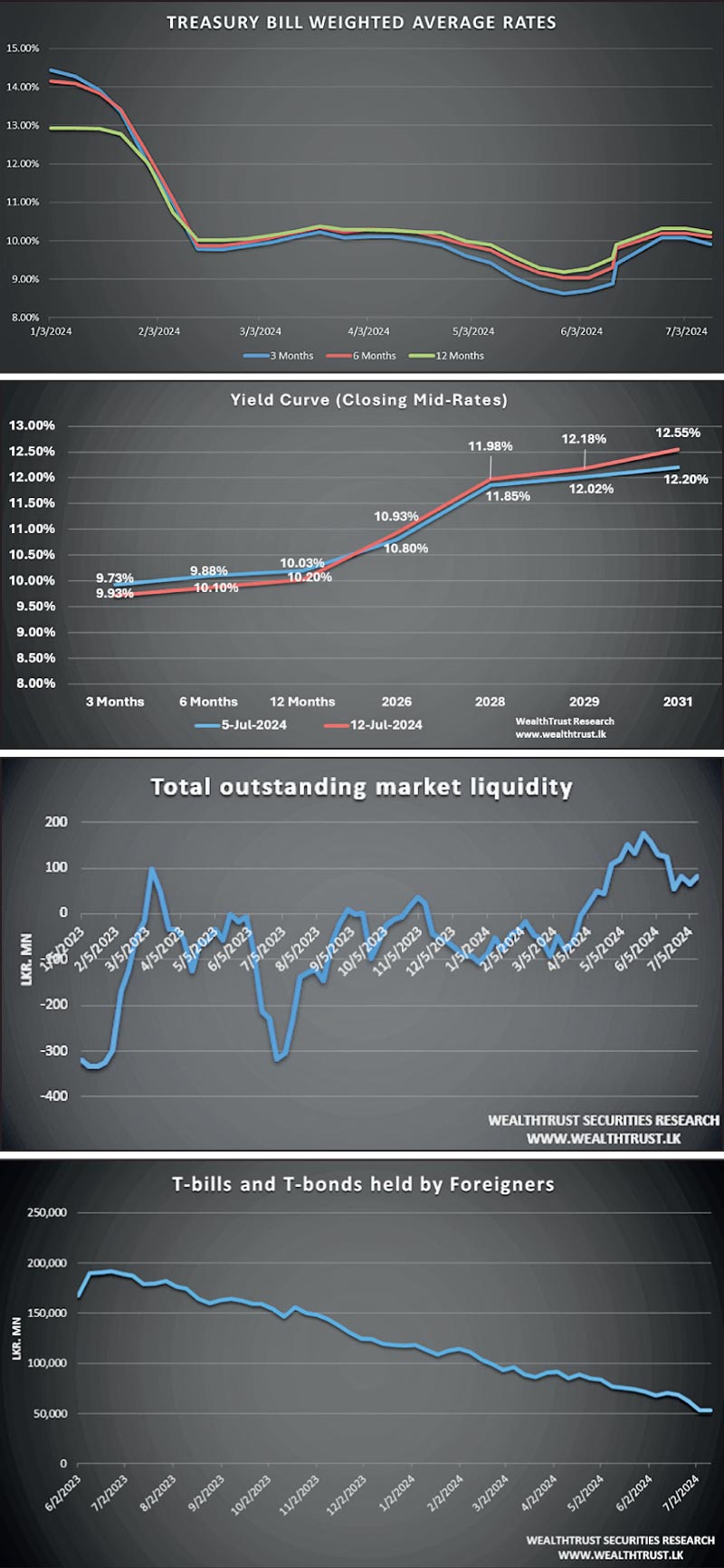

The primary auctions conducted last week produced contradictory results. A bullish outcome at the T-bill auction was followed by rates increasing at the T-bond auctions, resulting in a pronounced steepening of the yield curve.

The primary auctions conducted last week produced contradictory results. A bullish outcome at the T-bill auction was followed by rates increasing at the T-bond auctions, resulting in a pronounced steepening of the yield curve.

Firstly, the weekly Treasury bill auction conducted last Wednesday, saw a decrease in weighted average rates for the first time in six weeks. Robust demand led to a full subscription of the Rs. 105.00 billion offered, with bids exceeding the offered amount by 2.86 times, reversing the recent trend of rising rates. The 91-day yield fell by 16 basis points to 9.91%, the 182-day yield decreased by 9 basis points to 10.10%, and the 364-day yield dropped by 10 basis points to 10.21%. This outcome aligned with market expectations.

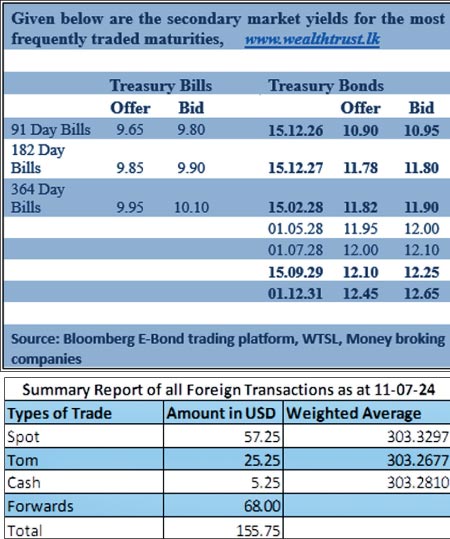

Whereas the Rs. 138.00 billion Treasury bond auction held last Thursday went undersubscribed, raising only 95.10% or Rs. 131.24 billion across the first and second phases, despite total bids exceeding the offer by 1.82 times. The 15.12.27 maturity was issued at a weighted average yield of 11.78%, above market expectations for a 2027 tenor, but in line with pre-auction quotes for a similar duration maturity of 15.02.28. The entire Rs. 58.00 billion offered on the 15.12.27 maturity was taken up at the first phase. The 01.12.31 maturity, issued at a weighted average yield of 12.31% also exceeded pre-auction rates. However, only Rs. 73.24 billion of the Rs. 80.00 billion offered was raised across both phases.

The secondary bond market started off the week slow with market participants adopting a wait-and-see approach ahead of the Treasury bond auction. The market was characterised by yields edging up, with transactions limited to selected maturities on muted overall activity. However, the notable exception was the 2028 tenors which saw demand drive the 15.02.28 and the 01.05.28 maturities to intraweek lows of 11.80% and 11.85% as against highs of 11.85% and 11.90% respectively, prior to the announcement of the T-bond auction results. However, following the release of the results the market two-way quotes on the 2028 tenors edged up marginally. Meanwhile, the rest of the yield curve continued to edge up during the week. Accordingly, the yield on the 15.12.26 maturity was seen up from an intraweek low of 11.80% to a high of 11.95%, while the 15.09.29 maturity was seen increasing from an intraweek low of 12.00% to a high of 12.15%.

In conclusion, at the close of the week, market two-way quotes were observed increasing with a notable steepening of the yield curve.

The foreign holding in rupee Treasuries for the week ending 11 July 2024, recorded a marginal net inflow for the first time in three weeks, to the tune of Rs. 51.00 million. As a result, the overall holding was registered at Rs. 53.12 billion.

This was against the backdrop of some positive market developments. It was reported that Barclays remains positive on Sri Lanka’s International Sovereign Bonds (ISBs), maintaining an “overweight” rating. The Sri Lankan economy shows strong signs of recovery with improved GDP forecasts, moderated inflation, increased remittances and tourism, and a surplus in the balance of payments. Structural reforms have boosted fiscal revenue collection, indicating a stable macroeconomic environment. Similarly, it was also reported by Standard Chartered Bank Global Research that SL is likely to record positive growth of 3.5-5.00% in the year 2024. Overall, expressing signs of renewed optimism in SL by the international investment community.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 31.73 billion.

In money markets, the total outstanding liquidity surplus increased to Rs. 80.399 billion by the week ending 12 July from its previous week’s surplus of Rs. 64.98 billion. The Domestic Operations Department (DOD) of Central Bank injected liquidity during the week by way of overnight reverse repo auctions and 7-day term reverse repos at weighted average rates of 8.59% to 8.96%. The weighted average interest rate on call money and repo ranged between 8.70% to 8.75% and 8.86% to 9.07% respectively. The Central Bank of Sri Lankas (CBSL) holding of Government Securities was registered at Rs. 2,595.62 billion as at 12 July 2024, unchanged from the previous week’s level.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts was seen appreciating considerably during the week to close at

Rs.301.70/302.00. This is as against its previous week’s closing level of

Rs. 304.45/304.75 and subsequent to trading at a high of

Rs.301.80 and a low of

Rs. 304.70.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 75.43 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)