Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 27 June 2024 00:39 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

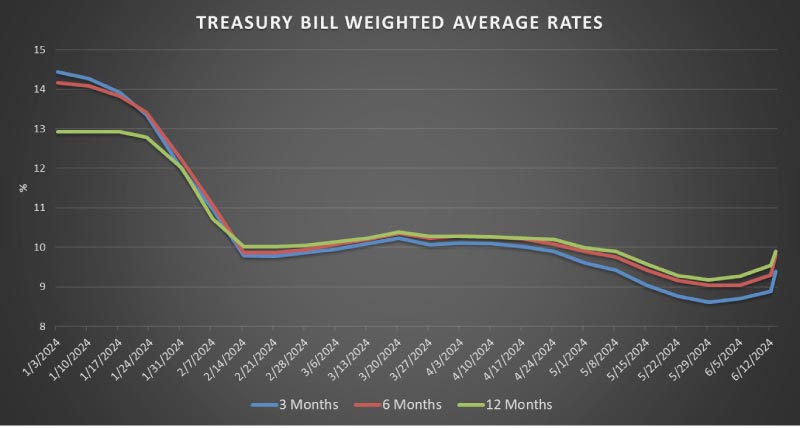

At the weekly Treasury bill auction held yesterday, weighted averages were seen increasing for a fourth consecutive week, with the yields across all three tenors moving up considerably once again. The yield for the 91-day maturity jumped by 68 basis points to 10.07%, the 182-day maturity by 38 basis points to 10.19%, and the 364-day maturity by 41 basis points to 10.31%. As such rates across all three maturities were seen moving above 10% for the first time since the 17 April 2024.

At the weekly Treasury bill auction held yesterday, weighted averages were seen increasing for a fourth consecutive week, with the yields across all three tenors moving up considerably once again. The yield for the 91-day maturity jumped by 68 basis points to 10.07%, the 182-day maturity by 38 basis points to 10.19%, and the 364-day maturity by 41 basis points to 10.31%. As such rates across all three maturities were seen moving above 10% for the first time since the 17 April 2024.

The auction went partially undersubscribed with only 72.32% or Rs. 115.71 billion being raised out of the total offered amount of Rs. 160.00 billion. The bulk of the accepted amount or 90% was raised through 91-day and 182-day maturities.

The 2nd phase of subscription, for the 182- and 364-day maturities will be opened until 4:00 pm on the day before the settlement date (i.e., 27.06.2024) at the respective weighted averages determined at the 1st phase of the auction. Given below are the details of the auction.

A round of Treasury bond auction is due to be conducted today. The auction will comprise of Rs. 50.00 billion from a bond due on 15 February 2028 bearing a coupon of 10.75% and Rs. 25.00 billion from a bond due on 01 June 2033 bearing a coupon of 09.00%.

For context, at the previous Treasury bond auction, which incidentally was the largest in Sri Lanka’s history, the entire offered amount of a colossal Rs. 295 billion was raised in the first phase through competitive bidding. The 15.10.27 recorded a weighted average of 10.69% in line with its pre-auction secondary market yield while the 15.09.29 and 01.12.31 recorded weighted averages of 11.78% and 12.03%, above its pre-auction rates of 11.40/60 and 11.85/12.00 respectively.

Following the previous auction, initially the market was buoyed by the successful auction and positive IMF news. However, subsequently activity was observed reducing and yields began to move up. Limited trades and thin volumes were observed in the market, with participants adopting a cautious stance. As the period progressed, the market continued to be sluggish, with elevated yields and low trading volumes.

Meanwhile, the secondary bond market yesterday, continued to remain muted with limited trades observed on selected maturities. Accordingly, the 15.10.27 and 15.09.29 maturities were seen changing hands within the range of 11.03% to 11.00% and at 12.15% respectively.

Yesterday also witnessed a major milestone on the external debt restructuring front. It was announced that Sri Lanka has finalised a

$ 5.8 billion debt restructuring agreement with the Official Creditor Committee (OCC), involving bilateral lenders led by France, India, and Japan. This agreement, reached in Paris, provides significant debt relief, enabling Sri Lanka to allocate funds to essential public services and secure concessional financing for development. Additionally, Sri Lanka is signing bilateral debt treatment agreements with China’s Exim Bank and continues to engage with bondholders. Progress in debt restructuring is crucial for continued funding from the International Monetary Fund, which has disbursed a third of a $ 3 billion bailout. Final negotiations with dollar bondholders and the China Development Bank are still pending.

The total secondary market Treasury bond/bill transacted volume for 25 June was Rs. 11.01 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.71% and 9.07% respectively while the net liquidity was a surplus Rs. 115.82 billion yesterday. An amount of Rs. 139.81 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%, while an amount of Rs. 3.99 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50%

Further, the DOD (Domestic Operations Department) of Central Bank conducted an overnight reverse repo auction amounting to Rs. 20.00 billion at the weighted average rate of 8.72%.

Forex Market

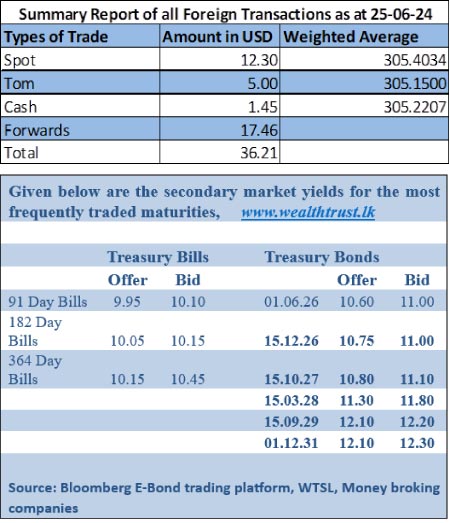

In the Forex market, the USD/LKR rate on spot contracts closed the day down marginally at Rs. 305.35/305.55, against its previous day’s closing level of Rs. 305.20/305.35.

The total USD/LKR traded volume for 25 June was $ 36.21 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)