Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 9 May 2024 02:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

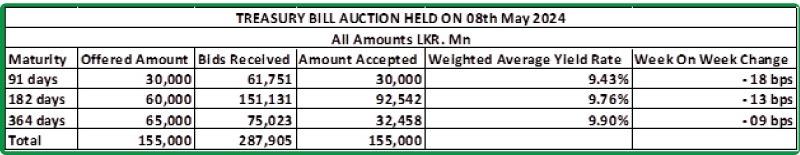

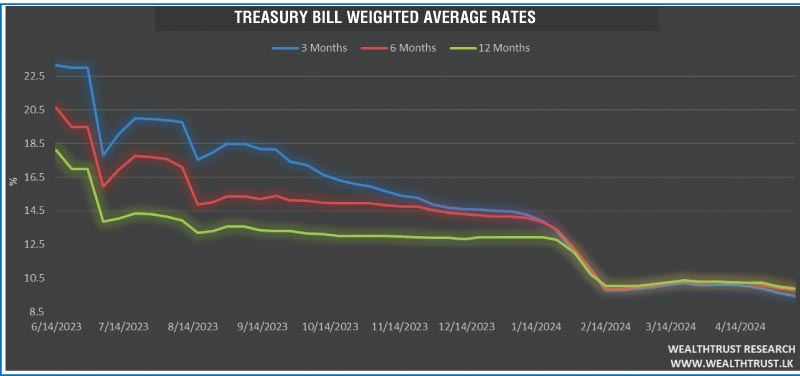

At the weekly Treasury bill auction conducted yesterday, the weighted average yields declined across all three maturities for a fifth consecutive week, reaching its lowest levels in over two years. This week’s decline was particularly steep, with the 91-day maturity falling by 18 basis points to 9.43%, the 182-day maturity by 13 basis points to 9.76% and the 364-day maturity by 09 basis points to 9.90%.

At the weekly Treasury bill auction conducted yesterday, the weighted average yields declined across all three maturities for a fifth consecutive week, reaching its lowest levels in over two years. This week’s decline was particularly steep, with the 91-day maturity falling by 18 basis points to 9.43%, the 182-day maturity by 13 basis points to 9.76% and the 364-day maturity by 09 basis points to 9.90%.

The 2nd phase of subscription, for the 91- and 364-day maturities will be opened until 4:00 p.m. on the day before the settlement date (i.e., 09.05.2024) at the respective weighted averages determined at the 1st phase of the auction. Given below are the details of the auction.

The secondary bond market remained active, with yields on the short tenor bonds declining marginally on the back of notable buying interest ahead of the Treasury bill auction. However, yields on the medium tenor bonds held mostly unchanged with activity slowing down considerably after the announcement of the Treasury bill auction results. As such, two-way quotes closed broadly steady at the close of the day. Trades were focused on the short to medium end of the yield curve, with a particular emphasis on 2026 to 2028 durations.

Notable demand was witnessed on the 2026 tenors prior to the release of the auction results, with yields on the 01.02.26 maturity declining to 10.20% as against an opening high of 10.30%. Similarly, the 15.12.26 maturity also continued to see strong demand, with yields edging down to an intraday low of 10.60% from an intraday high of 10.67% on the back of robust volumes. The 2027 tenors (01.05.27 and 15.09.27) also saw buying interest, causing its yields to dip down to an intraday low of 10.90% as against a high of 11.05%, collectively. Meanwhile the 2028 tenors of 01.05.28 and 15.12.28 were seen changing hands within the range of 11.60% to 11.50%, collectively. Additionally, the 15.05.30 maturity traded at the rate of 12.10%.

The upcoming round of Treasury bond auctions due on 13 May, will have on offer Rs. 70.00 billion. The auction will comprise of Rs. 15 billion from a bond due on 01 May 2028 bearing a coupon of 09.00%, Rs. 25.00 billion from a bond due on 15 October 2030 bearing a coupon of 11.00% and Rs. 30.00 billion from a bond due on 01 October 2032 with a coupon rate of 9.00%.

For context, at the previous round of Treasury bond auctions conducted on 29 April 2024 strong demand for the shorter tenor 15.03.28 bond was witnessed, which was issued at a weighted average of 11.72%, where the entire offered amount of Rs. 25.00 billion was snapped up at the 1st phase of the auction, in competitive bidding. Similarly, the 15.05.30 maturity was also fully subscribed and issued at a weighted average of 12.38%. Meanwhile, the 01.10.32 maturity saw mixed results, with Rs. 35.94 billion raised at the 1st phase at a weighted average of 12.47%. A further Rs. 8.79 billion was raised at the 2nd phase on the 01.10.32 maturity at its weighted average determined at the 1st phase. The total bids received exceeded the offered amount by 2.8 times at the 1st and 2nd phases. Despite this, the overall auction went slightly undersubscribed with 99.72% or Rs. 99.72 billion being raised out of a total offered size of Rs. 100 billion, due to the marginal shortfall on the 01.10.32 maturity. Interestingly at the direct issuance window the maximum offered amount of Rs. 5.5 billion was raised on the 2028 and 2030 tenors, at the weighted averages determined at the 1st phase, with a total market subscription of Rs. 37.51 billion.

The total secondary market Treasury bond/bill transacted volume for 29 April was Rs. 24.79 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.64% and 8.93% respectively while the net liquidity was a surplus Rs. 173.65 billion yesterday. An amount of Rs. 0.36 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 174.00 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%. The DOD (Domestic Operations Department) of Central Bank did not conduct overnight or term reverse repo auctions to inject liquidity for the first time in almost a year, since 25 May 2023.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day up at Rs. 298.75/298.85, against its previous day’s closing level of Rs. 299.40/299.70.

The total USD/LKR traded volume for 07 May was $ 104.20 million.