Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 2 May 2024 00:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

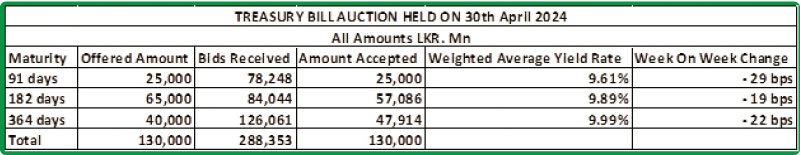

At the weekly Treasury bill auction conducted on Tuesday, the weighted average yields declined across all three maturities for a fourth consecutive week and were recorded below 10.00% for the first time since 2 March 2022.

This week’s decline was notably steep, with the 91-day maturity falling by 29 basis points to 9.61%, the 182-day maturity by 19 basis points to 9.89% and the 364-day maturity by 22 basis point to 9.99%. The bullish sentiment witnessed at the Treasury bond auctions the previous day was seen carrying over to the Treasury bill auction as well. The entire offered amount of Rs. 130.00 billion was taken up at the 1st phase, with total bids received exceeding the total offered amount by 2.22 times.

The 2nd phase of subscription, across all 3 maturities will be opened until 4:00 p.m. on the day before the settlement date (i.e., 02.05.2024) at the respective weighted averages determined at the 1st phase of the auction. Given below are the details of the auction.

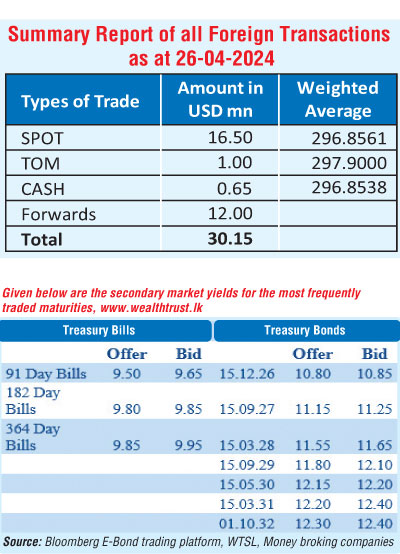

The secondary bond market on Tuesday continued to rally, which saw yields drop to fresh lows on the back of aggressive buying interest. Trades continued to be focused on the short end of the yield curve, with a particular emphasis on 2025 to 2028 durations.

In particular the popular liquid 2026 tenors of 15.05.26, 01.06.26, 01.08.26 and 15.12.26 continued to see strong demand, with yields falling to intraday lows of 10.80% from intraday highs of 11.00% on the back of robust volumes. The 2028 tenors (i.e. 15.03.28, 01.05.28, 01.07.28 and 15.12.28) also saw considerable buying interest with yields hitting intraday lows of 11.60% from intraday highs of 11.75%. Trades were observed on the 2027 tenors (i.e. 01.05.27 and 15.09.27), as its yields hit intraday lows of 11.05% from intraday highs of 11.30%. Additionally, the 15.05.30 maturity traded within the range of 12.25% to 12.20% as well.

On the inflation front, the Colombo Consumer Price Index -CCPI (Base: 2021=100) for the month of April 2024 was recorded at 1.50% on a year-on-year basis as against 0.9% recorded in March 2024. As such, inflation was seen accelerating for the first time in 3 months and this was attributable due to the low base effect from April 2023. However, the increase in inflation was well below a Bloomberg estimate of 2.5%. In addition, interestingly the CCPI experienced a deflation of 0.8% on a month-on-month basis, driven by ongoing reductions in food prices and a decrease in non-food prices following the cut in LP gas prices.

The Central Bank of Sri Lanka, which lowered the benchmark lending rate by 50 basis points in March, has said it doesn’t expect a threat to its 5% inflation target despite an up-tick in prices. The monetary authority will hold its next policy review on the 28th of May 2024. Bloomberg economists in an article titled “Sri Lanka React: Below-Target CPI to Spur Further Easing” opined that Inflation in Sri Lanka increased in April and is expected to further accelerate in the coming months, mainly due to a lower comparison base caused by sharp disinflation in 2023. However, weak demand and a stronger currency are likely to prevent it from surpassing the Central Bank of Sri Lanka’s 5% target. This allows the CBSL some scope to provide further support to the recovery through easing measures.

The total secondary market Treasury bond/bill transacted volume for 29 April was Rs. 24.79 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.57% and 8.91% respectively while the net liquidity was a surplus Rs. 173.82 billion yesterday. An amount of Rs. 8.32 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50% against an amount of Rs. 192.14 billion been deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight repo auction for Rs. 10.00 billion at a weighted average rate of 8.66%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day steady to Rs. 297.50/298.50, unchanged against its previous day’s closing level.

The total USD/LKR traded volume for 29 April was $ 30.15 million.