Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 12 March 2021 03:33 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

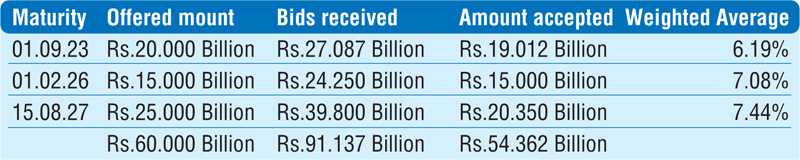

The primary Treasury bond auctions conducted on Wednesday recorded steady outcomes as a total amount of Rs. 54.36 billion was accepted against its total offered amount of Rs. 60 billion.

The primary Treasury bond auctions conducted on Wednesday recorded steady outcomes as a total amount of Rs. 54.36 billion was accepted against its total offered amount of Rs. 60 billion.

The 01.02.2026 maturity was fully subscribed at its 1st Phase of the auction while the 01.09.2023 and 15.08.2027 maturities were opened for its 2nd Phase. The maturity of 01.02.2026 recorded a weighted average rate of 7.08%, marginally below of its stipulated cut off rate of 7.10% while 01.09.2023 and 15.08.2027 maturities registered weighted average rates of 6.19% and 7.44% respectively against it cut off rates of 6.20% and 7.45%.

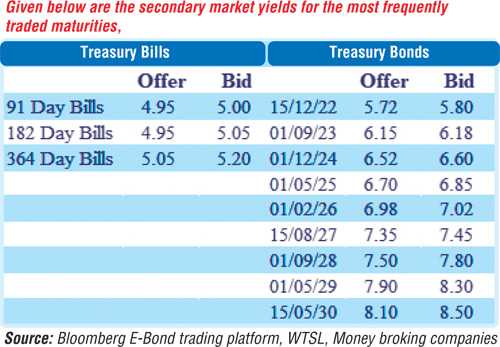

The secondary bond market regained some momentum on Wednesday as yields were seen declining marginally on the back of revived buying interest. The liquid maturities of 15.12.22, 2024’s (i.e. 15.09.24 and 01.12.24) and 2026’s (i.e. 15.01.26 and 01.02.26) saw its yields dip to intraday lows of 5.80%, 6.50%, 6.57% and 7.00% each respectively against its previous day’s closing levels of 5.84/86, 6.60/63, 6.60/70 and 7.05/15 each respectively.

Furthermore, maturities of 2021’s (i.e. 01.08.21 and 15.10.21) and 2023’s (i.e. 15.07.23 and 01.09.23) were seen changing hands at levels of 4.96%, 5.06%, 6.16% and 6.17% to 6.20% respectively as well. In the secondary bill market, June and September 2021 maturities traded at levels of 4.98% to 5.02%.

The total secondary market Treasury bond/bill transacted volume for 9 March was Rs. 12.59 billion.

In the money market, overnight surplus liquidity stood at Rs. 172.68 billion while weighted average rates on call money and repo was registered at 4.54% and 4.56% respectively.

USD/LKR

In the Forex market, USD/LKR rate on the more active one-week forward contracts were seen closing trading on Wednesday at Rs. 197.75/198.00 in comparison to its previous day’s closing level of Rs. 197.00/197.50.

The total USD/LKR traded volume for 9 March was $ 60.45 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)