Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 13 May 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

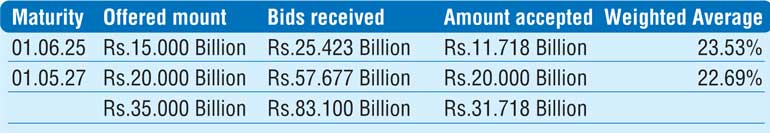

The two Treasury bond auctions conducted yesterday produced mixed outcomes as the weighted average of the three-year maturity of 01.06.2025 was seen exceeding the weighted average of the five-year maturity of 01.05.2027, while both averages were seen increasing in comparison to its previous round of auctions.

The increase in weighted averages were 152 basis points (1.52%) and 53 basis points on the three-year and five-year maturities respectively which asserted the inversion of the yield curve as three months to one year bill weighted averages were above 24% while the three-year average was 23.53% followed by the five-year average of 22.69%.

The offered amount of Rs. 20 billion on the 01.05.2027 maturity was fully taken up at its first phase of the auction at a weighted average of 22.69%, leading to a further 20% been offered through a direct issuance window, until close of business today (i.e., 4.00 p.m. on 13.05.2022).

However, only an amount of Rs. 11.72 billion was accepted on the 01.06.2025 maturity at a weighted average of 23.53% against an offered amount of Rs. 15 billion.

The bids to offer ratio on the five-year maturity decreased to 2.9:1 in comparison to its previous time while the bids to offer ratio on the three-year maturity decreased as well to 1.7:1.

The secondary bond market remained inactive yesterday. The total secondary market Treasury bond/bill transacted volume for 11 May 2022 was Rs. 14.17 billion.

In money markets, the net liquidity deficit stood at Rs. 561.50 billion yesterday as an amount of Rs. 201.24 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 762.74 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Call money and REPO stood at 14.50% each.

Forex Market

The Forex market continued to remain inactive.

The total USD/LKR traded volume for 11 May was $ 21.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)