Saturday Mar 07, 2026

Saturday Mar 07, 2026

Thursday, 25 January 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

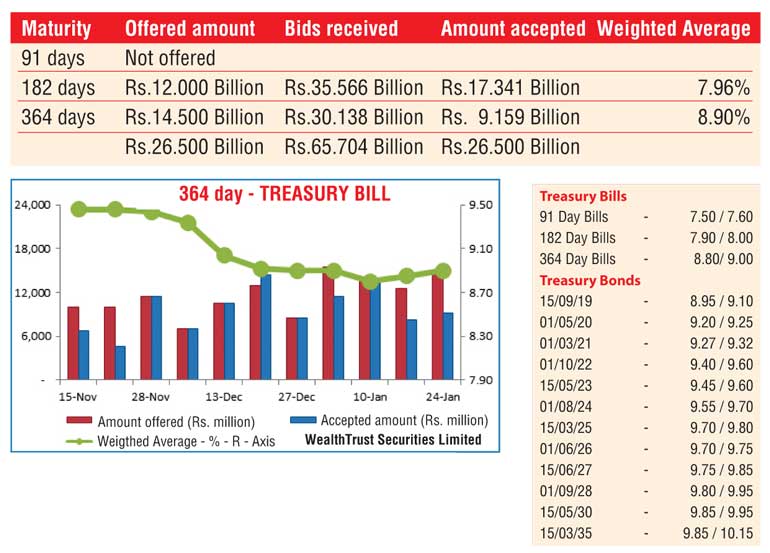

The weighted average yield of the 364 day maturity, continued its increasing trend at yesterday’s primary auction, recording a five basis point rise to 8.90%.

However, the weighted average yield of the 182 day bill decreased by one basis point to 7.96%. The 182 day bill continued to dominate the auction as it represented 65% of the total accepted amount of Rs.26.5 billion. The bid to offer ratio stood at 2.48:1.

In the secondary bond market, yields remained mostly unchanged as activity moderated. Limited amount of trades were witnessed consisting of the 2021 maturities within the range of 9.25% to 9.30%.

The total secondary market Treasury bond/bill transacted volumes for 23 January was Rs.3.55 billion.

In money markets, the overnight call money and repo rates averaged at 8.15% and 7.56% respectively, with the net surplus liquidity in the system standing at Rs.11.09 billion. The OMO Department of the Central Bank of Sri Lanka drained out an amount of Rs.5.28 billion at a weighted average of 7.25%, by way of an overnight repo auction.

Rupee appreciates

In the Forex market, the USD/LKR spot rate was seen appreciating yesterday, to close the day at Rs.153.65/75 against its previous day’s closing level of Rs.154.10/20 on the back of exporter conversions. The total USD/LKR traded volume for 23 January was $ 113.25 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 154.45/60; three months – 156.00/15; and six months – 158.35/50.