Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 5 January 2022 00:00 - - {{hitsCtrl.values.hits}}

Boston Consulting Group’s Center for Customer Insight (CCI) administered a consumer survey in Sri Lanka with over 1,200 respondents. BCG Principal Chilman Jain, BCG Managing Director and Partner Prateek Roongta, BCG Managing Director and Partner Natarajan Sankar and BCG Center for Customer Insight Partner and Associate Director Kanika Sanghi share key insights in part four of a series of four curated articles. In this article, they highlight the changing trends and patterns when it comes to the banking needs of Sri Lankans:

and Partner Prateek Roongta, BCG Managing Director and Partner Natarajan Sankar and BCG Center for Customer Insight Partner and Associate Director Kanika Sanghi share key insights in part four of a series of four curated articles. In this article, they highlight the changing trends and patterns when it comes to the banking needs of Sri Lankans:

Inarguably, the future of banking is ‘digital’. While globally, the shift from conventional banking to online banking commenced around two decades back, in developing countries, it has been fairly nascent. However, the pandemic has served to further accelerate this transition. And Sri Lanka is no exception to this shift in consumer behaviour. Our study revealed that Sri Lankans value the easy access to banking products, services, and information offered by digital banking platforms and channels.

Our research revealed three key observations.

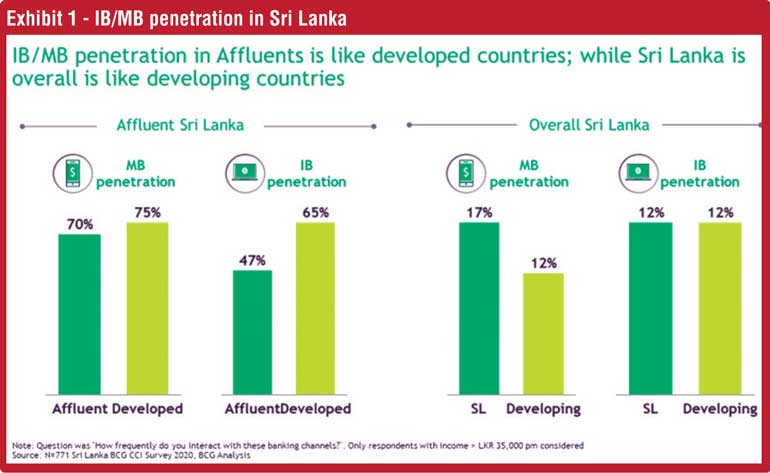

First, Internet/Mobile Banking (IB/MB) penetration in Affluents mirrors developed countries; for Sri

Lanka overall, it is akin to developing countries

There is a strong positive correlation between income and usage of digital banking services in the country. While internet/mobile banking penetration in Sri Lanka is at par with other developing nations (~17% for MB and ~12% for IB), it is significantly higher in the Affluent segments (household monthly income > 200K LKR). Thus, there is ample potential to bring more users from the Emerging (household monthly income Rs. 35-75K) and Aspirer categories (household monthly income Rs. 75-200K) into the folds of digital banking, as said groups have access to mobile devices.

Our research revealed that key barriers to mobile banking adoption among these segments include lack of knowledge on usage, safety concerns, and lack of essential features/services. Banks should proactively resolve these challenges by educating customers, developing customised product offerings, and creating a seamless user interface.

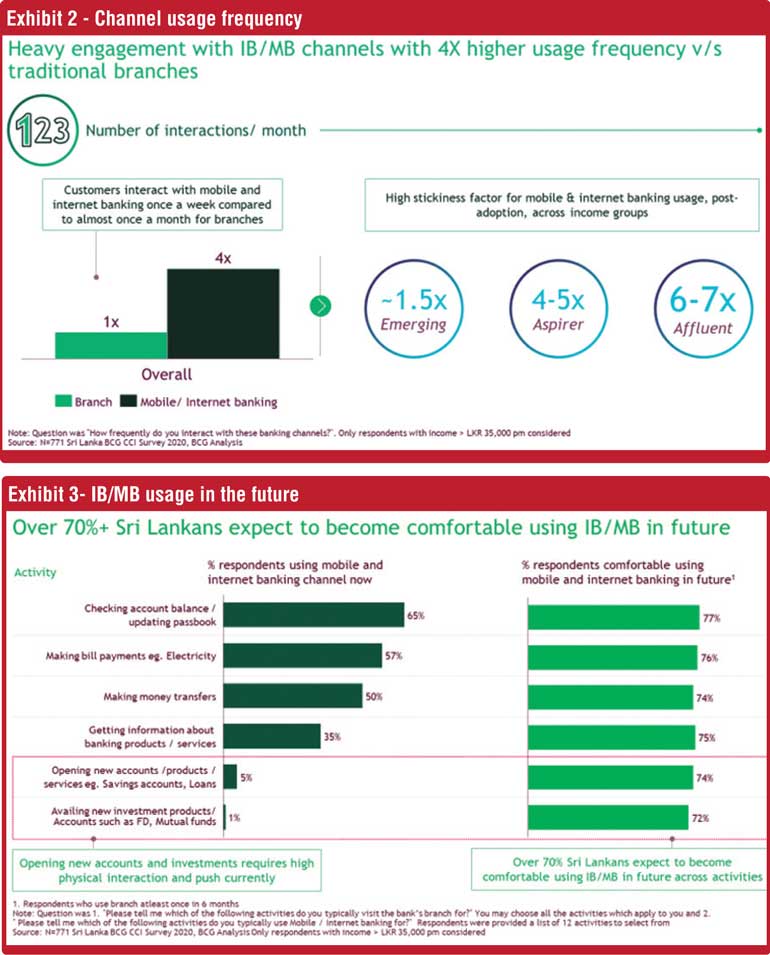

Second, IB/MB channels enjoy 4X higher usage frequency v/s traditional branches

On an average, customers in Sri Lanka use the mobile/internet banking platform once a week as opposed to almost once a month for branches. The usage frequency further increases among higher-than-average income groups such as the Affluents.

Banks can leverage this trend by cross-selling/upselling high-ticket items to their affluent digital users. Additionally, in order to retain customers and ensure that they continue to engage through the app / net banking, banks should strengthen their value proposition by means of offers and other nudges.

Third, over 70% Sri Lankans expect to become comfortable with IB/MB in the future

The future for digital banking in Sri Lanka looks promising, as a majority of respondents (from the Rs. 35K monthly household income and above categories) confirmed that they would be comfortable using IB/MB facilities in the near future. The gap between current and future expected usage is especially wide in two activities – opening new accounts/purchasing new products and availing investment products such as Fixed Deposits (FDs) or mutual funds. This can be attributed to the fact that these services currently require physical touchpoints and cannot be served digitally by most of the leading financial institutions in Sri Lanka. If this barrier is overcome, we can expect IB/MB penetration to further increase in the country.

Moreover, in the backdrop of the current COVID-19 environment, ~40% respondents expect to permanently reduce their branch interactions and move to alternate channels. The pandemic has clearly accelerated the shift in consumer preferences to digital banking channels with ~20% respondents expecting to increase interaction with IB/MB, of which ~60% were from the Affluent category.

The future of banking lies in “bionic banking” i.e., achieving a balance between digitisation and human interactions. Sri Lanka’s banking sector is on the right path with customers showing an intent to embrace digitisation. However, banks now need to adopt a ‘customer-first’ approach by re-imagining customer journeys and further fulfilling the unmet needs of the customer with innovative products and features, at par with developed nations.

Our sampling framework ensures that the study is truly representative of the country’s population. Over 1,200 Sri Lankans were interviewed in-person, with respondents spanning across four districts and diverse demographics (SECs, gender, and age). Consumers from urban as well as rural regions were part of the sample set.

(Boston Consulting Group is a premier global management consulting firm founded in 1963. BCG partners with leaders in business and society to tackle their most important challenges and capture their greatest opportunities.)