Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 13 August 2021 00:31 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

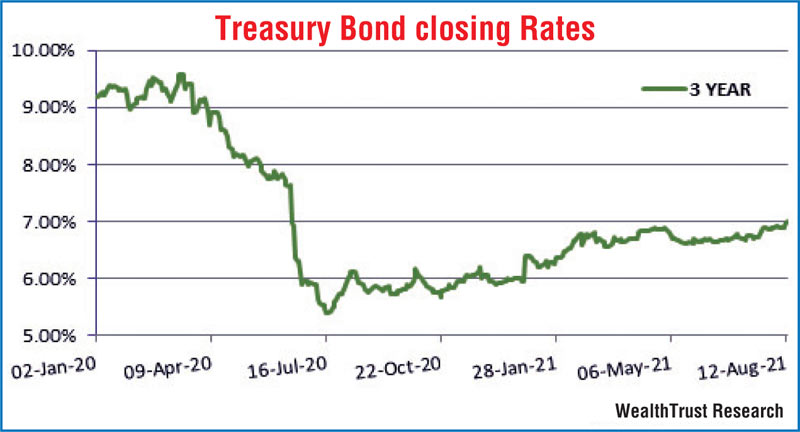

he secondary market yield on a three-year bond maturity was seen hitting the psychological level 7.00% for the first time since June 2020, underscoring a gradual increase in market yields since the Treasury bond auctions conducted on 29 July on the back of a dampened market sentiment.

he secondary market yield on a three-year bond maturity was seen hitting the psychological level 7.00% for the first time since June 2020, underscoring a gradual increase in market yields since the Treasury bond auctions conducted on 29 July on the back of a dampened market sentiment.

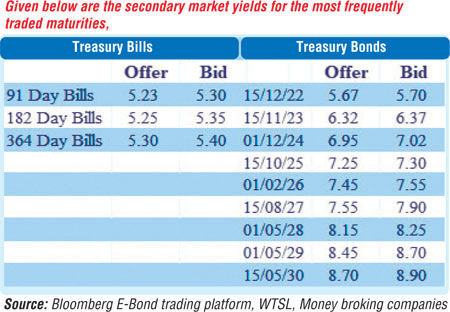

The liquid three-year maturity of 01.12.2024 saw trades take place at 7.00% in trading yesterday while yields on the 01.10.22, 15.12.22 and 15.11.23 maturities edged up as well to change hands at levels of 5.65%, 5.695% to 5.73% and 6.34% to 6.38% respectively.

The total secondary market Treasury bond/bill transacted volume for 11 August was Rs. 20.03 billion.

In money markets, the net liquidity surplus decreased to Rs. 33.21 billion yesterday with an amount of Rs. 119.70 billion been deposited at Central Banks SDFR of 4.50% against an amount of Rs. 86.50 billion withdrawn from Central Banks SLFR of 5.50%. The weighted average rates on call money and repo stood at 5.01% and 5.05% respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 11 August was $ 12.25 million. (References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)