Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 22 February 2024 00:20 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

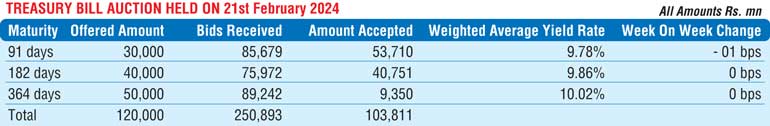

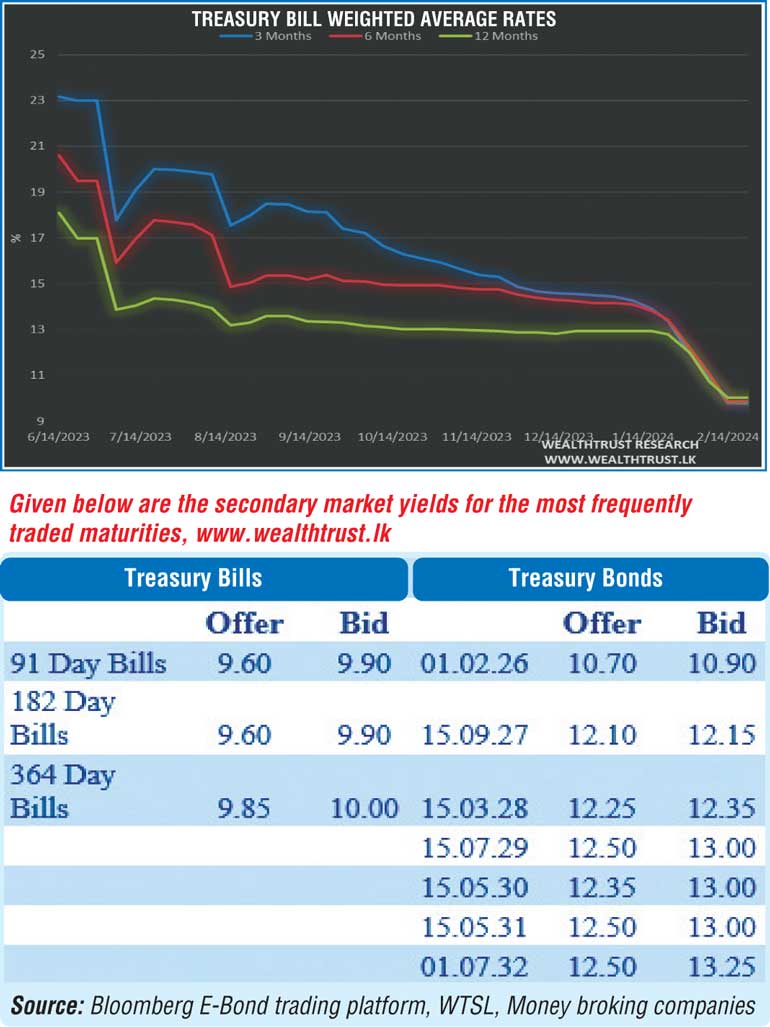

The Treasury bill auction conducted yesterday went undersubscribed at its first phase for the first time in seven weeks while weighted averages were seen holding broadly steady as well for the first time in seven weeks. Subsequent to five consecutive weeks of steep declines across all tenors, the 91-day maturity dipped by 01 basis point to 9.78%, while the 182-day and 364-day maturities held static at 9.86% and 10.02% respectively.

Only 86.51% or Rs. 103.81 billion of the total offered amount of Rs. 120 billion was raised at the first phase of the auction. This was despite total bids exceeding the offered amount by over two times.

The second phase of subscription, for the 182-day and 364-day maturities will be opened until 4 p.m. on the day before the settlement date (i.e., 22.02.2024) at the respective weighted averages determined at the first phase of the auction. Given below are the details of the auction;

Meanwhile, the secondary bond market yesterday saw two-way quotes close the day mostly stable on active trade. Trades as usual continued to be centred on the short end of the yield curve, with particular emphasis on 2025-2028 durations. Yields on the 2028 tenors (15.03.28 and 01.07.28) were seen trading down from opening highs of 12.35% down to 12.25%, post auction. The 2026 tenors (01.06.26 and 01.08.26) were seen trading at 11.10%. Additionally, trades were observed on the maturities of the two 25’s (01.06.25 and 01.07.25), two 27’s (01.05.27 and 15.09.27) within the ranges of 10.25% to 10.20% and 12.15% to 12.10%.

On the inflation front, the National Consumer Price Index -NCPI (Base: 2021=100) or National inflation for the month of January 2024 was recorded at 6.50% on its point to point as against 4.20% recorded in December 2023. As such inflation was observed increasing for a fourth consecutive month since cooling to a low of 0.80% in September 2023. However, the Central Bank of Sri Lanka in its Monetary Policy Report for February stated that projections suggest inflation deviating from the 5% target due to recent VAT changes in January 2024, but it’s anticipated to return to the target by the end of 2024. The report goes on to state that the inflationary uptick is expected to be brief and not pose a significant threat to maintaining a 5% target over the medium term.

The total secondary market Treasury bond/bill transacted volume for 20 February was Rs. 24.15 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 9.23 % and 9.53% respectively while the net liquidity surplus stood at Rs. 59.20 billion yesterday.

An amount of Rs. 116.86 billion was deposited at Central Bank’s SDFR (Standing Deposit Facility Rate) of 9% while an amount of Rs. 1.19 billion was withdrawn from the Central Bank’s SLFR (Standing Lending Facility Rate) of 10%. The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of overnight and term reverse repo auctions for Rs. 18.66 billion and Rs. 37.80 billion at the weighted average rate of 9.18% and 9.48% respectively.

Forex Market

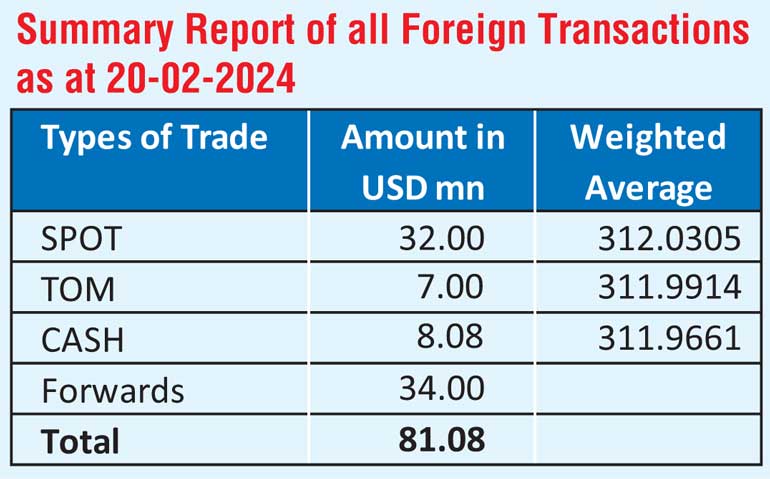

In the Forex market, the USD/LKR rate on spot contracts closed the day appreciating at Rs. 311.30/311.50 against its previous day’s closing level of Rs. 311.90/311.95.

The total USD/LKR traded volume for 20 February was $ 88.08 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)