Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 7 July 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd.

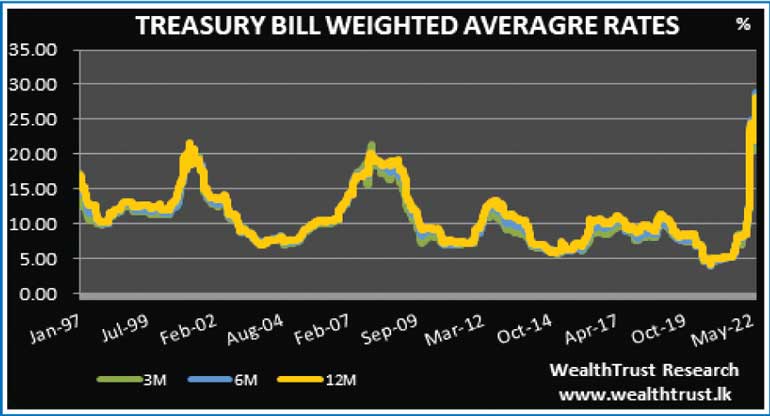

The steep increasing trend in primary market weighted average rates continued at yesterday’s Treasury bill auction, with weighted averages on all three maturities galloping by a minimum 400 basis points to exceed 28.00%, a level not witnessed over the past 25 years.

The steep increasing trend in primary market weighted average rates continued at yesterday’s Treasury bill auction, with weighted averages on all three maturities galloping by a minimum 400 basis points to exceed 28.00%, a level not witnessed over the past 25 years.

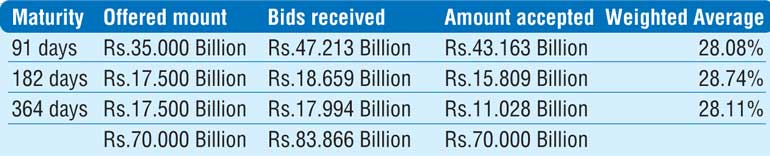

The 182 day bill recorded the highest increase of 434 basis points to 28.74% closely followed by the 91 and 364 day maturities by 423 and 427 basis points to 28.08% and 28.11% respectively. The total offered amount was fully taken up at its 1st phase of the auction after a lapse of two weeks which totalled Rs. 70 billion. The bids to offer ratio decreased to a 66-week low of 1.20:1. The phase 2 of the auction was opened until close of business of the day prior to settlement (i.e., 3:30 p.m. today). Given below are the details of the auction,

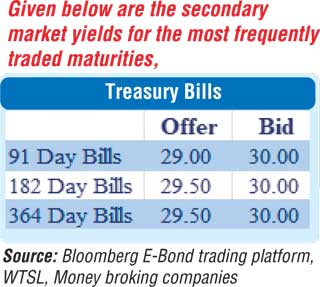

The sentiment in the secondary bond market remained gloomy yesterday while activity was at a standstill ahead of today’s monetary policy announcement. In secondary bills market, the latest 182 day and 364 day maturities were traded at a high of 30.00%.

The fifth monetary policy announcement for the year 2022 is due today at 7:30 a.m. The Central Bank of Sri Lanka kept policy rates unchanged at its previous announcement on 19 May at 13.50% and 14.50%.

The total secondary market Treasury bond/bill transacted volume for 5 July was Rs. 1.4 billion.

Forex market

In the Forex market, the middle rate for USD/LKR spot contracts depreciated marginally to Rs. 359.8167 yesterday against its previous day’s closing level of Rs. 359.7941.

The total USD/LKR traded volume for 5 July was $ 41.90 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)