Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 5 September 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

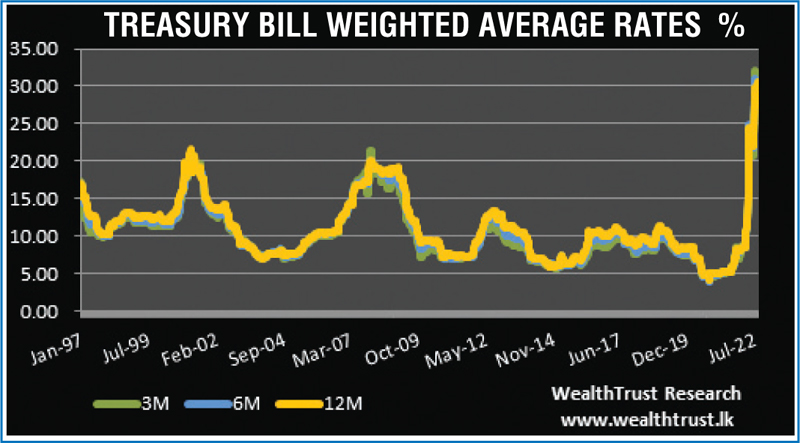

The trading week ending 1 September 2022 saw the weighted average rates on all three Treasury bill maturities increase above 30% for the first time in Sri Lanka’s history. The second consecutive week of increases across all three maturities saw the 91 day, 182 day and 364 day bills register weighted average rates of 32.89%, 31.28% and 30.50% respectively, recording accumulated increases of 345, 232 and 136 basis points.

The trading week ending 1 September 2022 saw the weighted average rates on all three Treasury bill maturities increase above 30% for the first time in Sri Lanka’s history. The second consecutive week of increases across all three maturities saw the 91 day, 182 day and 364 day bills register weighted average rates of 32.89%, 31.28% and 30.50% respectively, recording accumulated increases of 345, 232 and 136 basis points.

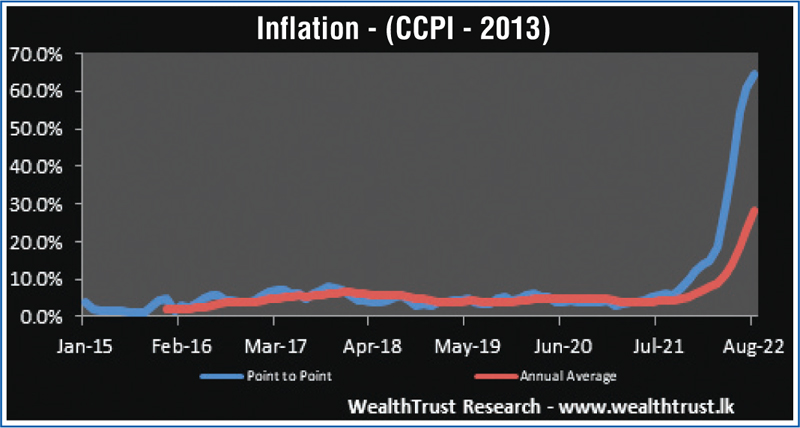

Furthermore, the outcome at the Treasury bond auctions during the week saw the weighted averages on the 2025 and 2031 maturities spike to 29.16% and 29.52% respectively against its previous averages of 28.45% and 23.91%. In addition, the Colombo Consumer Price Index (CCPI; Base 2013=100) for the month of August hit a high of 64.3%.

All these factors saw the sentiment in the secondary bond market close the week on a bearish note despite the IMF and the Government of Sri Lanka reaching a staff-level agreement on an Extended Fund Facility arrangement.

The limited trades during the week were seen on the two 2025 maturities (i.e. 01.06.25 and 01.07.25) within the range of 28.00% to 28.75%.

Meanwhile, the foreign holding in rupee bonds decreased marginally to Rs. 4.01 billion for the week ending 31 August 2022 while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 8.44 billion.

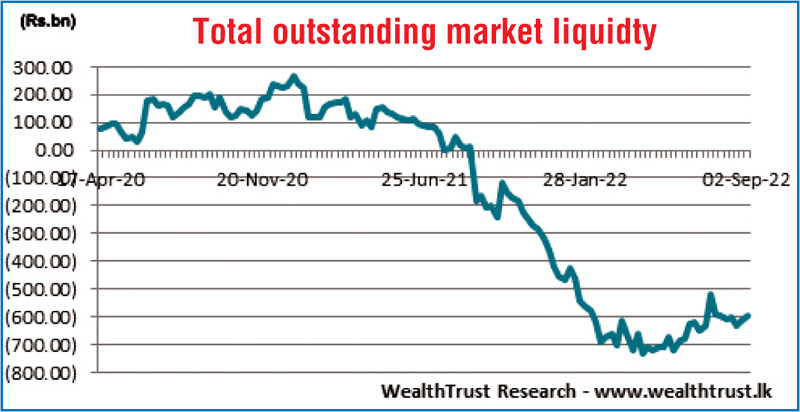

In money markets, the weighted average rate on repo and call money stood at 15.50% each for the week while the total outstanding liquidity deficit decreased further to Rs. 597.30 billion by the end of the week against its previous weeks of Rs. 614.94 billion. The CBSL’s holding of Government Securities was registered at Rs. 2,288.24 billion against its previous weeks of Rs. 2,258.11 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts closed the week marginally lower at Rs. 361.4500, subsequent to moving within the range of Rs. 361.0786 to Rs. 361.4500 during the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 66.31 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)