Monday Feb 09, 2026

Monday Feb 09, 2026

Thursday, 16 February 2023 00:08 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

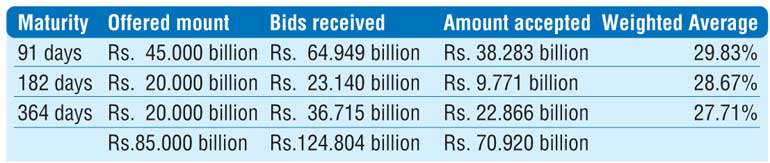

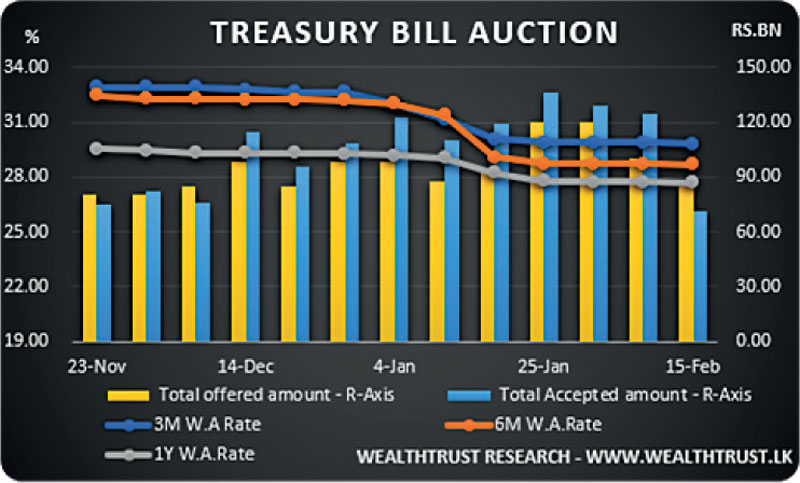

The Treasury bill weighted average yields, decreased across the board at yesterday’s primary auction, for the first time in three weeks. The 91-day and 182 bills dipped by 05 basis points each to 29.83% and 28.67% respectively while the 364-day maturity decreased by 01 basis point to 27.71%.

The Treasury bill weighted average yields, decreased across the board at yesterday’s primary auction, for the first time in three weeks. The 91-day and 182 bills dipped by 05 basis points each to 29.83% and 28.67% respectively while the 364-day maturity decreased by 01 basis point to 27.71%.

Phase 2 of the auction will be open for all three maturities at the weighted average yield, until close of business today. (i.e., 3.30 pm on 16.02.2023).

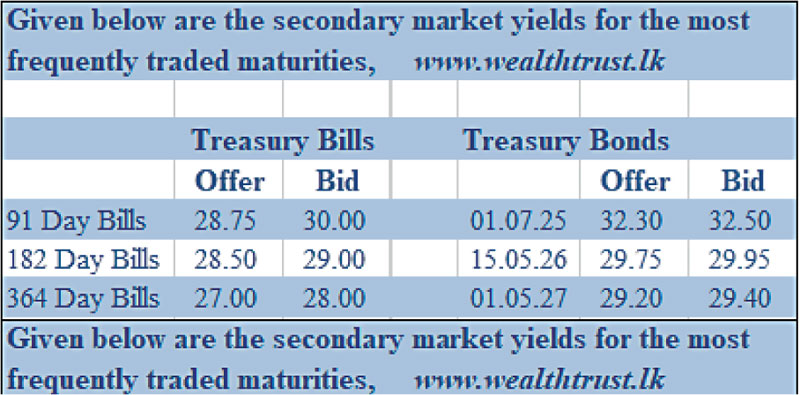

The activity in the secondary bond market increased with the liquid maturities of 15.01.25, 01.07.25, 15.05.26 and 2027’s (i.e., 01.05.27 & 15.09.27) changing hands at levels of 32.75% to 33.00%, 32.35%, 29.90% and 29.30% to 29.50% respectively. In the secondary bill market, March, April, May, June, August and November 2023 maturities changed hands at levels of 29.00%, 30.25%, 30.00% to 30.02%, 29.88%, 29.00% and 29.25% respectively.

The total secondary market Treasury bond/bill transacted volume for 14 February 2023 was Rs. 7.66 billion. In money markets, the average rate of overnight call money and REPO’s stood at 15.50% each with an amount of Rs. 188.18 billion being withdrawn from the Central Banks SLFR (Standard Lending Facility Rate) at 15.50%.

The DOD (Domestic Operations Department) of the Central Bank, also injected Rs. 10 billion by way of an overnight reverse repo auction, at a weighted average rate of 15.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady at Rs. 361.92.

The total USD/LKR traded volume for 14 February was $ 63.23 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)