Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Monday, 2 January 2023 00:00 - - {{hitsCtrl.values.hits}}

By WealthTrust Securities

The year 2022 saw the Treasury bill and bond markets go through one of its most turbulent and toughest years in its history, as it came to a close during the trading week ending 30 December 2022.

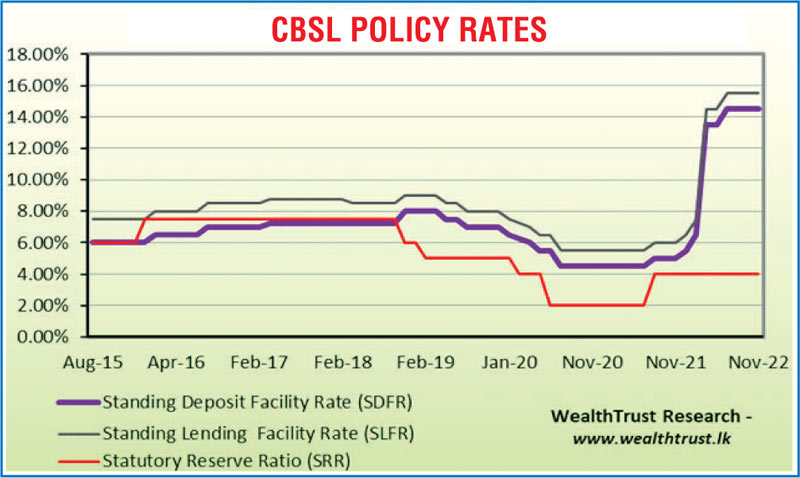

The economic crisis and political uncertainties during the year saw the Central Bank of Sri Lanka increasing its policy rates by 950 basis points (9.50%) to 14.50% and 15.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility (SLFR) respectively which led to yields on Treasury bills and bonds increasing to historical highs while Sri Lanka suspended all external debt payments in April.

The tightening monitory policy stance of Central Bank during the year saw the Treasury Bill and Treasury Bond yields increasing to historically high levels of 30% and above against its year’s opening lows of 8.00% to 12.00%.

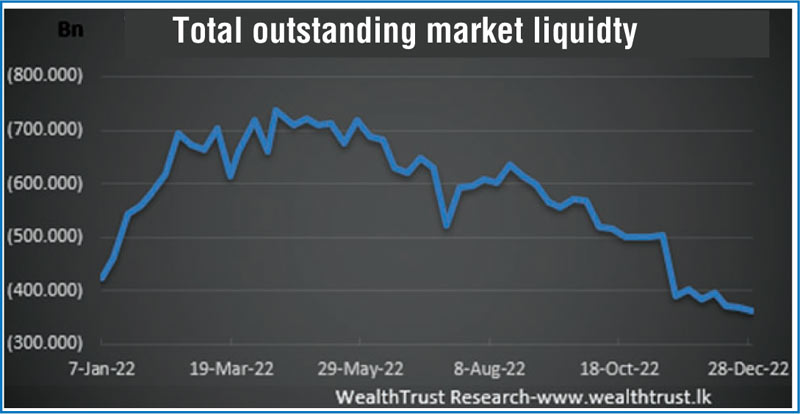

Meanwhile, the total outstanding liquidity deficit which commenced the year at Rs. 466.25 billion was seen peaking to a high of Rs. 735.46 billion before reducing considerably towards the latter part of the year to close at Rs. 361.25 billion. The Central Bank stock holding of Government Securities skyrocketed to a high of Rs. 2,598.18 billion by the end of the year in comparison to its year’s opening level of Rs. 1,416.75 billion.

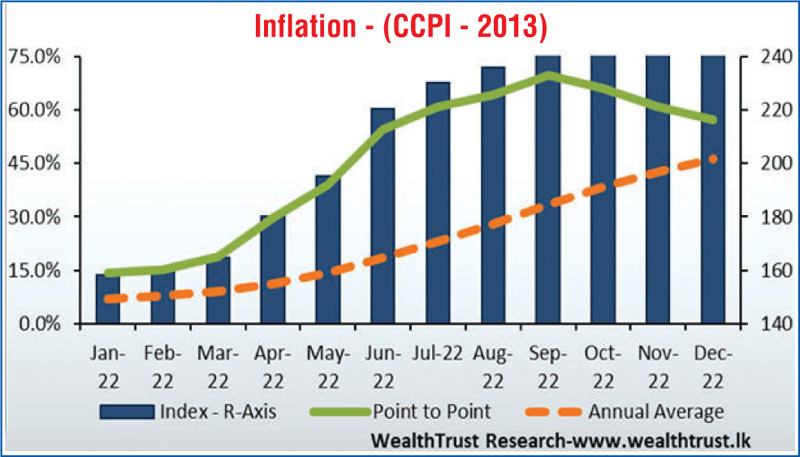

Furthermore, the Colombo Consumer Price Index (CCPI; Base 2013=100) increased sharply to an all-time high level of 69.8% on its point to point during the year in comparison to its opening level of 12.1% before closing the year at 57.2%. The annualised average stood at 46.4% at year end.

The Rupee against the dollar or USD/LKR on spot contracts was seen depreciating during the year to close the year at Rs. 363.11 against its year’s opening level of Rs. 200.75 based on its Telegraph Transfers quote.

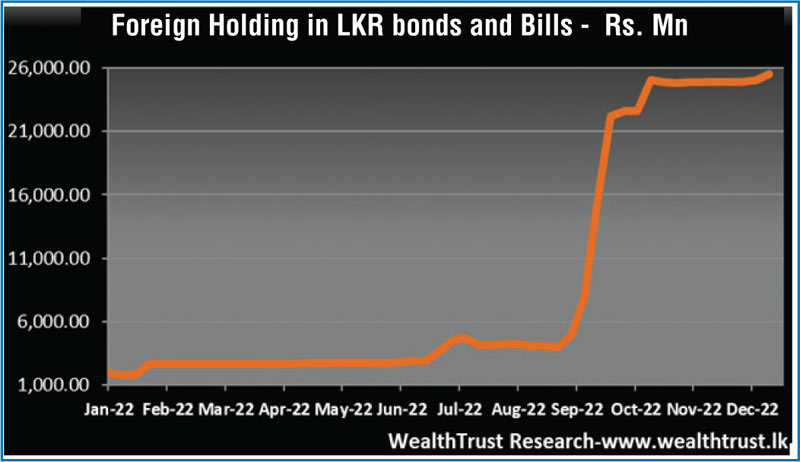

On a positive note, the foreign holding in Rupee bonds recorded a net inflow of Rs. 23.77 billion during the year to close the year at Rs. 25.57 billion, its highest level since the April 2020.

However, the continued uncertainties surrounding the economy leading into the new year is expected to keep the bill and bond market subdued.

Highlights of the week

The activity levels in the secondary bond market were subdued during the festive week ending 30 December while the Treasury bond auction conducted went undersubscribed for a second consecutive time during the month of December.

Nevertheless, the weekly Treasury bill auction was fully subscribed for a third consecutive week while weighted average rates on all three maturities decreased for third consecutive week as well.

The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 21.95 billion while the daily USD/LKR average traded volume for the first three trading days of the week stood at $ 54.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)