Saturday Feb 14, 2026

Saturday Feb 14, 2026

Monday, 15 August 2022 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The continued uncertainties with regard to government securities led to the secondary bond and bill market operating on a bearish mode during the shortened trading week ending 12 August 2022. The said sentiment was well supported by the outcome of the primary auctions, where demand was seen decreasing considerably.

The continued uncertainties with regard to government securities led to the secondary bond and bill market operating on a bearish mode during the shortened trading week ending 12 August 2022. The said sentiment was well supported by the outcome of the primary auctions, where demand was seen decreasing considerably.

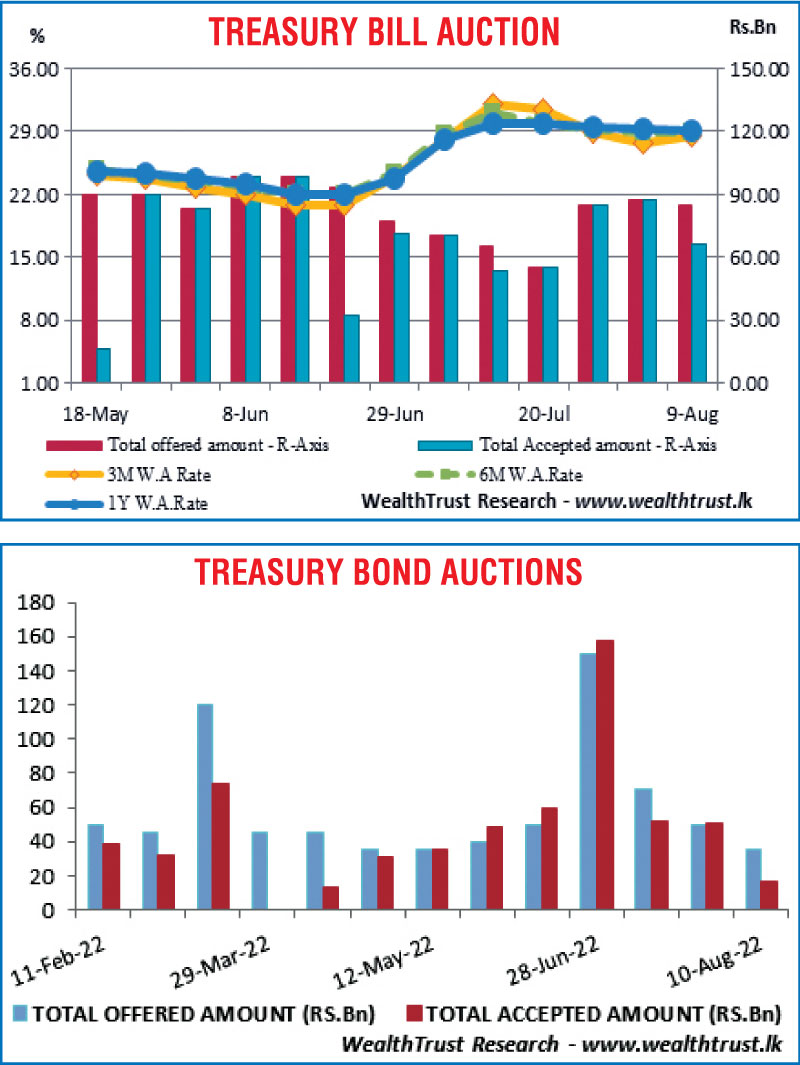

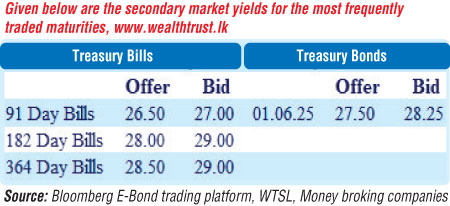

At the weekly bill auction, the total accepted amount fell below the total offered amount for the first time in four weeks while the market favourite 91 day Treasury bill weighted average rate increased by 71 basis points to 28.43%.

At the primary T-bond auction, all bids received for the Rs. 15 billion 3 year maturity of 01.06.2025 were rejected, the first such instance an auctioned bond maturity was rejected since April 2022 while the seven year maturity of 15.07.2029 drew only Rs. 16.96 billion in successful bids from its 1st and 2nd phases of the auction out of an offered amount of Rs. 20 billion.

The foreign holding in rupee bonds remained steady at Rs. 4.21 billion for the week ending 10 August while the daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 25.33 billion.

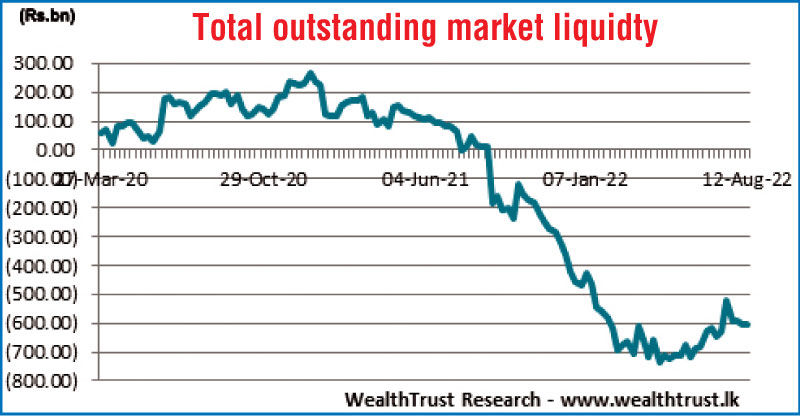

In money markets, the total outstanding liquidity deficit decreased marginally to Rs. 601.88 billion by the end of the week against its previous weeks of Rs. 607.61 billion while the CBSL’s holding of Government Securities decreased to Rs. 2,260.13 billion against its previous weeks of Rs. 2,263.04 billion. The weighted average rates on call money and repo stood at 15.50% each for the week.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts closed the week marginally lower at Rs. 360.85, subsequent to moving within the range of Rs. 360.80 to Rs. 360.94 during the week.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 55.63 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)