Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 31 July 2020 00:00 - - {{hitsCtrl.values.hits}}

Staying connected with each other was vital to ensure

business continuity

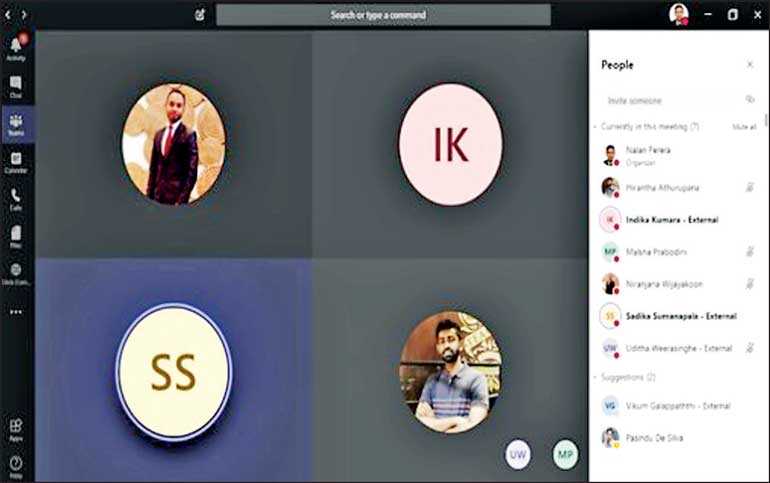

Team members practice virtual huddles to get

everyone on the same page quickly

As the pandemic continues to change the way we do business across the globe, it leaves no industry immune from disruption. In the financial sphere, companies have had to adapt swiftly to keep employees safe and deliver a new normal of service to customers.

|

| UA team members adapting to working from home |

|

| UA team members being present, respectful and on time |

Union Assurance is a case study of how a local company adapted in the wake of the lockdown, ramping up its operations to ensure the continued protection of its employees and customers as it navigated through the new normal.

As one of Sri Lanka’s largest life insurance providers, backed by the John Keells Group – Sri Lanka’s largest conglomerate – Union Assurance was at the forefront in rising to the challenges of the pandemic with cutting-edge technology, comprehensive customer outreach programs, agile working arrangements supported by awareness programs for employees and customers.

Union Assurance CEO Jude Gomes said: “It was a time for us to demonstrate resilience and adaptability as a responsible corporate citizen. Our employees and our customers were counting on us for direction, and we were swift to adapt to unfamiliar territory and change our operating model largely because of our digital preparedness. We had a formidable opportunity to live by our promise – ‘Your Life, Our Strength’, offering much-needed support to our employees and customers and demonstrating that being a responsible insurer can be much more than a tagline.”

The greatest challenge faced by many companies was their inability to adapt to remote working arrangements. A robust business continuity plan enabled Union Assurance to effectively adapt to working-from-home for 100% of its employees in the wake of the lockdown, making it one of the few companies that were swift to change key work processes and adapt digital infrastructure.

Change management procedures were put in place immediately to support online meetings and trainings to minimise the disruption posed by the developments of the external environment.

The uncertainty of the environment further catalysed the digital transformation process, enabling faster adoption of digital platforms. Union Assurance has been on a journey of automating processes to exploit long-term growth opportunities and to provide a new level of motivation to drive behavioural change among agent and customer.

One of several initiatives was the digital dashboards linked to benefits and rewards that aligned activities and prompted the next call to action bringing about efficiencies to the sales process. Other initiatives included boosting sales and staff activity, enabling income generation by building efficiency through digital platforms, using digital dashboards to resolve training gaps to monitor overall performance, and providing the sales force with comprehensive training on the role of technology in customer engagement.

Union Assurance was also swift to adapt a customer-centric, multi-pronged response to cope with the rising demands for protection and reassurance afforded by the pandemic. Among its first initiatives was the implementation of a 24/7 trilingual call centre supported by a web-chat service to increase capacity and meet demand for the response required.

Further initiatives included a free COVID-19 life cover to all policyholders. It was also one of the first life insurance companies to offer hospital cash benefits for quarantine treatments at the start of the outbreak in Sri Lanka.

The company took a step further to reach out to its policyholders by partnering with oDoc, a leading telemedicine solutions provider to offer convenient access to medical consultancy services and pharmaceutical deliveries – a much-needed service during the lockdown.

Elaborating on the future of the new normal for Union Assurance, Gomes commented further: “We will continue our endeavours in building more efficient, virtual engagement strategies along with technologies that support uncompromised customer service. Although COVID-19 has brought about many changes to our operating environment, we stay committed to keep our services accessible to our customers as we ensure efficient platforms and safe working environments for our employees. We also look forward to the new possibilities that will emerge post-crisis and will continue to accelerate our journey to meet the future needs of our customers.”

Union Assurance is one of the most-awarded life insurance companies in Sri Lanka, completing over three decades of success with a market capitalisation of Rs. 18 billion, a life fund of Rs. 38 billion and a Capital Adequacy Ratio (CAR) of 405% as at June 2020.

Set to empower the Sri Lankan dream, Union Assurance offers life insurance solutions that cover education, health, investment, protection, and retirement needs of Sri Lankans.

With 76 branches and an over-3,000-strong workforce, Union Assurance continues to invest in people, products, and processes to remain agile and responsive to emerging changes in the life insurance industry.