Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 4 November 2019 00:00 - - {{hitsCtrl.values.hits}}

Union Bank continued to focus on portfolio alignment and prudent cost management to sustain against a hard-hitting macro economic environment that continued to weigh down the banking sector during the third quarter of 2019.

As a result of focused efforts for enhancing operational efficiency, the Operating Expenses of the bank increased only by 5% YoY to Rs. 2,960 million within the period under review.

The results of the macro economic shocks that prevailed throughout, continued to affect the banking sector performance in the third quarter of 2019. Despite policy rate revisions the demand for private credit remained flat, affecting balance sheet growth through the thirrd quarter of the year. Amidst such a challenging business environment, Union Bank strived for revenue optimisation through portfolio realignment and enhanced emphasis on fee and commission income generation.

Total Operating Income of the bank continued to rise reporting Rs.4,637 million which was a YoY increase of 19%.

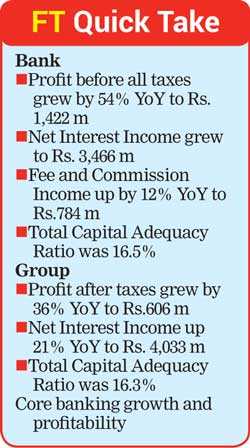

Net Interest Income (NII) for the period ended 30 September was reported as Rs.3,466 million. The bank’s well-executed strategic initiatives for fee income growth continued throughout the reporting period, resulting in a 12% YoY growth in Fee and Commission Income which grew to Rs. 784 million. The growth is mainly attributed to the increased influx of credit card processing fees due to focused acquisition efforts, along with the fee income generated through transaction banking services provided to corporate and SME banking cients.

The bank’s Treasury performance remained notable and recorded Rs. 380 million in capital gains YoY, which was a significant increase of 83%. Other Operating Income of the bank declined on the back of exchange rate deflation and due to a significant increase in the number of funding swaps entered in to during the review period. A decline in trade volumes stemming from adverse macro economic conditions was also contributory to the above.

Pre-impairment profits of the bank were Rs. 1,677 million for the period, which was an increase of 54% YoY. The impairment charge of the bank during the period under review was Rs. 354 million. Collective impairment charge for the period ended 30 September has been prepared in accordance with Sri Lanka Accounting Standard – SLFRS 9 (Financial Instruments), whilst prior period charge was prepared in accordance with LKAS 39 (Financial Instruments). Reflecting the stress of the macro economic challenges, the Gross NPL ratio of the bank stood at 5.2% while the Net NPL ratio was reported as 3.9%.

Despite the challenges of the operating environment, Union Bank presented a resilient performance recording a profit before all taxes of Rs. 1,422 million, which was a 54% growth YoY for the period ended 30 September, signalling the bank’s continued progress towards achieving its strategic growth objectives for the year.

Profit share from subsidiaries was reported as Rs. 98 million which was a Rs. 51 million increase YoY. UB Finance Ltd. was the major contributor to the above increase.

Taxes including Income, VAT, NBT and DRL on Financial Services amounted to Rs. 889 million which was an increase of 67% YoY. Profit after Tax (PAT) of the bank was Rs. 533 million, which was a 37% growth YoY.

The total comprehensive income of the bank was reported as Rs. 867 million with an increase of 469% YoY and was supported by the positive impact from the valuation on debt instruments at fair value through other comprehensive income.

Total assets of the bank stood at Rs. 115,574 million as at 30 September.The bank’s loans and receivables stood at Rs. 74,998 million and the deposits base was Rs. 74,707 million as at end of the quarter. Total average CASA grew to Rs.18,923 million which reflected a 22% YoY growth. Efforts of sustaining a healthy CASA inflow was supported through focused acquisition strategies driven by retail, corporate and SME banking segments.

Maintaining strong capital ratios continues to be a management priority. Union Bank’s Total Capital Adequacy Ratio as at 30 September was 16.5% and is well above the regulatory requirements.

The group comprising the bank and its two subsidiaries, National Asset Management Ltd. and UB Finance Company Ltd., reported a Profit after Tax of Rs. 606 million for the period which was a growth of 36% YoY. Total assets of the Group were Rs. 124,061 million of which 93% was represented by the bank. The group maintained a healthy Core Capital Ratio of 16.3% as at balance sheet date.

Operational performance

Union Bank recorded subdued business growth amidst challenging market conditions during the third quarter.

The Corporate Banking business of the bank continued to make progress within a competitive market space, with the bank meeting its core objectives of revenue and assets growth for the period under review.

Small and Medium Enterprises (SMEs) were the most affected by the trying economic backdrop that continously tests the adaptability of the smaller players in the market. Despite the challenges facing SMEs, Union Bank continued to identify strategically important segments and support the growth and endurance of these enterprises with customised solutions and advisory services.

The bank’s flagship transaction banking solution Union Bank Biz Direct continued to add value to corporate and SME clients as a cost-effective cash management automation tool. The bank is currently steering a modification of this transaction banking solution, with a view to enhancing its functions and features to facilitate up-to-the-minute business solutions that will deliver even greater banking conveniences to its users.

Retail Loans and advances showed moderate growth during the review period with special focus being placed on meeting the home equity needs of the retail clientele. The bank’s credit card portfolio further expanded on the back of focused sales and acquisition campaigns supported by a gamut of attractive lifestyle offers in diverse segments such as leisure, dining, shopping etc.

In line with its focus on building Current and Savings (CASA) balances, Union Bank continued the momentum of portfolio build-up of key products such as Children’s Savings, Investment Plans and Institutional CASA, with intense sales drives through branches, Relationship Managers and dedicated sales teams to pursue new acquisitions. As a result, the CASA base of the bank grew to 26.4% YTD as at end September 2019.

Continued efforts for operational efficiency and enhanced productivity through streamlining of processes resulted in improved cost management during the period under review.

The bank continued to offer enhanced banking conveniences to its clients via online and mobile banking facilities, with a project being underway to enable credit card self-care services along with enhanced safety of transactions through these platforms.

In August 2019 , Union Bank’s corporate website www.unionb.com was awarded the Gold winner under the Finance Category at the dotCoMM Awards 2019 based in the USA. This was an affirmation of its successful efforts in enhancing its digital impression, which incorporates some of the latest technologies and features to increase digital presence and security while providing greater convenience to users.

Commenting on the third quarter performance of the bank, Director/CEO Indrajit Wickramasinghe said, “I am pleased to share this resilient nine-month performance of Union Bank amidst a challenging economic backdrop and high tax regime, which is a clear assertion of the bank’s successful strategic direction that has helped withstand such tough conditions. I believe that the bank’s continued focus on operational efficiency, digital banking lead and inclusive portfolio expansion will augur well for the fourth and final lap of the year, in which we will continue to build on these growth dynamics and strive for more insistent business growth with a view to successfully meet our strategic objectives for 2019.”