Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 26 April 2018 00:00 - - {{hitsCtrl.values.hits}}

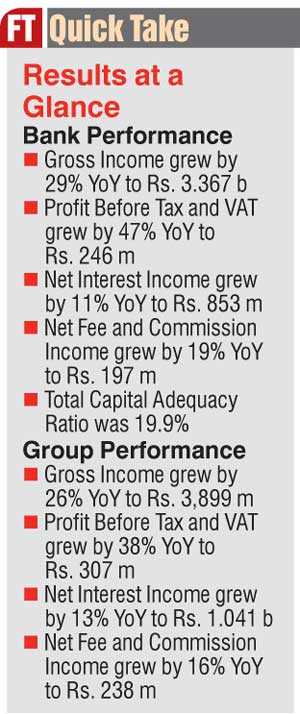

Union Bank recorded an impressive Profit Before Tax and VAT of Rs. 246 million, reporting a 47% growth YoY, thus setting the pace for its next growth phase powered by a new three-year growth strategy which includes its subsidiaries.

A significant growth in core banking operations contributed to the robust performance of the Bank during the period under review, while prudent cost and revenue management drove growth in profits over the corresponding period in 2017. In a clear reflection of a strong core banking performance over the last 12 months, the Bank’s loan portfolio grew by 16% YoY while the total deposits grew by 21% YoY.

A focused management of yields saw Net Interest Income (NII) of the Bank record Rs. 853 million during the quarter ended 31 March, which translated to an 11% increase YoY. Both Net Interest Margins (NIM) and spreads showed a marked improvement during the reporting period in 2018, compared to the last quarter of 2017. NIM for the quarter under review would have seen a higher growth if not for the interest expense on investments in units, the income in respect of which has been recognised as a capital gain under trading income.

The Bank continued to make significant efforts to improve its fee and commission income using the key enablers articulated in its strategy. Fee and commission income, which mainly comprises of deposit related fees, trade and remittances, loans, cards and other fees, increased by 18% to Rs. 224 million, as against Rs. 191 million recorded during the corresponding period in 2017. Overall, the growth in fees was mainly a result of processing fees on an expanding loan book and CASA related fees.

Net trading and other income was reported at Rs. 221 million for the quarter under review. A strong performance by the Treasury function resulted in capital gains of Rs. 69 million in comparison to Rs. 11 million reported in the corresponding period last year. Income from investments in units recorded a noteworthy growth of Rs. 62 million following increased investments in units. The Bank has no exposure to trading equities and has not invested in equity funds as at the reporting date.

Stemming from the overall growth in core banking activities and fuelled by the new three-year growth strategy, Total Operating Income of the Bank rose to Rs. 271 million, and represented a sharp increase of 26% YoY. Total Operating Expenses on the other hand were well managed and increased by 22% YoY to Rs. 938 million during the quarter, as against Rs. 771 million reported in the corresponding period in 2017. Pre-impairment profits of the Bank was Rs. 333 million and reported a 39% increase YoY. The impairment charge of the Bank was Rs. 109 million which was a 17% increase YoY.

Profit after Tax (PAT) for the 1st quarter of 2018 was Rs. 130 million and represented a 37% increase YoY.

The Bank’s loans and receivables stood at Rs. 70.736 billion, while the deposits base was Rs. 69.038 billion at the end of the quarter.

With the repositioning in 2014, the Bank has continuously improved its asset quality through a robust risk management frame work and the implementation of rigorous risk management practices that include stringent appraisal processes, strong collections efforts and risk based pricing. The gross NPL Ratio of the Bank was 3% at the end of the quarter.

Total CASA grew to Rs. 16.523 billion which translated to an increase of Rs. 3.441 billion over the 1st quarter of 2017. The impressive CASA growth that outperformed the market growth rate, was enabled by focused CASA acquisition strategies driven by the Retail, SME and Corporate Banking segments.

The Bank continued to maintain its robust Capital Adequacy, reporting a Total Capital Ratio of 19.9% as at the balance sheet date.

The Group, consisting of the Bank and its two subsidiaries, UB Finance Company Limited and National Asset Management Limited reported a PAT of Rs. 154 million for the quarter which was a growth of 28% YoY, supported by a total operating income growth of 22% YoY. Total assets of the Group was Rs. 123.883 billion, of which 93% was represented by the Bank. The Group maintained a healthy Core Capital Ratio of 19.3% as at the balance sheet date.

Propelled by the 3 year growth strategy, the Corporate Banking portfolio recorded a notable performance in the quarter under review. The corporate loans portfolio expanded by 15% YoY, while the deposits base of the corporate banking segment increased by a significant 22% YoY. Corporate Banking continued to deliver enhanced customer value by offering a comprehensive product package supplemented by Union Bank Biz Direct - the state of the art transaction banking solutions platform which is now extended with customised cash management possibilities for leading corporates in the country.

The SME Banking portfolio set off on a continued growth phase in the 1st quarter of 2018, recording a SME loan book growth of 6% YoY, on the back of a new strategic lending approach that focused on strategically important industries and geographic regions.

Within the period under review, the Bank introduced Union Bank Biz Partner, a status banking proposition designed to empower the Bank’s SME clientele with exclusive benefits and convenience whilst differentiating itself from the rest.

The retail deposit base too grew notably in 1Q-2018, supported by a focused strategy driven through identified key segments. An impressive YoY deposits growth of 32% was recorded under the retail segment. Amidst intense competition, retail banking accounted for 18% of the overall CASA growth of the Bank. The retail loan portfolio which consists of Personal Loans, Home Loans and Loans against Property recorded a remarkable growth of 90% YoY during the quarter under review.

The Treasury, which consists of Interbank, Fixed Income and Corporate Sales desks performed well above expectations, making significant contributions to the Bank’s bottom line.

Commenting on the 1st quarter performance of the Bank, Union Bank Director/CEO Indrajit Wickramasinghe said: “The Bank has set the pace for an excellent year of growth with an impressive first quarter performance in 2018 and we will continue to build on this strong balance sheet and profitability to accomplish our envisioned growth objectives for the year. Strengthened by its three-year growth strategy, Union Bank is now ready to take on the next phase of its expansion and growth.”