Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 26 October 2017 00:00 - - {{hitsCtrl.values.hits}}

Core banking growth

and profitability

In the third quarter of 2017, Union Bank continued its strong growth momentum, adding further traction to its strategic business focus of core banking growth and profitability.

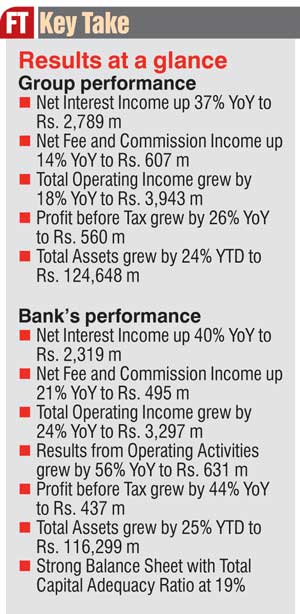

As a result of focused efforts on portfolio expansion, the Bank’s Loans and Advances grew by 22% year-to-date (YTD). The Net Interest Income (NII) rose to Rs. 2,318 m in the third quarter of 2017 – an impressive increase of 40% year-on-year (YoY). During the period under review, the bank continued to focus on improving NII through prudent management of the Net Interest Margin (NIM) coupled with Total Asset growth.

Union Bank’s well executed strategic initiatives for Fee Income growth continued throughout the reporting period, resulting in a healthy growth of Net Fee and Commission Income to Rs. 495 m, a 21% increase YoY. This can be mainly attributed to the increase in trade and remittances related fees, deposit related fees as well as loan processing fees collected during the reporting period.

The bank’s Treasury performance was notable and recorded Rs. 106.1 m surge in capital gains YoY, which is a significant increase of 88%. A change in the Asset Mix of the bank resulted in a dilution of the Net Trading Income as funds were shifted to Interest Earning Assets from Investments in Units, triggering a resultant decline in the income from investment in units by 45% YoY to Rs. 193 m. Consequently, the Total Trading Income decreased by 15% to Rs. 300 m. Other Operating Income fell by 24% YoY to report Rs. 182 m, largely due to the decline in foreign exchange income.

Stemming from the overall growth in core banking activities, the Total Operating Income of the bank continued to rise, reporting Rs. 3,296 m, a sharp increase of 24% YoY.

Supporting the strong Balance Sheet growth, Operating Expenses of the bank increased to Rs. 2,454 m, reporting a 11% growth YoY. The Impairment charge for the period increased by Rs. 173.2 m. However, the Gross NPL ratio remained low at 2.5% while the Net NPL ratio was reported at 1.7%.

The bank’s Results from Operating Activities increased by 56% YoY to record Rs. 630 m, reflecting the successful execution of its strategic initiatives which emphasised core banking growth. Profit after Tax for the period was Rs. 341 m, 6% growth YoY. The YoY PAT growth was impacted due to one-off income recorded from subsidiaries during the comparative period last year.

Total Assets of the bank grew to Rs. 116,299 m, a 25% growth YTD. Corresponding to this growth, the Loans and Receivables of the bank grew to Rs. 67,391 m, a 22% increase YTD. In line with the bank’s strategic priority to expand its liability product portfolio, Customer Deposits saw a further build up by 30% YTD, reporting Rs. 67,398 m as at end of September 2017. The continued focus on strategic CASA development initiatives resulted in the CASA portfolio growing by a significant 23% YTD.

The maintenance of strong capital ratios continues to be a management priority. Union Bank’s Total Capital Adequacy Ratio as at 30 September 2017 was 19%, well above the regulatory requirements.

The Group comprising Union Bank, National Asset Management Ltd. and UB Finance Company Ltd., recorded a 37% increase in Net Interest Income to Rs. 2,789 m. Net Fee and Commission Income of the Group grew by 14% YTD to Rs. 607 m. The Profit after Tax recorded by the Group for the period under review was Rs. 410 m.

Operational performance

Continuing on the envisioned growth trajectory, Union Bank focused its strategic investments on expansion and enhancement of banking services in the third quarter of 2017.

In August 2017, Union Bank in keeping with its Digital Banking Strategy announced the launch of its Mobile Banking Application with the aim to offer an easy, quick and convenient banking experience to its clients.

Union Bank’s all new Mobile Banking app offers a host of services that include general lifestyle services in addition to the banking services which are typically offered; making it a versatile and ingenious application even for non-customers. This is another significant step in the direction of digitalisation of financial services on which Union Bank will continue to invest, in-step with the rapidly evolving banking landscape of the country.

Union Bank’s customer reach was further expanded in the third quarter of 2017 with the opening of its 66th branch in Peradeniya, marking a significant milestone in its commitment towards the financial progress of individuals and businesses in the Central Province. In line with its premise to deliver a differentiated banking experience, the bank relocated its Gampaha branch, presenting a customer centric layout, spacious banking facilities and a vibrant atmosphere to further strengthen its commitment to this strategically important region in the Western Province.

The restructured Treasury function performed well in the third quarter, contributing to the strong net interest income and other income growth in the third quarter. The advisory role played by Treasury was also highly valued and appreciated by the customers.

As a result of its intense efforts to expand the Retail lending portfolio, the bank’s Personal Loans base grew by 75% YTD, as at end September 2017 making a commendable contribution to the impressive overall Retail Loan growth of 73%.

In line with its focus on building Current and Savings (CASA) balances, Union Bank continued the momentum of portfolio build-up of key products such as Children’s Savings, Investment Planner and Institutional CASA, with intense sales drives through branches, Relationship Managers and dedicated sales teams to pursue new acquisitions. As a result, the CASA base of the bank grew by 23% YTD as at end September 2017.

The bank’s continued momentum of Assets growth resulted in SME Loan book growth of 9%, while the Corporate Banking loan book expanded by 18% by the end of September 2017.

Adding value to the banking experience of its account holders, the bank continued to offer attractive savings and discounts of up to 30% on the Union Bank Visa International Debit Shopping Card for lifestyle related purchases.

Adding further traction to its valued banking relationships, Union Bank continued to extend its full-fledged cash management solution, Union Bank Biz Direct, to leading corporates and SMEs in the country. The bank hopes to further capitalise on this unique solution, in order to deliver a differentiated banking experience to its existing and potential clients.

Staying true to its roots as a dedicated financier for Lankan entrepreneurs, in September 2017 Union Bank came forward as the Premium sponsor of the 25th Annual Export Awards organised by the National Chamber of Exporters (NCE) of Sri Lanka for the third consecutive year. As the Premium sponsor, the bank partnered the awards for ‘Best Performer in Emerging Markets, Best SME Exporter, Best Value Added Exporter – Services and Best Value Added Exporter – Products’, categories; thereby reinforcing Union Bank’s continuous commitment towards the development of the export potential in the country.

Continued efforts for operational efficiency and enhanced productivity through streamlining of processes resulted in improved cost management during the period under review.

Marking a significant turning point in data security protection, Union Bank became the first bank in Sri Lanka to receive the international Payment Card Industry Data Security Standard (PCI DSS) by the Security Standards Council in September 2017. The PCI certification is a robust assurance of Union Bank’s data security standards across all systems and processes through which card and account transactions are effected.

Union Bank was conferred three prestigious awards for excellence at the CMO Asia Awards 2017, which concluded in Singapore in August 2017. At the CMO Social Media and Digital Marketing Awards 2017 the bank won the title for Best Facebook Campaign within the Banking sector in Sri Lanka while at the Asia Banking, Financial Services and Insurance Awards Union Bank managed to clinch two titles for Sri Lanka namely:

n Bank with the Best Customer Orientation

n Bank with the Best Technology Orientation

Union Bank’s encouraging financial position was further endorsed by Fitch Sri Lanka with the reaffirmation of the bank’s current rating with a positive outlook.

Commenting on the bank’s performance, Director/CEO Indrajit Wickramasinghe said: “I am happy to share this impressive performance up to the end of the third quarter for Union Bank, which is a clear affirmation of the bank’s focused strategy to win market share through profitable and inclusive expansion in terms of product portfolios, geographic reach and technological lead. We are confident that we will be able to build on these results to deliver on the anticipated growth objectives in the final lap of this year.”