Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 27 February 2019 02:12 - - {{hitsCtrl.values.hits}}

In 2018, Union Bank showcased an impressive performance, aided by its robust strategic plan, particularly excelling in core banking operations despite a challenging macroeconomic framework.

|

Chairman Atul Malik. |

|

CEO Indrajit Wickramasinghe |

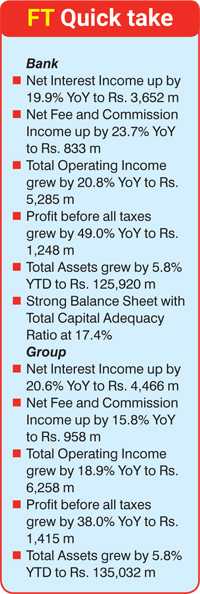

The Bank concluded 2018 recording an impressive profit before all taxes of Rs. 1,248 million. More importantly, the core-income of the Bank, excluding the capital gains and the negative impact due to the investments on the newly launched credit cards, reflected a 124% growth year on year (YoY). This was despite the withdrawal of notional tax credit on the interest on government securities.

However, Profit after Tax (PAT) was affected by the significant changes of tax regulations subsequent to enforcement of the new Inland Revenue Act. The Bank was a holding significant amount of investments in Sri Lanka Development Bonds, Debentures and Unit Trusts and hence, the removal of the tax exemption on profits derived out of these instruments bore a significant impact on the effective tax rate.

Introduction of the Debt Repayment Levy (DRL) during the last quarter of the year under assessment further amplified the negative impact on the effective tax rate.

The PAT of the Bank was Rs. 473 million and was only a 2.6% growth YoY. Total Assets of the Bank grew by 5.8% to Rs. 125,920 million.

The Bank continued to maintain its robust Capital Adequacy ratio which was well above the limits even after adoption of SLFRS 9.

Financial performance analysis

The Net Interest Income of the Bank reached Rs. 3,652 million in 2018. This is a significant improvement of Rs. 606 million which translated to an increase of 19.9%. Net Interest Margins (NIM) increased to 3.0% compared to 2.9% recorded in 2017. NIM for the current period would have been 3.2% if the return on investment in units were considered. Cost of funding of investments in units was accounted under interest expense of the Bank. The Returns from investment in units was Rs. 246 million and was recorded under capital gains under Net fair value gains/ (losses) from financial instruments at fair value through profit or loss. Withdrawal of notional tax credit of the government securities portfolio had a significant negative impact on the NII of the current year.

The Bank continued to make significant efforts to improve its fees and commission income using the key enablers articulated in the strategy. Fee and commission income, which mainly comprise of deposit related fees, trade and remittances, loans, cards and other fees stood at Rs. 968 million, recording an impressive growth of Rs. 185 million which translated to a 23.6% growth YoY.

The Bank reported net trading and other income of Rs. 800 million, which was a 21.9% growth over the previous year. This comprised of capital gains from Government Securities and investment in Units as well as exchange gains.

Despite the weakening of currency towards the end of the year, the Bank’s exchange income showed a noteworthy growth of 73.6% YoY. Income from Investments in Units were 23.5% lower YoY, as a result of lower investments made in Units during the year.

Reflecting the overall improvement in core-banking operations of the Bank, capital gains on government securities as a percentage of profit before all taxes declined to 18.9% from prior period’s 29.6%. This is a significant reduction of dependency on income of one-off nature on profitability. The total capital gains of Rs. 236 million was marginally lower by 4.9% YoY.

The Bank had no trading equities and has not invested in any equity funds as at Balance Sheet Date. The overall growth in core banking activities and consistent performance across all areas resulted in a 20.8% growth YoY in total operating income which was reported at Rs. 5,285 million.

The Bank adopted SLFRS 9 with effect from 1 January 2018. The comparative impairment numbers have been calculated based on the previous standard LKAS 39. Impairment charge for the year was Rs. 342 million, an increase of 37.5%. In addition to impairment for loans and receivables, the total impairment of the year under review, comprised of the impairment on treasury instruments as well.

Operating Expenses of the Bank were prudently managed to see an increase of only 11.5% to Rs. 3,729. Current period expenses were mainly driven by increased investment in human resources to support the Bank’s growing business requirements and included the expenses incurred on Credit Cards, which was a new initiative launched during the second half of 2018. The sound cost management adopted throughout the year was well reflected in the Cost to Income Ratio which improved to 71% from 76% in 2017.

The Bank has accounted Rs. 776 million as Financial Services VAT, NBT, DRL on financial services and Corporate Taxes during the year under review. This was a formidable 105.7% increase YoY. Effective tax rate (all taxes and DRL as a percentage of operating income) in 2018 increased to 62% compared to 45% in 2017. As changes to taxes occurred over the year, full year impact of tax changes are yet to be reflected in the P&L. The Increase in effective tax rate was mainly due to withdrawal of tax exemptions on profits made out of investment in units, SLDB and corporate debt instruments invested prior to the tax changes together with newly introduced Debt Repayment Levy (DRL).

Profit after tax for the year was Rs. 473 million compared to Rs. 461 million recorded in 2017.

The Group, consisting of the Bank and its two subsidiaries, UB Finance Company Limited and National Asset Management Limited reported a PAT of Rs. 535 million in 2018, supported by a growth of 38.0% in results from operating activities. Total assets of the Group stood at Rs. 135,032 million.

The Bank’s loans and receivables stood at Rs. 73,749 million. The increase of Rs. 3,171 million was a 4.5% growth in comparison to the previous year. During the year under review, key focus was placed mainly on portfolio realignment rather than the growth. The new growth in the portfolio was subdued as a result of a conscious decisions made with regard to exiting from selected segments. Proactive steps taken towards realignment further assisted the prudent management of the overall portfolio quality of the Bank. Loans to deposits ratio improved to 93% from 100% in 2017.

The Deposit Base stood at Rs. 79,251 million by the year end. This increase of Rs. 8,925 million was a 12.7% growth in comparison to 2017. The growth was primarily supported by the Retail Banking segment which pursued a focused strategy with enhanced relationship management driven through identified key segments during the year under review. CASA recorded Rs. 2,410 million growth which translated to an increase of 14.8% over the previous year.

The Bank’s gross NPL ratio was 3.7% and the Net NPL ratio was 2.5%. Gross and Net NPL ratios of the comparative period were 2.7% and 1.8% respectively. The Bank’s prudent risk management in credit assessment, proactive and focused monitoring of the portfolios and regionally driven remedial strategies have been instrumental in preserving the asset quality and preventing potential loan losses.

A year of resilience and growth

Union Bank remained resilient against the macroeconomic effects of 2018 to record indomitable growth in all areas of business.

The Corporate Banking business of the Bank grew on the back of strengthened corporate relationships and enhanced focus on Union Bank Biz Direct - the cutting-edge transaction banking technology offered by the Bank to its corporate and SME segments. The Bank continued to support the SME Banking segment with customised banking facilities and advisory services delivered across a regional strategy that placed focus on this nationally important segment.

The Treasury of the Bank continued to perform at its optimum making significant contributions towards the Bank’s revenue through its prudent operations.

Retail banking business of the Bank saw significant growth with the focused efforts in expansion of retail deposits and CASA coming to fruition within the year. Union Bank shifted its focus to the Home Equity market in the year under review, thus driving the growth of Home Loans and Loans against Property portfolios of the Bank. The launch of Credit Cards was a key highlight of the year, which opened up a new avenue of revenue growth while complementing the personal banking offering of the Bank with the addition of this versatile solution to its gamut of banking solutions.

The Bank continued to deliver enhanced value and convenience through its diverse delivery channels including digital banking solutions that saw significant take-up and usage during the year under review. Union Bank’s comprehensive delivery strategy geared to deliver improved levels of service was recognised and awarded with the title of ‘Best Bank for Seamless Backend Operations’ at the Lanka Pay Technovation Awards 2018.

Commenting on the performance of the Bank, Union Bank Director/Chief Executive Officer Indrajit Wickramasinghe stated: “2018 was a year that placed heavy demands on the banking industry which faced multiple headwinds in the economic and political spheres. With cohesive strategic realignment, Union Bank remained resilient and showcased impressive progress and financial performance with outstanding growth in its core banking operations. Our aim is to further strengthen our position as one of Sri Lanka’s fastest growing Banks and become the preferred Retail/ SME and transactional Bank by 2021, a virtue that will be built on trust and partnerships. We will build on this growth and carry the momentum during the year 2019, with focused commitment on meeting the strategic growth objectives of the 2nd year of our three-year strategic growth plan.”