Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 5 July 2022 03:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

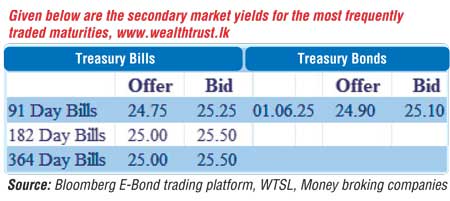

The fresh trading week commenced with the continuation of the upward momentum in secondary market bond yields. Persistent selling interest on the 01.06.25 maturity saw its yield increase to an intraday high of 25.10% against its previous day’s closing level of 24.00/50. In secondary bills, September 2022 and May 2023 maturities changed hands at levels of 25.00% to 25.25%.

The fresh trading week commenced with the continuation of the upward momentum in secondary market bond yields. Persistent selling interest on the 01.06.25 maturity saw its yield increase to an intraday high of 25.10% against its previous day’s closing level of 24.00/50. In secondary bills, September 2022 and May 2023 maturities changed hands at levels of 25.00% to 25.25%.

The total secondary market Treasury bond/bill transacted volume for 1 July was Rs. 2.38 billion.

In money markets, the weighted average rates on overnight Call money and REPO stood at 14.50% each while the net liquidity deficit stood at Rs. 503.98 billion yesterday. An amount of Rs. 224.23 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% while an amount of Rs. 728.21 billion was withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%.

No bids were accepted for the Rs. 15 billion outright sale of Treasury bills for durations of 101 days to 283 days.

Forex market

In the Forex market, the middle rate for USD/LKR spot contracts depreciated to Rs. 359.7941 yesterday against its previous day’s Rs. 359.55.

The total USD/LKR traded volume for 1 July was $ 103.08 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)