Friday Mar 06, 2026

Friday Mar 06, 2026

Monday, 4 October 2021 02:32 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

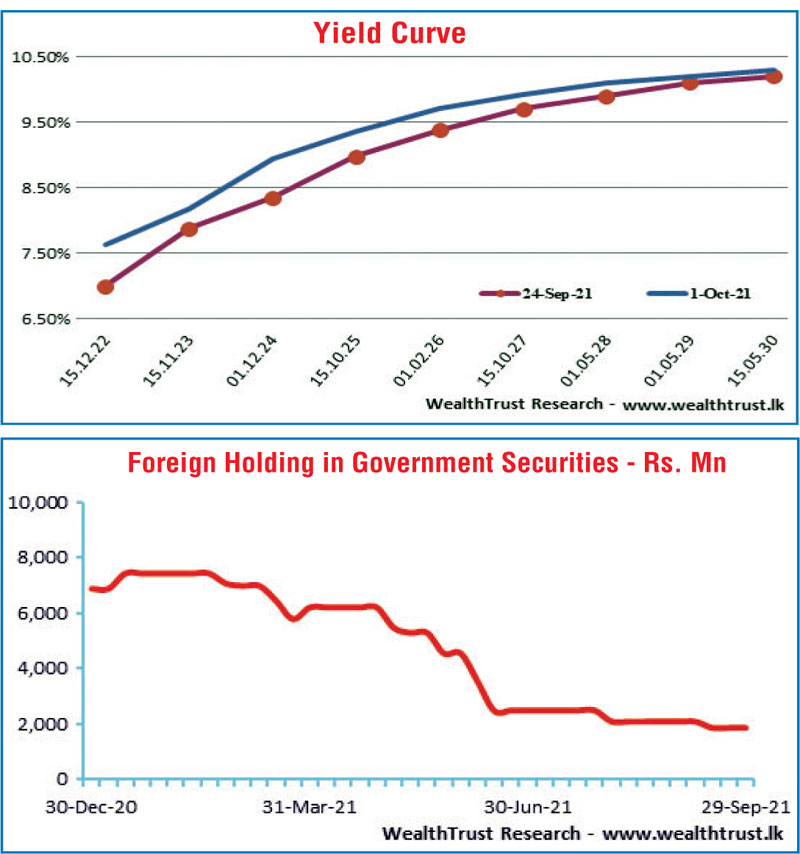

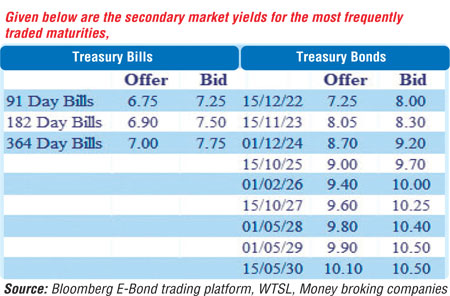

The secondary market bond yields increased across the yield curve during the week ending 1 October, driven by continued selling interest on the back of sporadic trades, following the outcomes of the Treasury bond auctions and the weekly Treasury bill auction. The two Treasury bond auctions conducted during the week following the removal of the stipulated cut-off rates, produced mixed outcomes as the short dated maturity of 15.11.2023 recorded a weighted average rate of 8.12%, above its pre-auction level of 7.75/8, while the long dated maturity of 15.05.2030 recorded a weighted average rate of 10.23%, within its pre-auction rate of 9.90/10.60

The secondary market bond yields increased across the yield curve during the week ending 1 October, driven by continued selling interest on the back of sporadic trades, following the outcomes of the Treasury bond auctions and the weekly Treasury bill auction. The two Treasury bond auctions conducted during the week following the removal of the stipulated cut-off rates, produced mixed outcomes as the short dated maturity of 15.11.2023 recorded a weighted average rate of 8.12%, above its pre-auction level of 7.75/8, while the long dated maturity of 15.05.2030 recorded a weighted average rate of 10.23%, within its pre-auction rate of 9.90/10.60

Furthermore, weighted average rates increased sharply to highs of 6.70%, 6.99% and 7.01% respectively on the 91-day, 182-day and 364-day maturities, similar to levels of 6.71%, 7.10% and 7.40% recorded at the 20 May 2020 and 1 April 2020 auctions.

Yields on the 01.12.24 maturity increased to a weekly high of 9.115%, a closing level last seen in April 2020 and against its previous week closing level of 8.20/50. In addition, yields on the maturities of 01.10.22, 15.01.23 and 01.09.23 increased to 7.50%, 7.75% and 7.90% respectively.

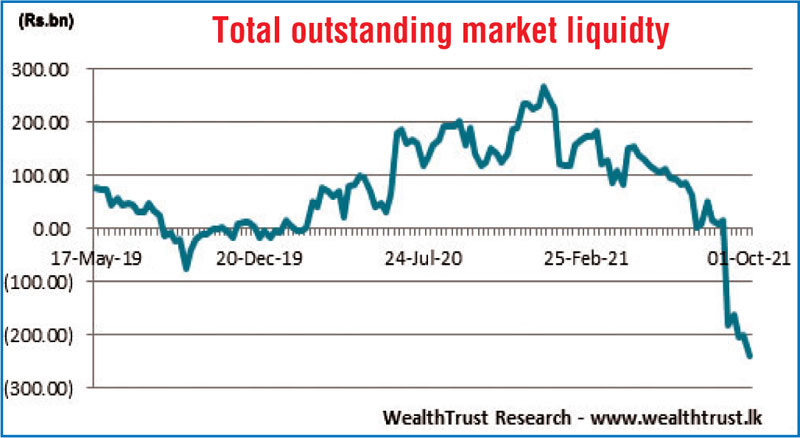

The foreign holding in rupee bonds decreased marginally to Rs. 1,861.77 million for the week ending 29 September, while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 7.19 billion.

In money markets, the weighted average rates on overnight call money and repo decreased marginally to 5.94% and 5.93% respectively for the week while the net liquidity shortfall at the end of the week increased to Rs. 240.01 billion against its previous weeks Rs. 200.62 billion. The CBSL’s holding of Gov. Securities increased to Rs. 1,336.05 billion against its previous week’s Rs. 1,332.21 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts continued to trade within the range of Rs. 202.90 to Rs. 202.92 during the week, while overall activity remained moderate.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 49.39 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)