Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 13 March 2023 00:15 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

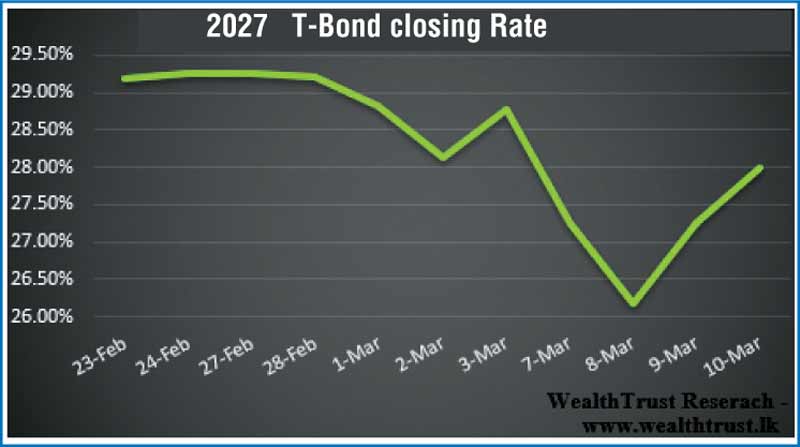

The week ending 10 March saw secondary market bond yields see-saw, decreasing during the first half of the week and following the mid-week Treasury bill auction outcome while increasing once again towards the later part, ahead of two Treasury bonds auction due today.

The week ending 10 March saw secondary market bond yields see-saw, decreasing during the first half of the week and following the mid-week Treasury bill auction outcome while increasing once again towards the later part, ahead of two Treasury bonds auction due today.

Today’s Treasury bond auctions conducted in lieu of a Treasury bond maturity of Rs. 107 billion due on 15 March will see an all-time high volume of Rs. 180 billion on offer, consisting of Rs. 70 billion on a 15.11.2024 maturity and Rs. 110 billion on a 01.05.2027 maturity, carrying coupon rates of 22.00% and 18.00% respectively.

At the last bond auctions conducted on 27 February 2023, the 15.09.2027 maturity was issued at a weighted average rate of 29.37% while it drew Rs. 24 billion in successful bids at its first and second phases of the auction against its initial total offered amount of Rs. 20 billion. However, all bids received on the 15.01.2025 maturity were rejected.

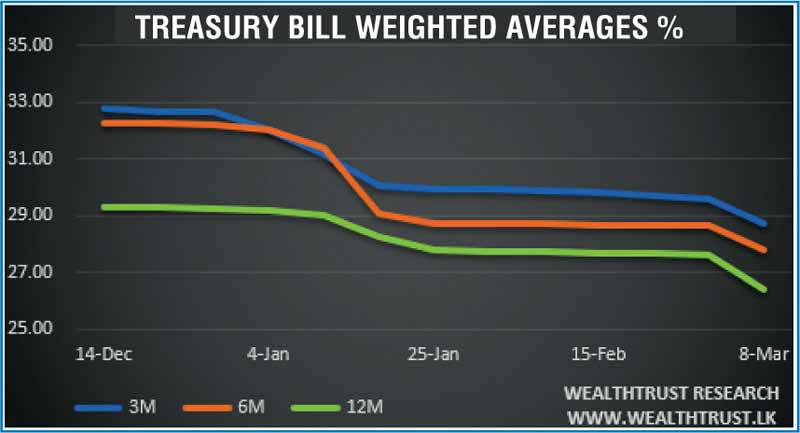

The positive developments with regard to the IMF Extended Fund Facility (EFF) to Sri Lanka during the early part of the week led to yields on the liquid maturities of 01.07.25, 15.05.26 and two 2027’s (i.e., 01.05.27 & 15.09.27) decreasing to intraweek lows of 29.70%, 27.65%, 26.00% and 26.05% respectively against its previous weeks closing levels of 32.00/33.00, 29.00/30.00 and 28.25/29.25 each. The dip in yields was further supported by the weekly Treasury bill auction results, where its weighted average rates recorded steep declines. The 91-day, 182-day and 364-day maturities registered dips of 84, 87 and 121 basis points respectively to 28.75%, 27.77% and 26.43%.

However, renewed selling interest towards the later part of the week led to yields increasing once again as the maturities of 01.07.25 and 15.09.27 hit highs of 31.75% and 28.00% respectively.

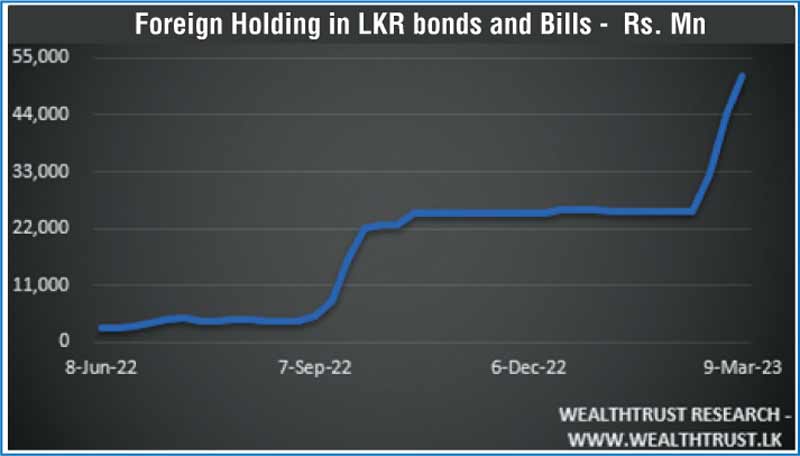

The foreign holding in rupee bonds increased for a third consecutive week with an inflow of Rs. 7.13 billion for the week ending 9 March while the accumulated inflow stood at Rs. 26.14 billion. The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 42.55 billion.

The foreign holding in rupee bonds increased for a third consecutive week with an inflow of Rs. 7.13 billion for the week ending 9 March while the accumulated inflow stood at Rs. 26.14 billion. The daily secondary market Treasury bond/bill transacted volumes for the first three trading days of the week averaged Rs. 42.55 billion.

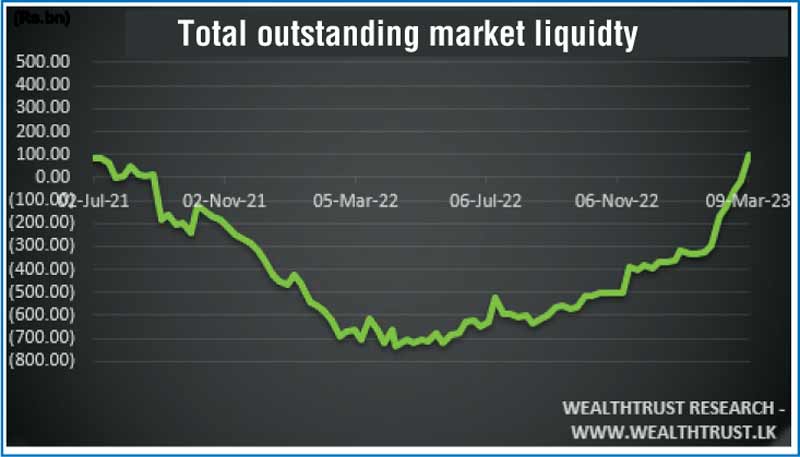

In money markets, the total outstanding liquidity was seen turning positive for the first time since 27 August 2021 to a surplus of Rs. 98.43 billion at the end of the week against its previous week’s deficit of Rs. 14.09 billion.

The weighted average rates of overnight call money and repo transactions carried out during the week was 16.48% and 16.45% respectively while the CBSL’s holding of Gov. Securities was registered at Rs. 2,603.60 billion against its previous weeks of Rs. 2,621.68 billion.

In the Forex market, the Rupee or USD/LKR rate appreciated week on week to close at Rs 320/323 against its previous week's closing middle rate of 346.1724. The interbank market was active throughout the week as spot contracts traded within the range of Rs. 318 to Rs. 325.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 144.70 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)