Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 20 June 2024 00:50 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

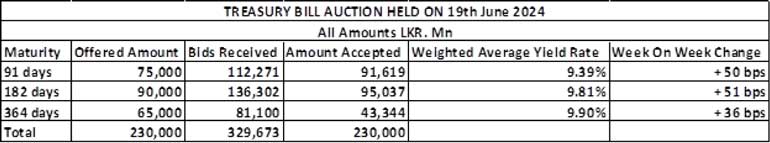

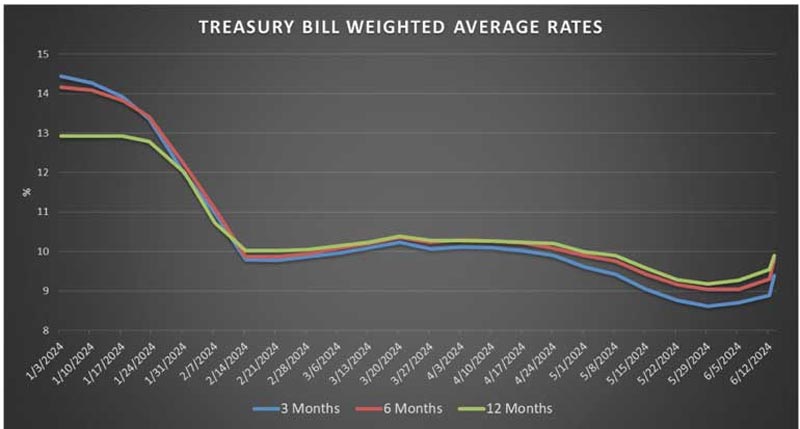

At the weekly Treasury bill auction held yesterday, weighted averages were seen increasing for a third consecutive week, with the yields across all three tenors moving up. The yield for the 91-day maturity jumped by 50 basis points to 9.39%, the 182-day maturity by 51 basis points to 9.89%, and the 364-day maturity by 36 basis points to 9.90%.

At the weekly Treasury bill auction held yesterday, weighted averages were seen increasing for a third consecutive week, with the yields across all three tenors moving up. The yield for the 91-day maturity jumped by 50 basis points to 9.39%, the 182-day maturity by 51 basis points to 9.89%, and the 364-day maturity by 36 basis points to 9.90%.

The entire offered amount of Rs. 230 billion was successfully taken up during its first phase of the auction. This marks the third consecutive round of auctions exceeding Rs. 200 billion. The bulk of the accepted amount (81%) was raised through 91-day and 182-day maturities.

The 2nd phase of subscription, across all three maturities will be opened until 4:00 p.m. on the day before the settlement date (i.e., 13.06.2024) at the respective weighted averages determined at the 1st phase of the auction. Given below are the details of the auction.

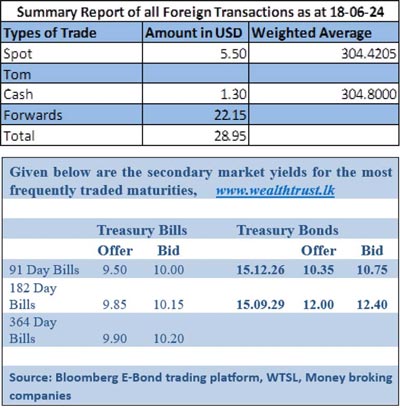

Meanwhile, the secondary bond market was relatively active during the morning hours of with maturities of 01.06.26, 01.08.26, 15.12.26 and 15.09.29 changed hands at levels of 10.25% each, 10.45% and 11.90% to 12.03% respectively. Additionally, 15.10.27 traded at 10.68%. Nevertheless, activity came to a halt following the release of the auction results.

In the secondary bill market too, transactions were seen prior to the auction results with June to July 2024 trading at 8.90% to 8.95%. Close to 3 months, September 2024 maturity was seen changing hands at 9.10%. Additionally, November 2024 and June 2025 were seen trading at 9.65% to 9.75% and from 9.75% to 9.85%. The total secondary market Treasury bond/bill transacted volume for 18th June was Rs. 2.81 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 8.73% and 8.84% respectively while the net liquidity was a surplus Rs. 80.75 billion yesterday. An amount of Rs. 139.69 billion deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 8.50%, while an amount of Rs. 23.94 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 9.50%.

Further, the DOD (Domestic Operations Department) of Central Bank conducted an overnight reverse repo auction amounting to Rs. 35.00 billion at the weighted average rate of 8.73%.

Forex Market

In the Forex market, the USD/LKR rate on spot contracts closed the day up at Rs. 305.40/305.55, against its previous day’s closing level of Rs. 304.75/305.40.

The total USD/LKR traded volume for 18 June was $ 28.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)