Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 26 January 2022 02:51 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

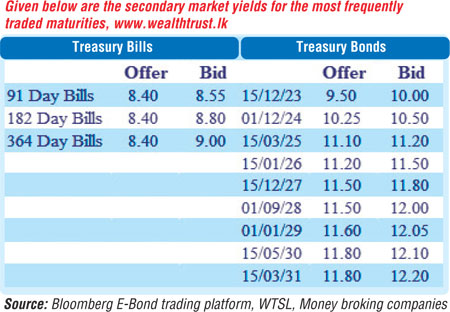

The first primary auction following the monetary policy increase is due today, which will see an amount of Rs. 80.5 billion of Treasury bills on offer. This will consist of Rs. 30 billion on the 91-day maturity, Rs. 20.5 billion on the 182-day maturity and Rs. 30 billion on the 364-day maturity. At last week’s auction, an all-time high amount of Rs. 97 billion was successfully subscribed with weighted averages rates increasing across the board by 11 and four basis points each to 8.49%, 8.44% and 8.48% respectively. In the secondary bond market yesterday, limited trades were witnessed on the maturities of 01.10.22, 15.12.22, 15.09.24, 01.05.25 and 01.05.28 at levels of 9.30% to 9.37%, 9.25%, 10.25%, 11.20% to 11.22% and 11.75% respectively.

The first primary auction following the monetary policy increase is due today, which will see an amount of Rs. 80.5 billion of Treasury bills on offer. This will consist of Rs. 30 billion on the 91-day maturity, Rs. 20.5 billion on the 182-day maturity and Rs. 30 billion on the 364-day maturity. At last week’s auction, an all-time high amount of Rs. 97 billion was successfully subscribed with weighted averages rates increasing across the board by 11 and four basis points each to 8.49%, 8.44% and 8.48% respectively. In the secondary bond market yesterday, limited trades were witnessed on the maturities of 01.10.22, 15.12.22, 15.09.24, 01.05.25 and 01.05.28 at levels of 9.30% to 9.37%, 9.25%, 10.25%, 11.20% to 11.22% and 11.75% respectively.

The total secondary market Treasury bond/bill transacted volume for 24 January was Rs. 1.97 billion. In money markets, the weighted average rates on overnight Call money and REPO remained mostly unchanged at 6.46% and 6.50% respectively as an amount of Rs. 579.19 billion was withdrawn from the Central Bank’s SLFR (Standard Lending Facility Rate) of 6.50%. An amount of Rs. 73.13 billion was deposited at the Central Bank’s SDFR (Standard Deposit Facility Rate) of 5.50%, while an amount of Rs. 39.73 billion was drained out by way of an overnight repo auction at a weighted average rate of 6.48%.

USD/LKR

In the Forex market, the overall market remained inactive yesterday.

The total USD/LKR traded volume for 24 January was $ 22.15 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)