Sunday Feb 15, 2026

Sunday Feb 15, 2026

Thursday, 5 October 2023 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

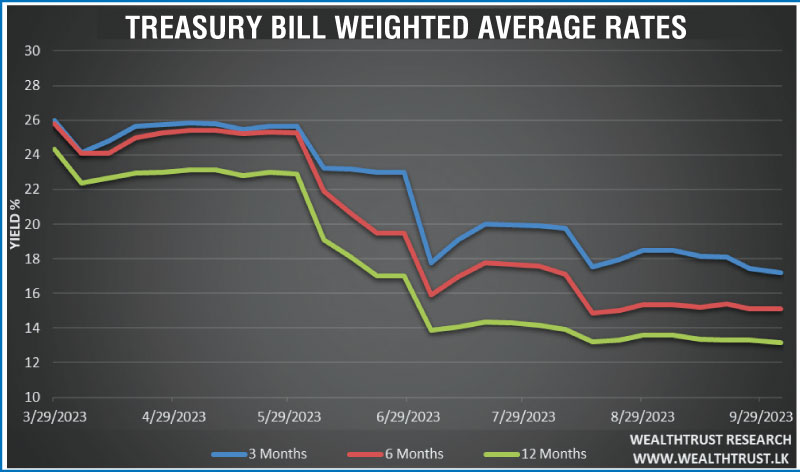

This week’s Treasury bill auction conducted yesterday, continued to receive a bullish response. The weighted average rates dropped across the board for a second consecutive week. The 91-day bill in particular, saw significant demand, which led to its weighted average yield dropping by 20 basis points, as it received Rs. 112.87 billion of bids against an offered amount of only Rs. 55 billion. The auction overall was oversubscribed by 1.86 times. Similarly, the 182-day and 364-day bills dipped by 4 and 14 basis points respectively to record weighted averages of 15.09% and 13.16%.

This week’s Treasury bill auction conducted yesterday, continued to receive a bullish response. The weighted average rates dropped across the board for a second consecutive week. The 91-day bill in particular, saw significant demand, which led to its weighted average yield dropping by 20 basis points, as it received Rs. 112.87 billion of bids against an offered amount of only Rs. 55 billion. The auction overall was oversubscribed by 1.86 times. Similarly, the 182-day and 364-day bills dipped by 4 and 14 basis points respectively to record weighted averages of 15.09% and 13.16%.

An amount of Rs. 105.02 billion or 95.47% was raised of the total offered amount of Rs. 110 billion at the 1st phase of the auction. Subsequently, the 2nd phase of subscription for all three maturities was opened at the weighted averages determined at the 1st phase of the auction until 4.15 p.m. yesterday. This was in lieu of the Monetary Policy Announcement due today. Here, an additional amount of Rs. 32.48 billion was raised. Given below are the details of the 1st phase of the auction:

The secondary bond market saw activity pick up, led by aggressive buying interest which drove yields down yesterday. Accordingly, trading was predominantly seen on the liquid maturities of the two 2026’s (i.e., 01.06.26 and 01.08.26) and 01.07.28, which saw its yields dropping from 15.50% to 14.90% and 14.50% to 14.15% respectively. Additionally, trades were seen on the two 2025’s (i.e., 01.06.25 and 01.07.25) and 15.09.27 maturities, as its yields declined from levels of 15.50% to 15.00% and 15.00% to 14.65% respectively as well.

This was ahead of the 7th Annual Monetary Policy Announcement for the year 2023 due today. It is widely anticipated that the CBSL will resume its policy easing cycle, as steady and rapidly cooling inflation creates space. It was reported that Bloomberg predicted a cut of 200 basis points citing a need to reduce real borrowing costs and support economic growth. Additionally, a Reuters’ survey of 17 economists and analysts hailing from policy think tanks, universities and eminent market participants also expressed a median estimate of a rate cut of 100 basis points.

The total secondary market Treasury Bond/Bill transacted volume for 3 October was Rs. 7.67 billion.

In money markets, the weighted average rates on overnight call money and Repo stood at 11.25% and 11.75% respectively while the net liquidity stood at a deficit of Rs. 86.98 billion yesterday.

The DOD (Domestic Operations Department) of Central Bank injected liquidity by way of an overnight reverse repo auction for Rs. 18.23 billion at a weighted average rate of 11.10%. An amount of Rs. 59.47 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 12.00% and an amount of Rs. 5.72 billion was deposited with the Central Banks SLDR (Standard Deposit Facility Rate) of 11.00%.

Forex Market

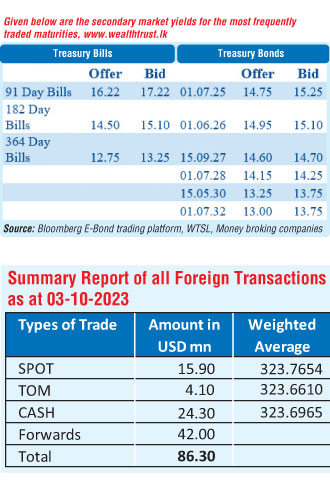

In the Forex market, the USD/LKR rate on spot contracts closed the day flat at Rs. 323.70/324.00 against its previous day’s closing level of Rs. 323.70/324.00.

The total USD/LKR traded volume for 3 October was $ 86.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)