Saturday Feb 14, 2026

Saturday Feb 14, 2026

Wednesday, 21 September 2022 00:02 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weekly Treasury bill auction due today will have in total an amount of Rs. 65 billion on offer, a decrease of Rs. 15 billion in comparison to its previous weeks offered amount. This will consist of Rs. 28 billion of the 91-day maturity, Rs. 20 billion of the 182-day maturity and a further Rs. 17 billion of the 364-day maturity.

The weekly Treasury bill auction due today will have in total an amount of Rs. 65 billion on offer, a decrease of Rs. 15 billion in comparison to its previous weeks offered amount. This will consist of Rs. 28 billion of the 91-day maturity, Rs. 20 billion of the 182-day maturity and a further Rs. 17 billion of the 364-day maturity.

At last week’s auction, the weighted average rates all the maturities decreased for the first time in six week by 18, 46 and 24 basis points respectively to 32.71%, 30.82% and 30.26%. A total amount of Rs. 100 billion was accepted in successful bids by way of its first and second phases of the auction against its initial total offered amount of Rs. 80 billion.

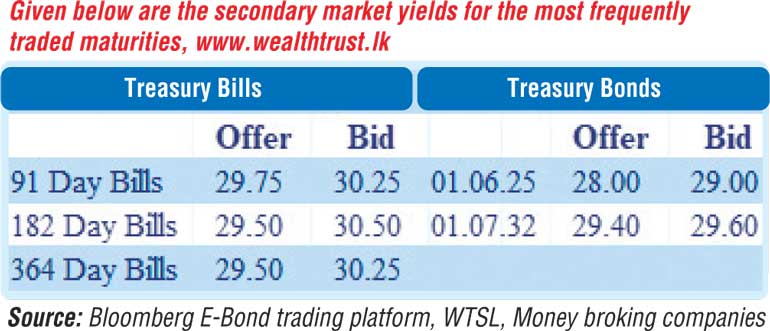

In the secondary bond market, activity continued to surround only the 01.07.32 maturity as it changed hands within the range of 29.25% to 29.75% against its previous day’s closing level of 29.40/60. In the secondary bill market, October 2022, April-May 2023 and August 2023 maturities traded at levels of 26.50% to 26.85%, 30.00% and 31.00% respectively.

The total secondary market Treasury bond/bill transacted volume for 19 September was Rs. 4.72 billion.

In money markets, the net liquidity deficit stood at Rs. 413.07 billion yesterday as an amount of Rs. 354.24 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50% against an amount of Rs. 767.31 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 15.50%. The weighted average rate on overnight REPO stood at 15.50%.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts remained steady for a third consecutive day at Rs. 362.90. The total USD/LKR traded volume for 19 September 2022 was $ 6.24 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)