Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 21 August 2023 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

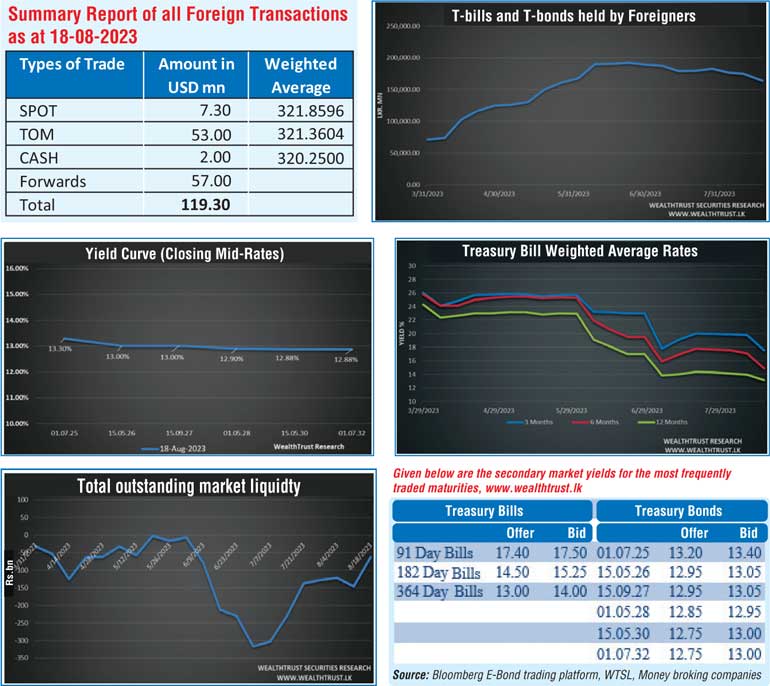

The weekly Treasury bill auction saw an impressive outcome; with the weighted average rates decreasing considerably across the board for a fourth consecutive week.

The total offered amount of 180 billion was raised at the first phase of the auction and a further 12.48 billion was raised at its second phase. This was on the back of the announcement of the SRR cut of 200 bps the week prior and ahead of the monetary policy announcement due on 24 August.

The secondary bond market saw activity moderate during the week ending 18 August, with yields edging up slightly at the close, on a week-on-week basis. The yields on the liquid maturities of 01.07.25, 15.05.26, 15.09.27, 01.05.28 hit intraweek highs of 13.60%, 13.03%, 13.16%, 13.15% respectively against its previous week’s closing levels of 13.23/13.27, 12.95/13.05, 12.85/13.00, 12.70/00. The yield curve remained relatively flat at the close of the week.

Foreign holding in Rupee bonds recorded its sharpest decline in 177 weeks with an outflow of Rs. 10.52 billion for the week ending 17 August 2023, a level last witnessed on 25 March 2020. The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged at Rs. 26.69 billion.

In money markets, the total outstanding liquidity deficit improved significantly to Rs. 62.91 billion by the end of the week against its previous weeks of Rs. 145.91 billion following the SRR cut coming into effect on 16.08.23. While the Domestic Operations Department (DOD) of Central Bank continued to inject liquidity during the week by way of overnight to seven-day Reverse repo auctions at weighted average yields ranging from 11.46% to 12.00%.

The Central Bank of Sri Lanka’s (CBSL) holding of Government Securities was registered at Rs. 2,604.82 billion against its previous week’s of Rs. 2,649.07 billion.

In the forex market, the USD/LKR rate on spot contracts was seen depreciating marginally during the week to close the week at Rs. 323.00/324.00 against its previous week’s closing level of Rs. 319.50/320.50, subsequent to trading at a high of Rs. 320.40 and a low of Rs. 324.50.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 54.89 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)