Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 14 July 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

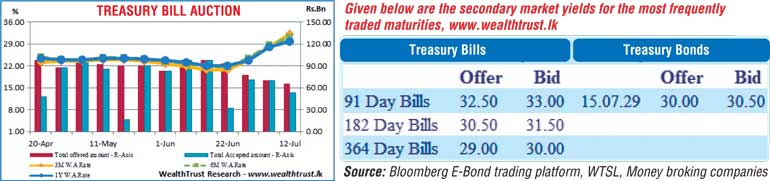

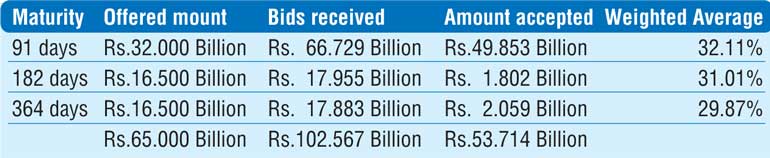

The weighted average rates were seen increasing substantially at the weekly Treasury bill auctions held on Tuesday, keeping with its recent trend while crossing a historical high of 30.00%.

The increase was led by the three month bill by 403 basis points to 32.11% followed by the six month and 12 month bills by 227 and 176 basis points respectively to 31.01% and 29.87%. However, only a total amount of Rs. 53.71 billion was accepted in total against a total offered amount of Rs. 65 billion.

The phase two of the auction will be opened for the 182-day and 364-day maturities until close of business of the day prior to settlement (i.e., 3.30 p.m. on 14 July 2022).

The dull sentiment in the secondary bond market continued on Tuesday as activity was at a standstill. Only the 15.07.29 maturity traded at a level of 30.50%.

The total secondary market Treasury bond/bill transacted volume for 11 July 2022 was Rs. 16.29 billion.

In money markets, the net liquidity deficit decreased further to Rs. 361.37 billion on Tuesday as an amount of Rs. 671.58 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50% while an amount of Rs. 310.21 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Repo and Call money stood at 15.50% each.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated once again to Rs. 360.9048 on Tuesday against its previous day’s closing level of Rs. 361.35.

The total USD/LKR traded volume for 11 July 2022 was $ 152.33 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)