Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 18 August 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

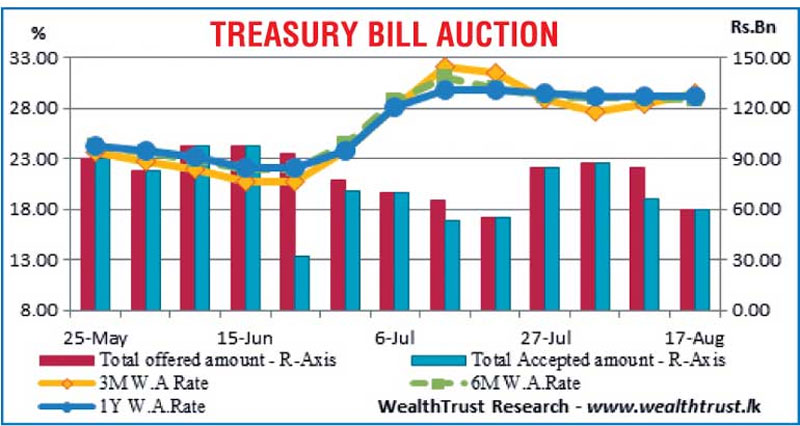

The weekly Treasury bill auction conducted yesterday was fully subscribed once again, with the market favourite 91 day bill representing 83.34% or Rs. 50 billion of the total offered and accepted amount of Rs. 60 billion.

The weekly Treasury bill auction conducted yesterday was fully subscribed once again, with the market favourite 91 day bill representing 83.34% or Rs. 50 billion of the total offered and accepted amount of Rs. 60 billion.

Its weighted average rate increased by 101 basis points to 29.44%. The weighted average rates on both the 182 day and 364 day maturities decreased by 01 basis point each to 28.96% and 29.14% respectively while the total bids to offer ratio stood at 1.75:1.

The sixth monetary policy announcement for the year 2022 is due today at 7:30 a.m. The Central Bank of Sri Lanka increased policy rates by 100 basis points at its previous announcement on 7 July to 14.50% and 15.50%.

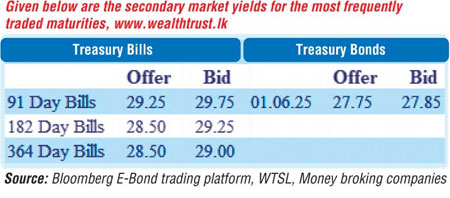

Activity in the secondary bond market somewhat increased yesterday, mainly surrounding the 01.06.25 maturity as its yield decreased marginally to change hands within the range of 27.80% to 27.90% while the 15.07.29 maturity traded at 27.20%. In secondary bills, 4 August 2023 maturity traded at a level of 29.25%, following the auction outcome.

The total secondary market Treasury bond/bill transacted volume for 16 August was Rs. 0.6 billion.

In money markets, the net liquidity deficit was registered at Rs. 457.90 billion yesterday as an amount of Rs. 286.58 billion was deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 14.50% against an amount of Rs. 744.48 billion withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 15.50%. The weighted average rate on REPO stood at 15.50% while no Call money transactions were witnessed.

Forex market

In the forex market, the middle rate for USD/LKR spot contracts was at Rs. 360.9600 yesterday against its previous day’s closing level of Rs. 360.9733.

The total USD/LKR traded volume for 16 August was $ 6.97 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)