Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Wednesday, 3 February 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

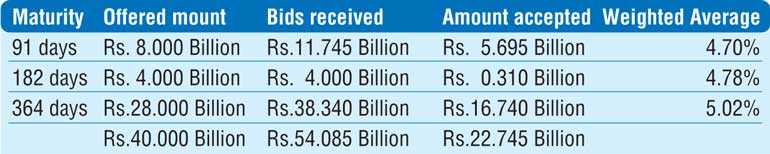

The demand for Treasury bills at the weekly auction reduced further yesterday, as only a total amount of Rs. 22.75 billion was accepted in comparison to its previous week’s total accepted amount of Rs. 25 billion and against a total offered amount of Rs. 40 billion each week.

The demand for Treasury bills at the weekly auction reduced further yesterday, as only a total amount of Rs. 22.75 billion was accepted in comparison to its previous week’s total accepted amount of Rs. 25 billion and against a total offered amount of Rs. 40 billion each week.

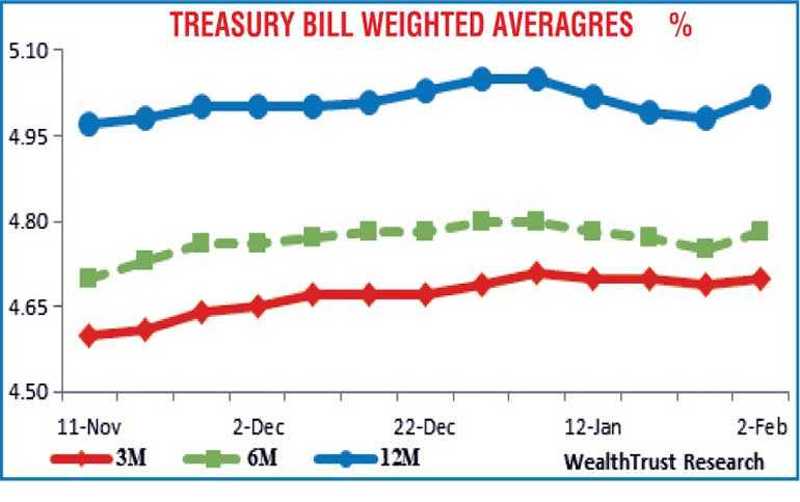

The weighted average on the 364 day maturity was recorded at its stipulated cut off rate of 5.02% while the weighted average rates of the 91 day and 182 day maturities were registered at 4.70% and 4.78% respectively against its stipulated cut off rates of 4.71% and 4.80%. The auction was undersubscribed for a second consecutive week as the bids to offer ratio stood at 1.35:1.

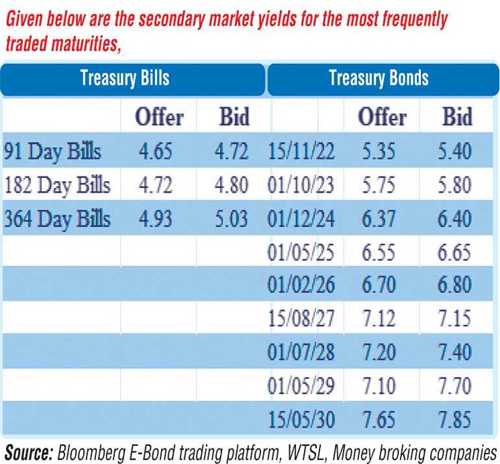

Activity in the secondary bond market picked up marginally yesterday with maturities of 2022’s (i.e. 01.10.22, 15.11.22 and 15.12.22), 2023’s (i.e. 15.01.23, 15.12.23), 01.12.24 and 2027’s (i.e. 15.08.27 and 01.10.27) changing hands at levels of 5.38%, 5.40%, 5.40% to 5.43%, 5.45% to 5.48%, 5.81% to 5.82%, 6.37% and 7.15% to 7.153% respectively. In addition, a shorter tenure maturity of 01.05.21 traded at 4.71% as well.

The total secondary market Treasury bond/bill transacted volumes for 1 February was Rs. 5.05 billion.

In the money market, overnight surplus liquidity decreased marginally to Rs. 115.73 billion yesterday while the weighted average rates on call money and repo remained mostly unchanged at 4.55% and 4.57% respectively.

Rupee depreciates further

In the Forex market, the USD/LKR rate on spot contracts depreciated further yesterday to hit a low of Rs. 195.90 before closing the day at Rs. 194.50/196.00 in comparison to with the previous day’s closing levels of Rs. 193.00/194.00. The total USD/LKR traded volume for 1 February was $ 72.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)