Friday Feb 13, 2026

Friday Feb 13, 2026

Wednesday, 30 September 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

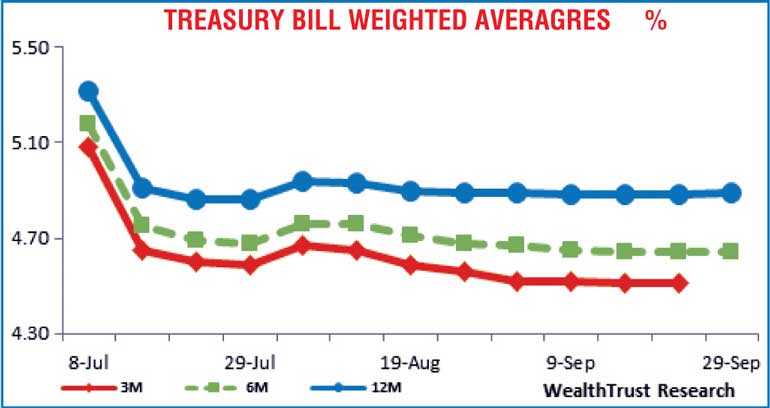

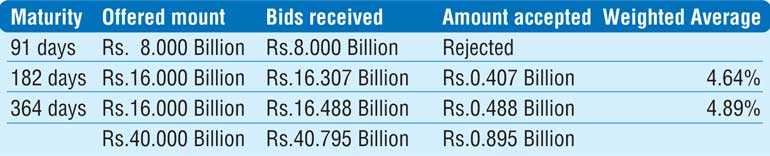

The weekly Treasury bill auction conducted yesterday saw only an amount of Rs. 895 million been accepted in total against a total offered amount of Rs. 40 billion as the bids to offer ratio decreased sharply to 1.02:1. The weighted average rate on the 364 day maturity reflected an increase of 01 basis point to 4.89% while it remained unchanged on the 182 day maturity at 4.64%. All bids received on the 91 day bill maturity were rejected.

The weekly Treasury bill auction conducted yesterday saw only an amount of Rs. 895 million been accepted in total against a total offered amount of Rs. 40 billion as the bids to offer ratio decreased sharply to 1.02:1. The weighted average rate on the 364 day maturity reflected an increase of 01 basis point to 4.89% while it remained unchanged on the 182 day maturity at 4.64%. All bids received on the 91 day bill maturity were rejected.

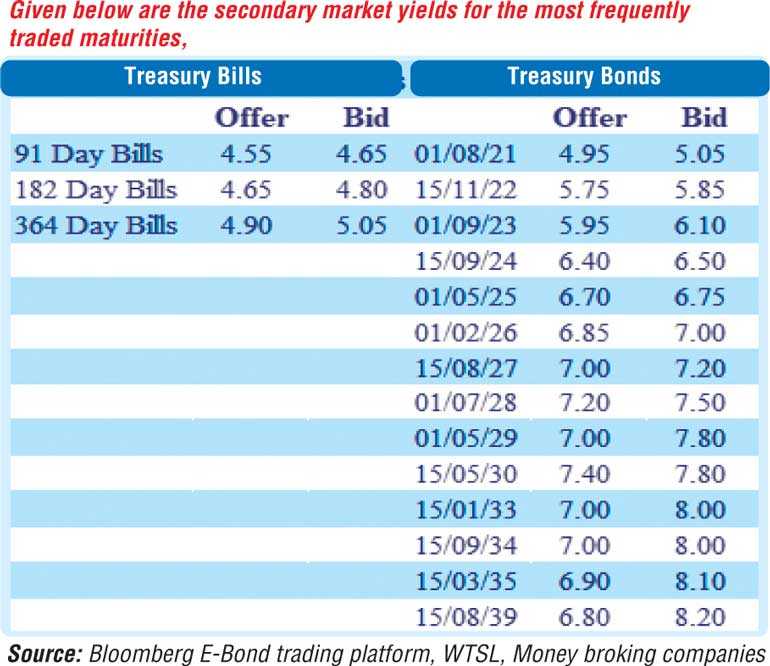

The sovereign down grade to Sri Lanka by Moody’s Investor Services led to secondary market bond yields increasing further yesterday. Activity centred the liquid maturities of 15.11.22, 15.01.23, 2024s (i.e. 15.06.24 & 15.09.24), 01.05.25 and 01.02.26 as its yields were seen increasing to intraday highs of 5.80% each, 6.45%, 6.43%, 6.70% and 6.92% respectively during morning hours of trading against its previous day’s closing levels of 5.62/68, 5.65/75, 6.13/23, 6.15/30, 6.58/60 and 6.65/73.

In addition, activity was witnessed on the 2021 maturities (i.e. 01.08.21 & 15.10.21) within the range of 4.93% to 5.00% while in the secondary bill market 11 December 2020 maturity traded at 4.65%, pre-auction.

The total secondary market Treasury bond/bill transacted volumes for 28 September was Rs. 20.73 billion.

In the money market, the weighted average rates of overnight call money and Repos recorded at 4.53% and 4.59% respectively yesterday as the overnight net liquidity surplus increased to Rs. 188.46 billion. The DOD (Domestic Operations Department) of Central Bank further injected an amount of Rs. 3.00 billion by way of a 14 day reverse repo auction at a weighted average rate of 4.53%, subsequent to offering Rs. 15 billion, valued today.

LKR fluctuates

In the Forex market, USD/LKR rate on spot contracts was seen depreciating to an intraday low of Rs. 186.10 yesterday in morning hours of trading before bouncing back strongly to close the day at Rs. 185.10/20, subsequent to hitting an intraday high of Rs. 185.10.

The total USD/LKR traded volume for 28 September was $ 34.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)