Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 29 November 2021 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

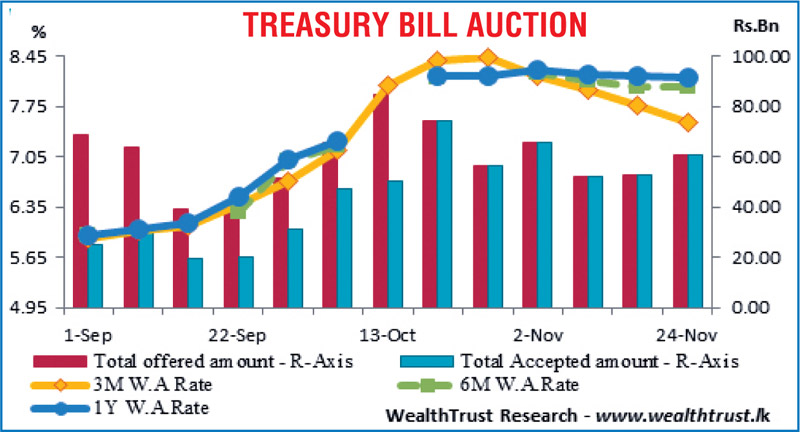

The downward momentum on the market favourite 91-day Treasury bill weighted average rates continued for a fourth consecutive week, accumulating a total drop of 90 basis points over the past four weeks. Furthermore, the weighted average rates on all three maturities decreased for a third consecutive week as the total offered amount was successfully accepted for a sixth consecutive week. In secondary market bills, January, February and May 2022 maturities were seen changing hands at lows of 7%, 7.25% and 7.78% respectively.

The downward momentum on the market favourite 91-day Treasury bill weighted average rates continued for a fourth consecutive week, accumulating a total drop of 90 basis points over the past four weeks. Furthermore, the weighted average rates on all three maturities decreased for a third consecutive week as the total offered amount was successfully accepted for a sixth consecutive week. In secondary market bills, January, February and May 2022 maturities were seen changing hands at lows of 7%, 7.25% and 7.78% respectively.

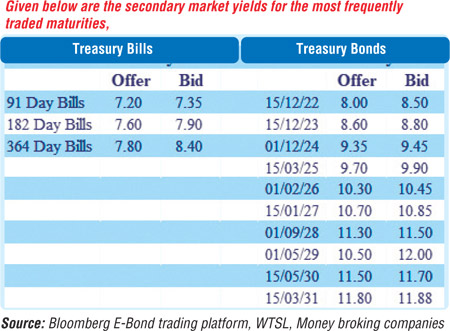

However, overall activity in the secondary bond market continued to remain dull during the week ending 21 November as yields were seen fluctuating within a narrow range on the back of limited trades. The 2023’s (i.e. 15.11.23 and 15.12.23), 2024’s (i.e. 15.03.24 and 01.12.24) 15.01.27, 15.05.30 and 15.03.31 maturities changed hands at levels of 8.8% each, 9.2%, 9.41% to 9.47%, 10.8%, 11.55% to 11.73% and 11.83% to 11.86% respectively.

This is ahead of today’s Treasury bond auctions, where a total amount of Rs. 30 billion will be on offer, consisting of Rs. 15 billion each of a 15.03.2025 and a 15.05.2030 maturity. The weighted average yields at the bond auctions conducted on 11 November were 9.16%, and 11.91% for the maturities of 15.03.24 and 15.03.31 respectively. The direct issuance window was opened for both maturities as it was fully subscribed at its first phase.

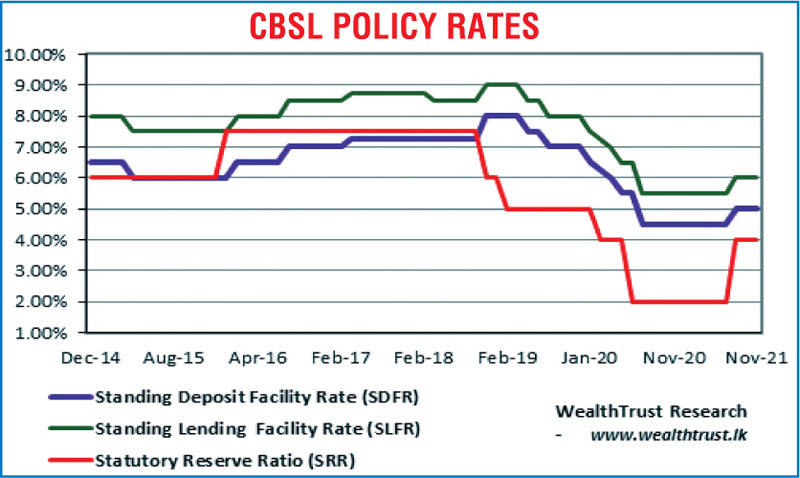

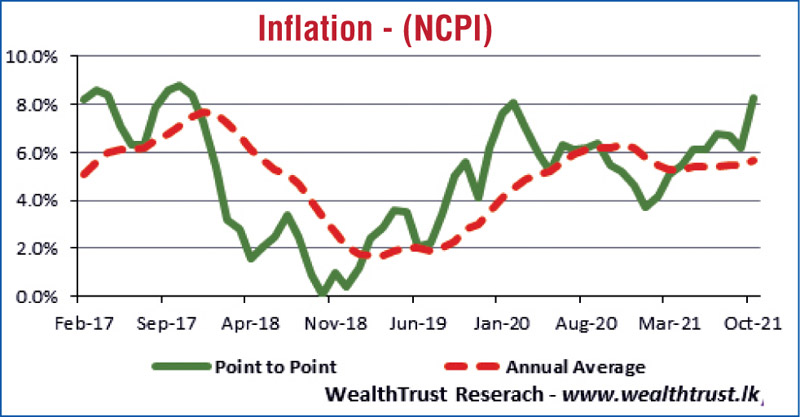

Furthermore, during the week, the National Consumer Price Index (NCPI) for October was announced and it was seen crossing the psychological level of 8% on its point-to-point to reach a 47-month high of 8.3%, while the Central Bank of Sri Lanka was seen holding its policy rates steady at 5% and 6% at its monetary policy announcement.

The foreign holding in rupee bonds decreased marginally to Rs. 1.81 billion for the week ending 24 November while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 17.15 billion.

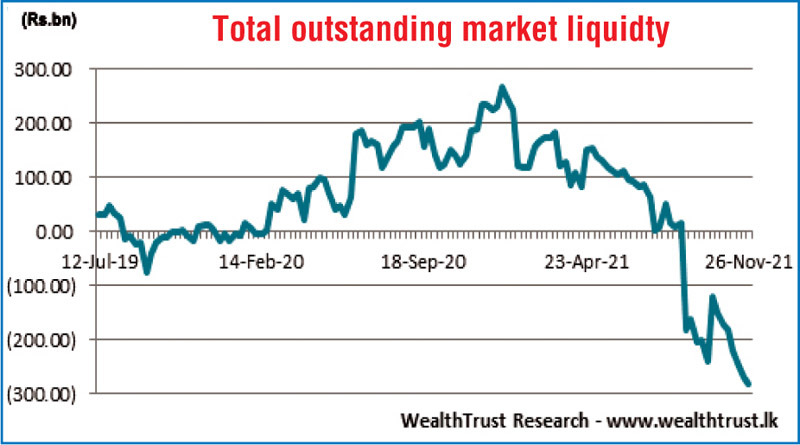

In money markets, the total outstanding liquidity deficit was seen increasing further during the week to reach Rs. 282.99 billion by the end of the week against its previous week amount of Rs. 270.95 billion, while The CBSL’s holding of Gov. Securities decreased to Rs. 1,433.91 billion against the previous week’s Rs. 1,436.09 billion. The weighted average rates on overnight call money and repo were 5.92% and 5.97% respectively for the week.

The Domestic Operations Department (DOD) of Central Bank was seen draining out liquidity during the week by way of overnight to seven-day repo auctions at weighted average yields ranging from 5.97% to 5.99%. However, no successful bids were recorded for the outright sale of Treasury bills totalling Rs. 10 billion for durations of 11 days to 32 days.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts continued to trade at Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 49.93 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)