Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 21 November 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

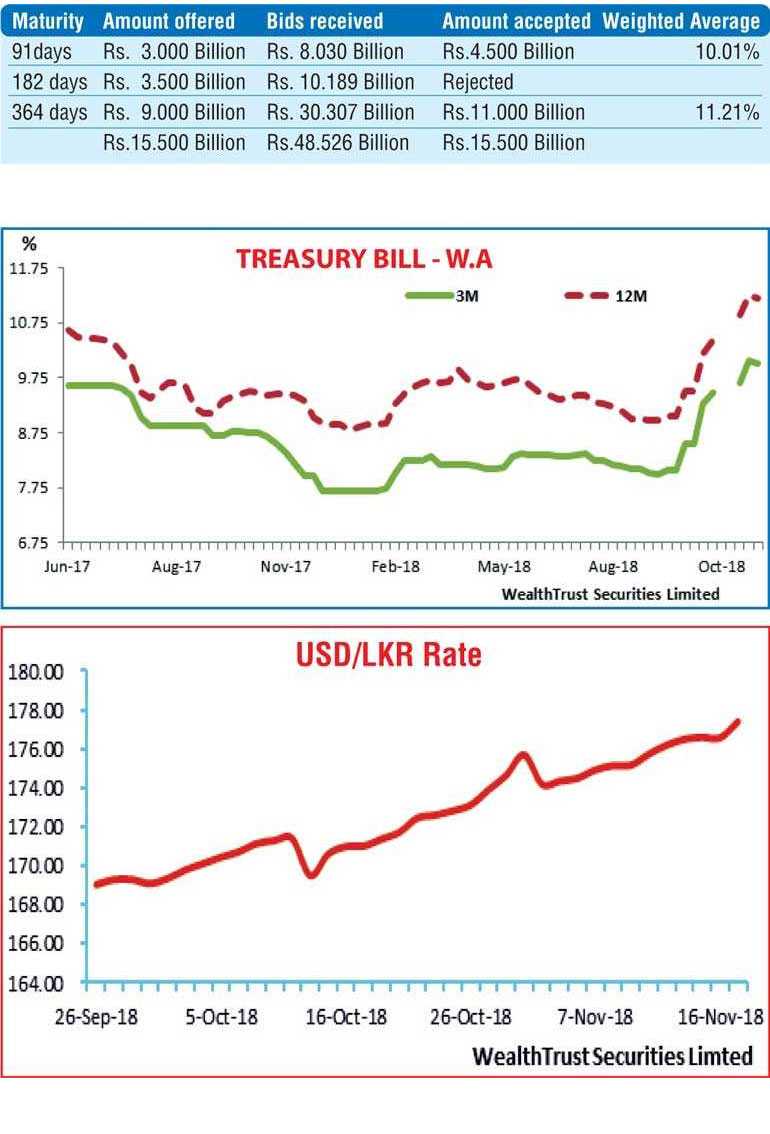

The weekly Treasury bill auction conducted on Monday due to the shortened trading week saw its weighted averages decline from its previously recorded averages for the first time in 12 weeks or 12 auctions.

The 91 day bill recorded a dip of 06 basis points to 10.01% closely followed by the 364 day bill by 04 basis points to 11.21%. All bids received for the 182 day bill were rejected as the total offered amount of Rs 15.5 billion was fully met from the two maturities. The total bids received to total offered amount ratio was seen increasing to a four week high of 3.13:1.

Activity in the secondary bond market moderated on Monday and limited to the maturities of 01.03.21 and 15.06.27 as its yields were seen declining marginally to change hands within the range of 11.55% to 11.50% and 12.30% to 12.27% respectively. In addition, demand for secondary market bills saw April and May 2019 maturities change hands at levels of 10.25% and 10.30% respectively as well.

The total secondary market Treasury bond/bill transacted volumes for 16 November was Rs. 11.70 billion.

In the money market, overnight call money and repo averaged 8.95% and 8.94% respectively as the net liquidity shortfall stood at Rs. 85.36 billion. The OMO department of Central Bank infused liquidity for durations of overnight, seven days and 14 days for successful amount of Rs. 42.56, Rs. 12.01 and Rs. 11.30 at weighted averages of 8.60%, 8.77% and 8.74% respectively.

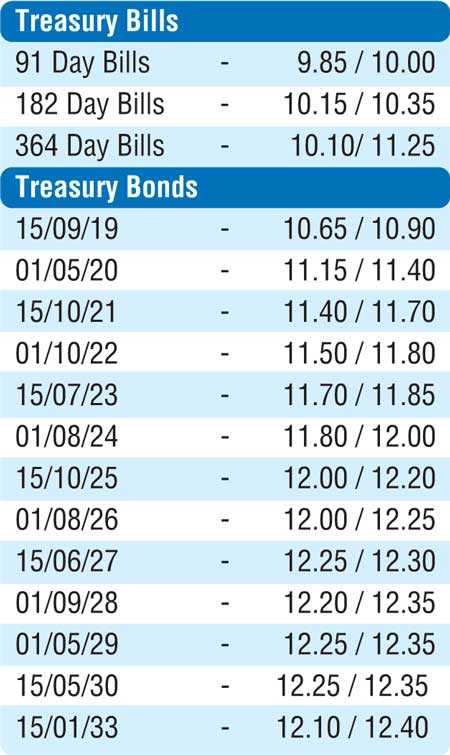

Rupee dips below Rs. 177

The continued demand by banks, importer demand coupled with the prevailing political uncertainties saw the USD/LKR rate on spot contracts dip below the Rs. 177 psychological level for the first time to close Monday’s trading at Rs 177.30/50 against its previous day’s closing of Rs. 176.50/65.

The total USD/LKR traded volume for 16 November was $ 45.86 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 178.20/60; three months – 180.35/75; and six months – 183.50/90.